While ongoing trade negotiations between the U.S. and China have the capital markets eagerly anticipating a tangible trade deal, stimulus measures by the Chinese government to prop up the domestic economy are starting to take its effect. This could be fueling China ETFs, such as the VanEck Vectors ChinaAMC CSI 300 ETF (NYSEArca: PEK) and the VanEck Vectors ChinaAMC SME-ChiNext ETF (NYSEArca: CNXT).

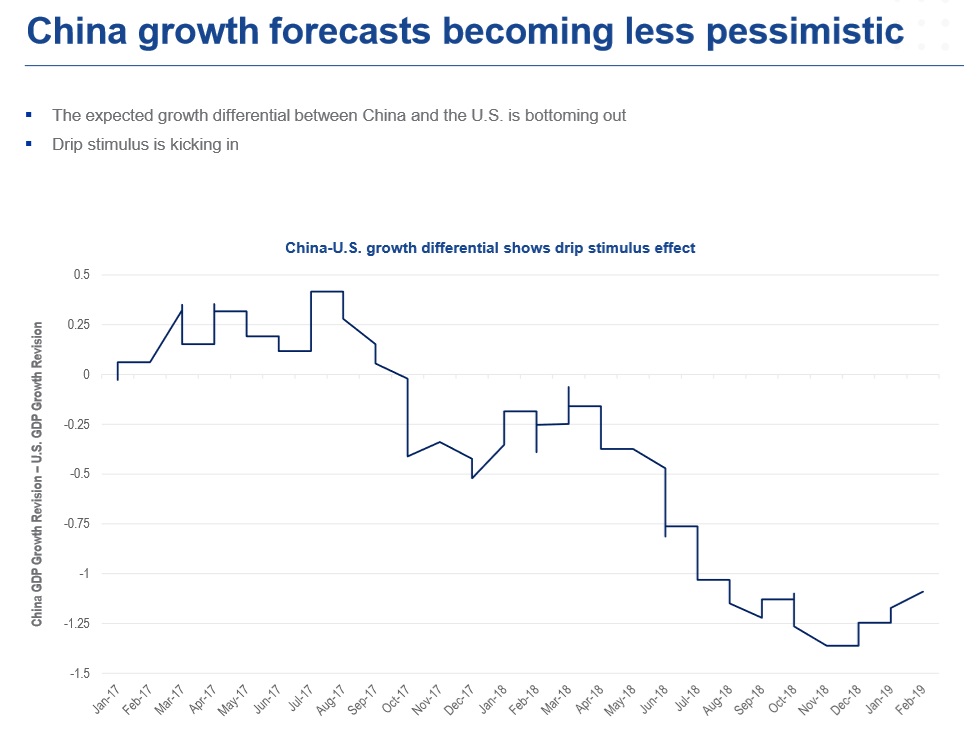

A mix of Chinese stimulus measures have been providing the fodder for economic growth, such as lower taxes, no corporate tax breaks, monetary policy adjustments, and more market access for foreign companies to set up shop. All in all, Wall Street is looking at the Chinese government’s latest efforts as a plus for its economy and a boon for China ETFs.

According to Morningstar performance numbers, PEK is up 26 percent year-to-date while CNXT is up 29.18 percent.

More Foreign Investment Opportunities

Additionally, China is becoming less resistant to safeguarding its businesses, which will open the pathways to more foreign investment. Forbes reported this week that Chinese officials are meeting to discuss which sectors to give access to foreign investors.

China ETFs have also been the beneficiaries of index provider MSCI Inc. announcing recently that it would quadruple its weighting of large-cap Chinese shares in its benchmark indexes. In a press release, MSCI Inc. said it would increase the weight of China A shares in the MSCI Indexes by increasing the inclusion factor from 5% to 20% in three steps.

The decision came after an extensive global consultation with a large number of international institutional investors, including asset owners, asset managers, broker/dealers and other market participants worldwide. MSCI said the proposal to increase the weight of China A shares garnered overwhelming support from investors.

“Stock Connect has proven to be a robust channel to access A shares. The successful implementation of the initial 5% inclusion of China A shares has been a positive experience for international institutional investors and has fostered their appetite to increase further their exposure to the mainland China equity market,” said Remy Briand, MSCI Managing Director and Chairman of the MSCI Index Policy Committee. “The strong commitment by the Chinese regulators to continue to improve market accessibility, evidenced by, among other things, the significant reduction in trading suspensions in recent months, is another critical factor that has won the support of international institutional investors.”