For many investors, gold is the standard in precious metal investing, which has become more accessible than ever thanks to options via an exchange-traded fund (ETF) wrapper like the SPDR Gold MiniShares (NYSEArca: GLDM).

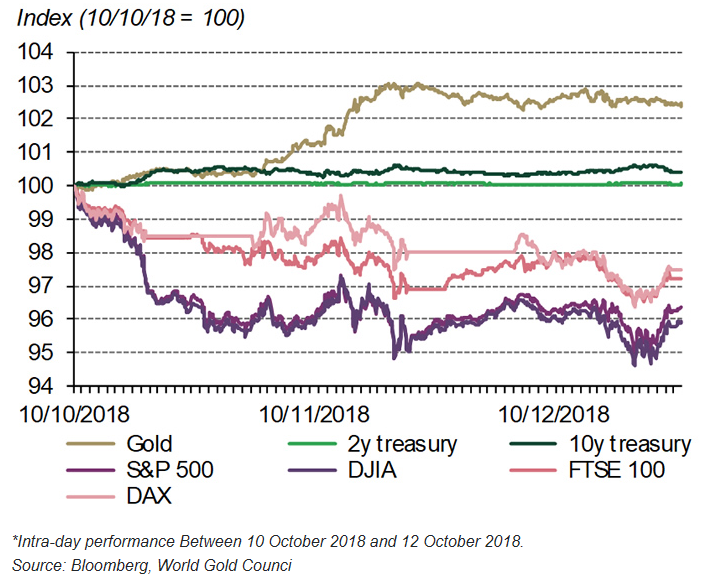

In 2018, rising interest rates that coincided with an extended bull run in U.S. equities for most of the year fueled a strong dollar, tamping down gains for gold. However, when investors got washed in a cycle of volatility that started in the fall and lasted through year’s end, investors were quick to reconsider the precious metal as a safe haven, which helped ETFs like the SPDR Gold Shares (NYSEArca: GLD)–an industry leader with a $34 billion market cap.

Adding precious metals to a portfolio certainly speaks to the diversification benefits of gold, among other things. However, with gold trading at over $1,300 an ounce and GLD having a share price of over $100, investors who feel they might be priced out of this asset can look to a low-cost solution like GLDM.

“GLDM has a low yearly management fee,” said Greg Collett, Director of Investment Products at the World Gold Council. “It was squarely-aimed at the long-term holding, buy-and-hold gold investor.”

A Default Safe-Haven Against a Falling Dollar

Gold has long been used as a safe haven asset, particularly when the value of the dollar declines. Furthermore, it provides a hedge for inflation since its price typically rises in conjunction with consumer prices.

During the Great Depression of the 1930s, gold was also a hedge against deflation. While the prices of assets were dropping during this time, the purchasing power of gold rose to prominence.

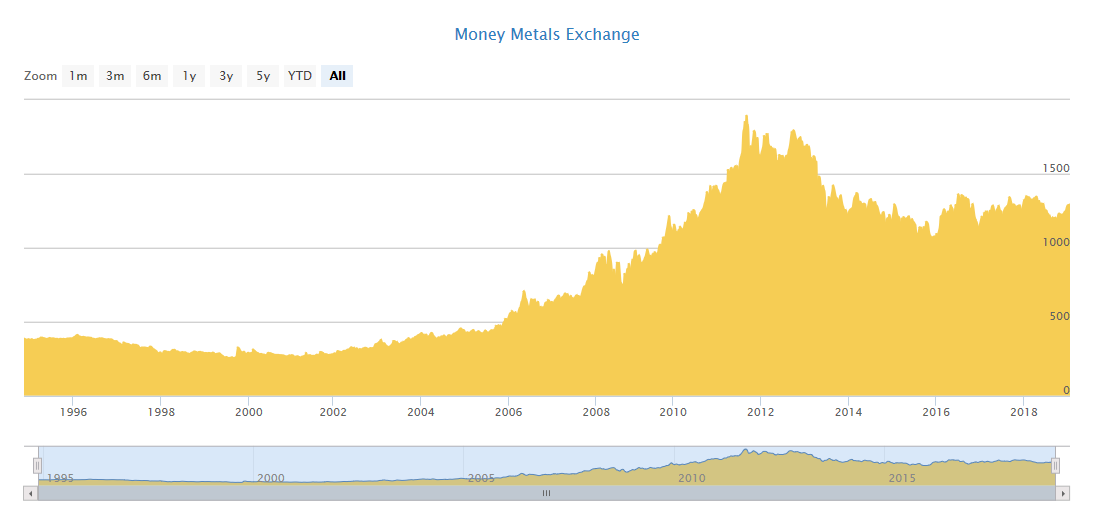

Fast forward to the financial crisis in 2008, the price of gold increased sharply while faith in U.S. equities was languishing. In essence, gold has proven to withstand times of geopolitical and economic uncertainty.

