By Lauren Goodwin, CFA; Multi-Asset Solutions Team for New York Life Investments

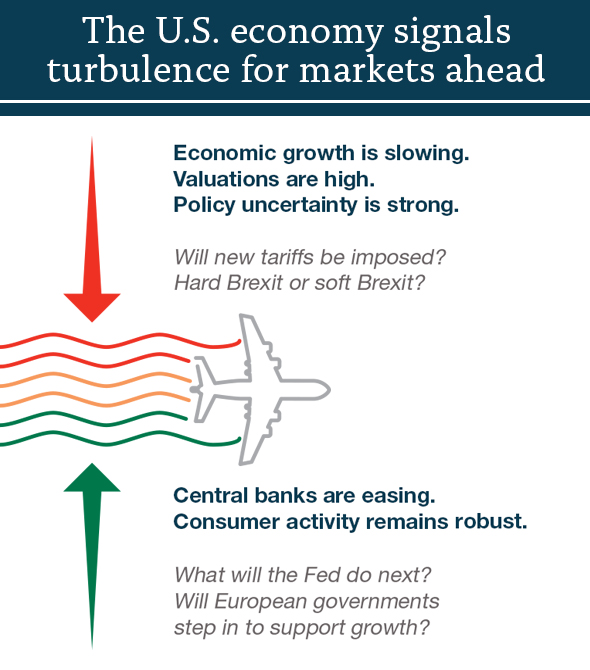

In our latest outlook update, we identified conflicting forces that would set the stage for a volatile market. On one hand, risks to investors are increasing. Economic growth is slowing, downside political and geopolitical risks are ever-present, and equity market valuations have ticked steadily higher—increasing the risk of drawdown. At the same time, central banks are easing policy and consumer spending serves as the single-engine of growth.

Which force will drive market valuations moving forward? It’s anyone’s guess. Weighing the pluses and minuses, we conclude the upside opportunity embedded in risky assets is limited while downside risks are accumulating. We are staying invested, but gearing up for turbulence ahead.

Investors can always expect some turbulence in financial markets. Determining whether we are due for a crash landing can be more difficult. Economic and market data is mixed, and the news covering key risks changes day-to-day. How can investors use this mixed information to decide whether it’s time to de-risk further?

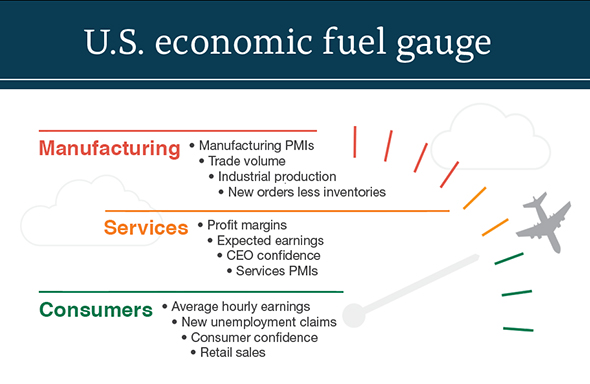

Every economic cycle is different, but there is some consistency across time. We monitor a series of conditions that help tell us whether the economy can stay in flight or will require an emergency landing. These conditions are called “signposts”—hints that the winds could be changing course. The more our signposts are triggered by deteriorating economic conditions, the more worried we become about market turbulence and investor returns.

For now, economic conditions look reasonable. The consumer, more than two-thirds of the economy, has proven resilient despite a slowdown in the manufacturing sector and business investment. However, if business conditions weaken more broadly, or consumer confidence begins to fade, we will opt to turn on our “fasten seatbelt sign.”

What can reduce turbulence if the economy runs out of fuel? In short, we are pulling back moderately on risk, reducing equity exposure at the periphery and upgrading the quality of our bond holdings. While rarely the highest-earning strategy in a bull market, these tactics can create less volatile conditions during times of market stress.

This material represents an assessment of the market environment as at a specific date; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

“New York Life Investments” is both a service mark and the common trade name, of the investment advisors affiliated with New York Life Insurance Company.