Even with the S&P 500 reaching new highs earlier this week, gold is still gaining additional traction, increasing demand further after substantially greater demand in 2018.

While the first quarter of 2018 saw demand at just 984.2t, a 3-year low for the precious metal, gold demand in 2018 reached 4,345.1t, up from 4,159.9t in 2017 and in line with the five-year average of 4,347.5t.

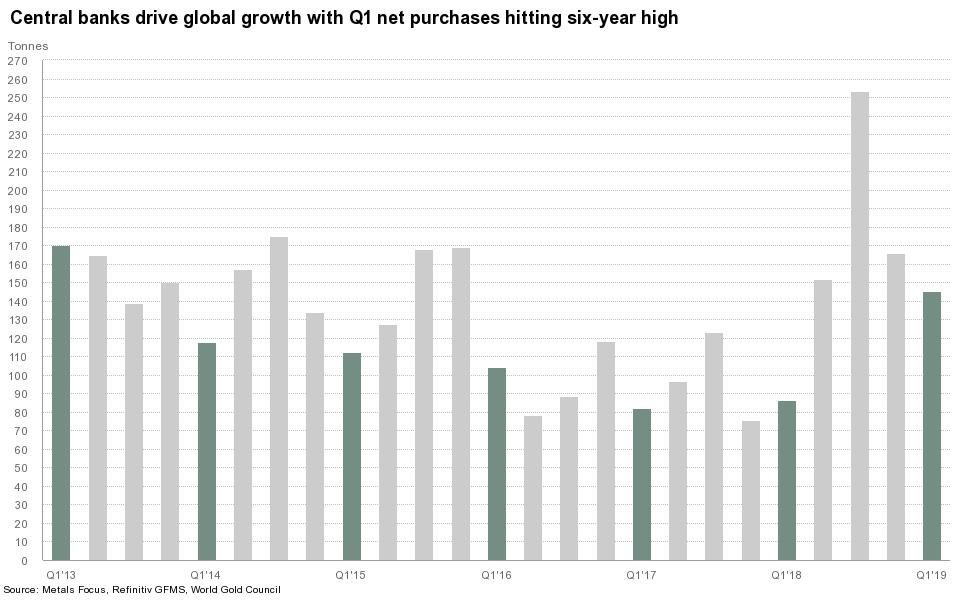

Most of this growth was driven by substantial buying on the part of the central bank. Nine Central banks actively purchased gold bullion. Central bank net purchases totaled 145.5t in the first quarter of 2019, which was the strongest first quarter since 2013 (179.1t).

According to a new report by the World Gold Council, “Investment in bars and coins accelerated in the second half of the year, up 4% to 1,090.2t in 2018. Full year jewelry demand was steady at 2,200t. Gold used in technology climbed marginally to 334.6t in 2018, although growth ran out of steam in Q4. Annual gold supply firmed slightly to 4,490.2t, with mine production inching up to a new high of 3,364.9t.”

Gold has always been a popular metal historically, serving both industrial and cosmetic uses. The Indian market especially serves as a hotbed of activity for the precious metal. With over 15 million Indian weddings per year, gold figures prominently in most every ceremony. In some cases, brides are literally weighted down by the amount of gold jewelry they don for the event.

One side-effect of the thirst for gold bullion is an increase in gold-backed ETF investment. Physically Backed Gold ETFs seek to track the spot price of gold. Most gold-backed ETFs are involved in physically holding gold bullion, bars and coins in a vault on investors’ behalf. Each share of the ETF is worth a proportionate amount of one ounce of the gold. Therefore a gold-backed ETF’s price will fluctuate depending on the value of the gold in the physical vault.

SPDR Gold Trust (GLD) is one of the most popular gold ETFs. GLD is currently trading in the middle of its range, up slightly for the year, Other notable gold-backed ETFs include: iShares Gold Trust (IAU), Aberdeen Standard Physical Swiss Gold Shares ETF (SGOL), SPDR Gold MiniShares Trust (GLDM), and GraniteShares Gold Trust (BAR).

For more gold investing news and strategy, visit our Gold category.