By Denis Rezendes, Beaumont Capital Management

In the past, the Consumer Staples sector has had a reputation for providing investors with the best of both worlds: market-like returns and defensive characteristics. This reputation is well deserved—during the 10 years starting 12/31/2007 and ending 12/31/2017 the Consumer Staples sector outperformed the S&P 500® Index by roughly 1.5% annualized with a maximum drawdown of 27.4%, compared to 48.4% for the S&P 500. The sector also held up well during the more recent market drawdowns in 2011, 2015, and 2016, but this hasn’t been the case so far in 2018.

Year-to-date, through the close on 2/13/2018, the sector and the S&P 500 both experienced a drawdown, with Consumer Staples underperforming the index by over 4%. As a result, investors are asking “what’s different this time?” Of course there is no “answer” but we do have a theory and it centers largely on inflation expectations.

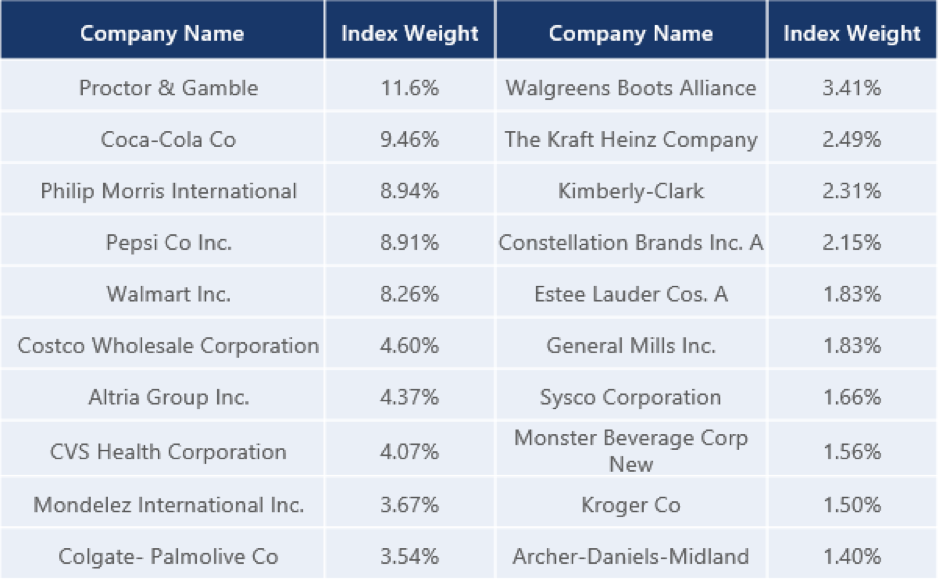

Before diving into that we need to back up and provide a little context. The Consumer Staples sector owes its strong past performance to two wonderful characteristics, consistent demand and pricing power. Understanding why is as simple as looking at the top constituents of the index.

![]()

The sector is comprised of well-known high quality branded products that consumers around the world use every day such as Gillette razors, Vicks VapoRub, Oreo cookies, and Kleenex tissues. Daily usage is responsible for the consistent demand, and the well-known brands are responsible for the pricing power. These are brands that consumers know and trust, and as a result these companies have been able to command premium pricing and generally pass on any cost increases directly to consumers. The consistent demand hasn’t changed, consumers aren’t washing fewer dishes or brushing their teeth less. Instead the worry is whether the pricing power associated with brands will continue. To illustrate why, imagine the following exchange: