The case for investing in the growing pet care industry and a look at key trends

By Simeon Hyman, CFA, Global Investment Strategist, ProShares

Pets are loyal companions and increasingly considered part of the family. They’re also big business. Let’s look at some notable trends that may make the pet care industry a beneficial part of investors’ portfolios.

Pet ownership is growing

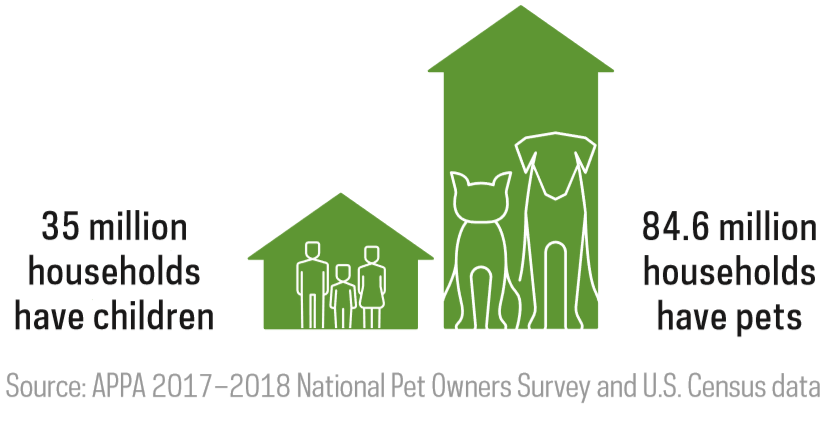

Today, roughly 68% of U.S. households have pets, up from 56% in 1988, according to the American Pet Products Association (APPA). In fact, more households have pets than have children.

What’s driving the growth in pet ownership? The two most populous generations in the United States—baby boomers and millennials—are bringing pets into their homes in greater numbers.

Baby boomers, the largest generation in history, are entering a new phase of life as empty nesters and retirees. As this occurs, they’re becoming pet owners in greater numbers. A decade ago, only 34% of people over 70 had pets. But as boomers began to cross into their 70s, the percentage quickly jumped to 40%.

Millennials, who will become our nation’s largest generation, have also embraced pet ownership. Many millennials are becoming pet owners before, or even instead of, having children. And for those who don’t currently own a pet, 43% say they want one in the future. In addition, when millennials take major steps, like purchasing homes, their pets’ needs are quite often a driving force behind their choices.

If these generational trends continue, boomers and millennials could drive pet ownership for decades to come.

More and more, owners are caring for pets like family

Over the years, pet owners have dramatically changed the way they think about and care for their pets. A recent Harris Poll reports 95% of owners consider their pets part of the family. They want their pets’ lives to be as happy, healthy and fulfilling as their own, and they’ll likely spare little expense to ensure it. As a result, they’re spending billions on premium-quality foods, state-of-the-art health care, insurance policies, luxury services and more. With this new attitude, pet care has evolved to offer more sophisticated products and services that are being driven by three main factors.

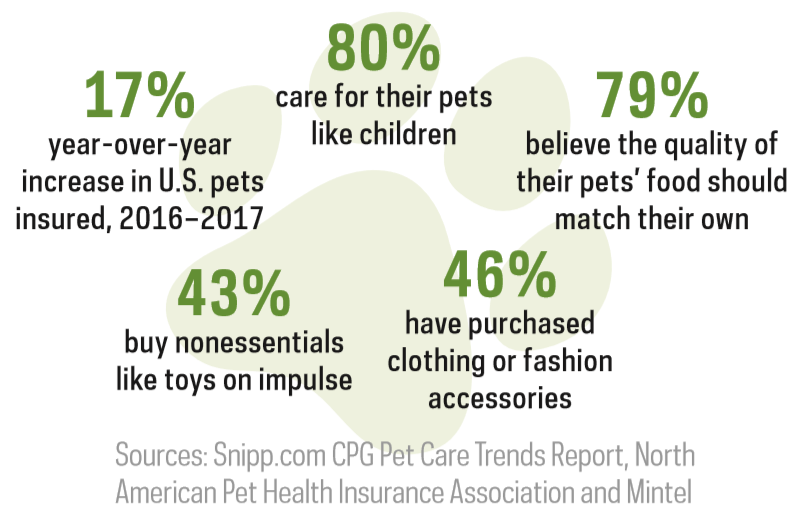

- We’re humanizing our pets. Pet owners often think of their pets as they would their children. They talk to their pets, bring them along on vacation, modify homes to accommodate them and celebrate pets’ birthdays. Today, pets are true members of the family.

