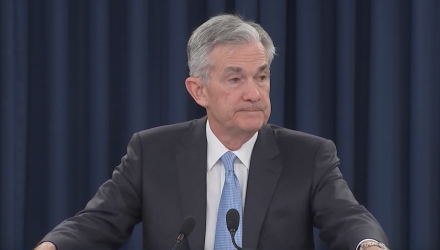

The market sell-offs during the fourth quarter of 2018 also gave the Fed more pause with respect to rate hikes. During Federal Reserve Chairman Jerome Powell’s semiannual testimony before Congress last month, he mentioned that “crosscurrents and conflicting signals” are warranting a patient approach with respect to interest rate policy.

“The federal funds rate is now in the broad range of estimates of neutral–the rate that neither tends to stimulate nor restrain the economy,” Powell said. “As I noted, my colleagues and I think that this setting is well-suited to the current outlook and believe that we should be patient in assessing the need for any change in the stance of policy.”

In a prepared testimony to Congress in February, Powell said that domestic and global developments have “along with ongoing government policy uncertainty, warranted taking a patient approach with regard to future policy changes.” Furthermore, Powell said that economic data will continue to be the primary driver in future Fed decisions, but will be more flexible with the inclusion of new data.

Following the announcement, the Dow Jones Industrial Average effectively erased a 200-point loss in the early trading session to settle for a 30-point as of 3:00 p.m. ET.

The rate decision comes after results from a survey of central bank respondents revealed that gross domestic product is expected to slow to a 2.33 percent rate of growth this year after initially forecasting 2.44 in January.

The 2.33 GDP growth reading is also lower than that of the current growth rate of 3.1 during the fourth quarter of 2018. Things aren’t looking much better for 2020 as survey respondents are expecting GDP to grow under 2 percent.

On the topic of trade, the majority of respondents are expecting a U.S.-China trade deal to materialize this year. 79 percent of respondents are expecting a deal, while 2 percent foresee a new round of tariffs and 17 percent expect tariffs to continue at their current pace.

For more market trends, visit ETF Trends.