Furthermore, the value of gold has risen steadily over the years.

With the latest Fedspeak sounding more dovish as it now projects two interest rate hikes in 2019 as opposed to three or more, this could be the trigger for gold to return to come back into the forefront, particularly as a safe-haven option in the wake of more volatility. While bonds are typically the default play when U.S. equities go awry, gold is also a prime option for diversification as a safe alternative.

With the latest Fedspeak sounding more dovish as it now projects two interest rate hikes in 2019 as opposed to three or more, this could be the trigger for gold to return to come back into the forefront, particularly as a safe-haven option in the wake of more volatility. While bonds are typically the default play when U.S. equities go awry, gold is also a prime option for diversification as a safe alternative.

“The gold price was depressed during the middle two quarters of last year in particular by the exceptional strength in the U.S. equity market and by the strength of the dollar,” said George Milling-Stanley, of Head of Gold Strategy at State Street Global Advisors. “Looking into 2019, I don’t expect either of those two markets to be as strong and therefore, a headwind for gold.”

Ease of Investing Via an ETF

As mentioned, precious metals like gold offer investors an alternative to diversify their holdings. Like other commodities, gold will march to the beat of its own drum compared to the broader market.

Due to this negative correlation, large downturns in the broad market may not affect commodities. By investing in a gold ETF like GLDM versus actual gold, investors can also reap the benefits of an ETF like its tax efficiency.

Gold ETFs can be bought and sold freely via an exchange when compared to physical gold. As such, investors can utilize the hedging properties of gold without having to endure the costs of actually owning and storing the asset like they would with physical gold.

For GLDM investors specifically, the ETF offers the following benefits:

- The investment objective of SPDR® Gold MiniShares Trust (GLDM) is for the Shares of GLDM to reflect the performance of the price of gold bullion, less GLDM’s expenses

- Shares of GLDM are designed for investors who want a cost-effective and convenient way to invest in gold and will be offered on a continuous basis

- For many investors, costs associated with buying and selling the Shares in the secondary market and the payment of GLDM’s ongoing expenses will be lower than the costs associated with buying and selling gold bullion and storing and insuring gold bullion in a traditional allocated gold bullion account

Per GLDM’s latest factsheet, net assets exceed over $600 million–a remarkable feat given that the inception date of the fund was less than a year ago–June 25, 2018.

“GLDM had the highest organic growth of any ETF launched last year,” said Collett, who referenced GLDM’s growth in comparison to other ETFs where a firm brought its own assets to the fund or ETFs that were launched as part of a structural change to a pre-existing product.

Interest in Gold Rising

The U.S. stock market has been the default play for investors during the historic, decade-long bull run, but the latest volatility may have steered them off course and opportunities abroad could be an alternative. Despite the deep declines in emerging markets this year, with respect to value compared to price, many of these plays from abroad present a profitable opportunity that can be realized, especially if China and the U.S. ameliorate their trade differences.

On the flip side, the performance of these emerging markets is often tied to the performance of their local currency. As such, a strong U.S. dollar will tamp down gains for emerging markets, but increasingly, the EM space is looking to gold as a viable hedge.

With the price of gold experiencing a serendipitous rebound from 2018, investing in gold for these countries abroad makes sense. Gold is up just over 4 percent thus far in 2019.

Source: tradingeconomics.com

“We’ve seen record levels of buying by emerging markets central banks in 2018–the highest net purchases in one year since 1971–the end of the gold standard,” said Milling-Stanley.

However, EM countries buying gold is not a new phenomenon.

“Emerging markets central banks have been steady buyers of gold for a decade now and they show every intention of continuing to reduce their holdings of U.S. Treasuries and increase their holdings of gold,” added Milling-Stanley.

The World Gold Council, in conjunction with State Street Global Advisors, are certainly putting gold investment education at the forefront to ensure that investors are aware of the benefits that can be derived from gold investing. With both GLD and GLDM growing at a rapid rate, a resurgence of interest in gold could be at its nascent stages.

“We put significant resources behind these products and I think investors like that,” said Milling-Stanley. “Not everybody comes to the gold story committed to investing in gold–they need to know more about it.”

For more market trends, visit ETF Trends.