By Robert Serenbetz, from the Multi-Asset Solutions Team at New York Life Investments

Slowing economic growth has weighed on corporate sales and profits. The MAS team believes further negative guidance will likely prompt market volatility throughout the rest of the year. As a result, we have reduced our equity exposure, favoring investments less exposed to wage pressures, global trade disruption, and manufacturing weakness.

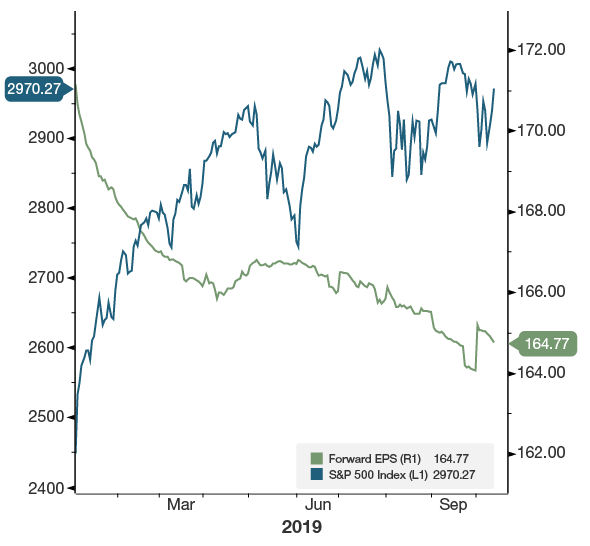

Weaker earnings are not reflected in S&P 500 Index valuations

Source: New York Life Investments Multi-Asset Solutions team, Bloomberg, S&P. As of 10/15/19.

Analysts already anticipate a weak corporate earnings season. Current FactSet estimates suggest that S&P 500 corporate profits may decline -4.1% versus this time last year. Yet the price of the S&P 500 Index doesn’t yet reflect this weakness. Why? Expectations for 2020 profit growth remain high – upwards of 10%.

We are concerned that S&P 500 Index earnings may display weakness beyond the third quarter 2019. September’s weak ISM reading for both services and manufacturing (47.8 and 52.6 respectively) suggest that economic growth will continue to slow. Meanwhile, the yield curve and payrolls are sending worrying signals of an impending recession. We believe investors and analysts may be too optimistic on earnings-per-share growth in the year ahead.

Source: New York Life Investments Multi-Asset Solutions team, Bloomberg, S&P, Institute for Supply Management. As of 10/15/19.

What’s causing weak earnings?

The late cycle economic environment lends itself to growing margin pressure primarily through rising labor costs, but the trade war has also exacerbated these pressures. Weaker than expected inflation data suggests that a substantial share of tariffs is being absorbed across supply chains via margin compression and currency market adjustments.

The National Income and Product Accounts (NIPA) profits, which include a broader universe of companies in the US economy than the S&P 500, have already peaked, and appear to be on the decline. Importantly, NIPA profits tend to lead S&P profits. We expect that current divergence forewarns that S&P 500 profits may weaken.