- We’re “premiumizing” pet care. Pet owners are building an appetite for premium and even luxury pet products. Higher-quality pet food is becoming the norm, with sales of super-premium brands increasing over 9% as sales of value brands decreased 5.7% (2012-2015). Owners are also indulging pets with non-essentials, purchasing toys or accessories on impulse and spending on pet furniture and clothing—with some even buying designer apparel.

- We’re providing pets with health care comparable to our own. Advances in veterinary health care are providing meaningful improvement in our pets’ lives. There are ongoing innovations in veterinary treatments, preventative medications, diagnostic and screening tools, imaging (MRIs and other scans), and wellness products and therapies. Owners are willing to pay for these treatments—in fact, it’s estimated that pet owners will spend more than $18 billion on veterinary care in 2018. To offset the expenses, pet owners are also buying health insurance policies. In North America, private health insurance was purchased for more than two million animals in 2017, surpassing $1 billion in premiums.

The pet care industry is thriving

The pet industry spans veterinary pharmaceuticals, diagnostics, product distributors and services, manufacturers of pet food and pet supplies, and online and traditional pet and pet supply stores. Each of these subindustries is responding to the demands of pet owners with continued innovation that’s led to notable growth.

Here in the United States, the pet care industry has seen twice the percentage growth of GDP since 2007, increasing even during the Great Recession. Meanwhile, a similar boom has been building internationally. The global pet care industry is expected to grow from $132 billion in 2016 to as much as $203 billion by 2025.

With growing sales numbers in the pet care industry, corporate interest has intensified. More than 80 mergers and acquisitions over the past 12 months indicate that a wide range of companies are attracted to and investing in this dynamic opportunity.

With growing sales numbers in the pet care industry, corporate interest has intensified. More than 80 mergers and acquisitions over the past 12 months indicate that a wide range of companies are attracted to and investing in this dynamic opportunity.

Pet care could be a valuable part of investor portfolios

Why is investment in the pet care industry an opportunity? Because of growing pet ownership, the evolving attitudes and behaviors of pet owners—and the innovations of the global companies behind the pet care businesses we’ve discussed here. All of these suggest that growth in the industry is poised to continue over the long term. Pet care industry investment may be a beneficial part of investment portfolios, and an opportunity not to overlook. And the ProShares Pet Care ETF (ticker: PAWZ) is the first ETF focused on the pet care industry.

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. Whether or not actual results and developments will conform to ProShare Advisors LLC’s expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions, changes in laws or regulations or other actions made by governmental authorities or regulatory bodies, and other world economic and political developments. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Data sources: American Pet Products Association 2017-2018 National Pet Ownership Survey (68% with pets up from 56%, 84.6M households have pets, $18B in vet care spending, GDP and resistance to downturns); Snipp.com, Industry Trends CPG Pet Care Trends Report (more pets than children, premium food vs. value brands); Research and Markets, July 2017 (over-70 pet-ownership numbers); Research and Markets, May 2017 (millennials without pets want them); North American Pet Health Insurance Association as quoted by Veterinarian’s Money Digest, April 2018 (2M pets insured, $1B premiums); Grand View Research, March 2018 ($203 billion pet care market); Deal House Pet Report Q2 2018 (mergers and acquisitions).

Shares of the fund are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns .

Investing involves risk, including the possible loss of principal. This ProShares ETF is non-diversified and entails certain risks, including imperfect benchmark correlation and market price variance, that may decrease performance. Investments in smaller companies typically exhibit higher volatility. Smaller company stocks also may trade at greater spreads or lower trading volumes, and may be less liquid than stocks of larger companies. Please see the summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective.

The fund is subject to the risks faced by companies in the pet care industry. Although the pet care industry has historically seen steady growth and has been resilient to economic downturns, these trends may not continue or may reverse.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Obtain them from your financial advisor or broker-dealer representative or visit ProShares.com.

ProShares are distributed by SEI Investments Distribution Co., which is not affiliated with the funds’ advisor.