U.S. equities are off to a stellar beginning to 2019 and the volatility that reared its ugly head near the end of 2018 has been missing. However, according to a Wells Fargo recession model, this is could be the calm before the storm.

Just recently, the S&P 500 reached a key bullish technical level, moving past its 200-day moving average for the first time since December 3. The S&P 500 was down 6.2 percent to end 2018, but it has since recovered after U.S. equities were roiled by volatility to close the year.

To some technical analysts, breaking through that 200-day moving average paves the way for bigger gains ahead. In December alone, the S&P 500 was down 9 percent, making it the worst December for the index since 1931.

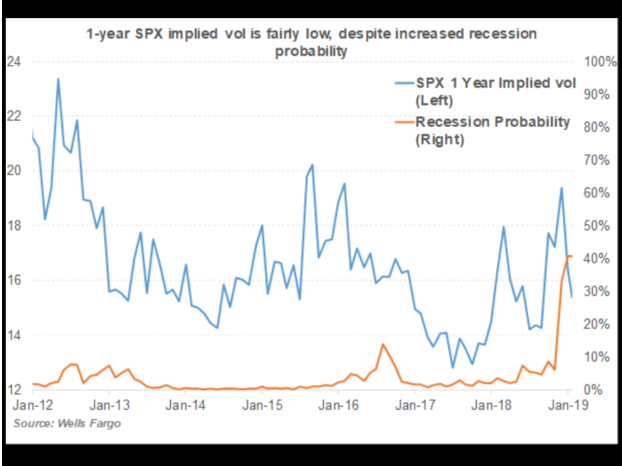

However, the Wells Fargo recession model is eerily reminding investors of 2008. The model, which uses a mix of spreads from Treasury yields, is showing that a chance of a recession jumped above 40 percent in January.

The concept is difficult to fathom given that market volatility is down, but according to analysts, this is where the red flag begins waving.

“Despite the increased recession probability, long-dated equity volatility is actually trading lower than in previous years,’’ Pravit Chintawongvanich, a Wells Fargo equity derivatives strategist, wrote in a note.

Related: Industrial ETFs Are Outperforming Among U.S. Sector Picks

This disconnect between volatility and recession probability hearkens back to the financial crisis in 2008.

“In 2007, 1-year vol traded at very low levels despite recession risk having increased rapidly in 2006,’’ Chintawongvanich wrote. “It was only when Bear Stearns started running into trouble in summer 2007 that 1-year vol rapidly repriced.’’

In the video below, Neil Hennessy, Hennessy Funds portfolio manager and CIO, and CNBC’s Bob Pisani join Kelly Evans on ‘The Exchange’ to discuss the market’s winning streak and where they see it headed.

For more market trends, visit ETF Trends.