HIVE reported $5.6 million in net income in the first quarter of fiscal year 2020, having mined some 1,331 newly minted bitcoin during the period, as well as 35,000 Ethereum Classic and 3,200 newly minted Ethereum. You can read the full press release here.

Since HIVE’s debut a little over two years ago, investors have used it as a proxy to trade cryptocurrencies. That’s precisely why we took it public. I wasn’t able to open a bitcoin ETF for regulatory reasons—indeed, this is unlikely to change any time soon, as the SEC just rejected the latest attempt at creating such an ETF—so the next best thing was to create a world-class crypto miner and bring it to market.

I’m proud of how far HIVE has come these past two years, and even prouder that we managed to make money in what could have been a disastrous quarter. I’m very excited to see what’s in store.

Time to Buy the Gold Dip?

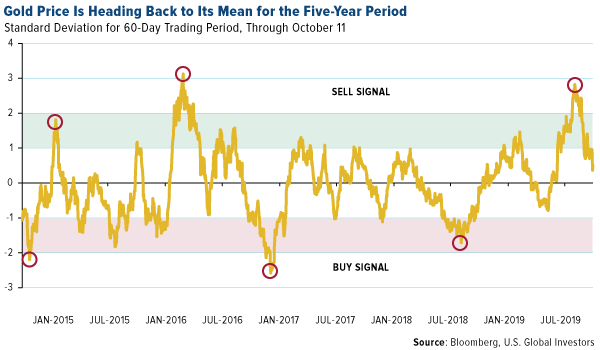

The same goes with gold, which is headed back to its mean after its price was up nearly three standard deviations in August. As CLSA analysts said recently, these price dips look like attractive buying opportunities “in anticipating of a resumption of the initial base breakout.”

Last week our office was visited by the legendary economist Nancy Lazar, co-founder of Cornerstone Macro, who commented that the growing mountain of global debt, not to mention the proliferation of low to negative-yielding debt, makes the yellow metal very attractive right now.

I agree. During my interview with Kitco News’ Daniela Cambone, I reiterated my call for $10,000 gold. Some critics believe only a major event, such as a war or famine, would be enough to push the metal up that high, but really all it takes is monetary and fiscal mismanagement. That’s exactly what we’re seeing right now in Europe, where growth is slowing because of business-killing regulations. But instead of getting rid of these rules, interest rates have been allowed to dip below zero. In Denmark, banks are actually paying borrowers to take out a mortgage, which is contributing to what Nancy sees as a European housing bubble.

Conditions aren’t much better in the U.S.—or at least they weren’t, until President Trump began rolling back unnecessary regulations.

According to Steve Forbes, there are 773,000 words in the Bible, which sounds like a lot until you learn that there are around 10 million words in the federal income tax code. Similarly, there are more than 185,000 pages in the Federal Register of rules and regulations. That’s up 17 percent from 158,000 pages in 2008. But in 2018, the number of pages actually fell almost 1,000 pages, or 0.5 percent, meaning Trump is keeping his word.

Register now for our upcoming webcast!

Mark your calendars! Pierre Lassonde, co-founder of Franco-Nevada, agreed to participate on our upcoming webcast scheduled for October 31. We’ll be discussing opportunities in gold mining, as well as our outlook for the gold price. (If you recall, Pierre says it could hit $25,000 by 2049!) It’s sure to be an interesting conversation—I look forward to you joining us!

To register, send us an email at [email protected].

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

Frank Holmes has been appointed non-executive chairman of the Board of Directors of HIVE Blockchain Technologies. Both Mr. Holmes and U.S. Global Investors own shares of HIVE. Effective 8/31/2018, Frank Holmes serves as the interim executive chairman of HIVE.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2019): Delta Air Lines Inc., American Airlines Group Inc., United Airlines Holdings Inc., Allegiant Travel Co., Spirit Airlines Inc., Franco-Nevada Corp.