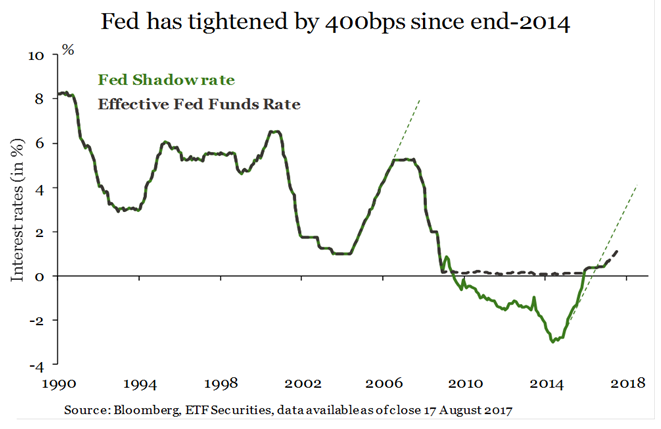

Investors will also have to consider the effects of monetary policy as the Federal Reserve looks to normalize interest rates. The Fed has tightened the effective Fed Funds rate by 400 basis points since the end of 2014, compared to the average tightening of 380 basis points in previous cycles, and the central bank is expected to tighten its monetary policy ahead as well.

In an uncertain environment ahead, many have looked to precious metals and commodities as an alternative asset to diversify a traditional equity and fixed-income portfolio. However, investors should look to some considerations, such as gold’s correlation to real interest rates. Broad commodities have performed well in rate hikes, which may make sense since raw materials like oil are needed to fuel a the further growth where rate hikes may be issued to keep the economy in check.

Butterfill also pointed to the safe-haven, hedging benefits of precious metals like gold as a way to shield the portfolio against unknowns. For instance, gold experienced price jumps following major geopolitical events, such as the recent global financial crisis, Nixon’s resignation and Yom Kippur War, among others.

Matt Collins, Head U.S. Product Operations and Capital Markets at ETF Securities, pointed out that investors have a number of ways to access the commodities markets to access an asset class with low correlation to traditional investments and potentially better diversify a portfolio. For instance, investors can look to physically backed metals-related ETFs, including ETFS Physical Swiss Gold Shares (NYSEArca: SGOL), ETFS Physical Silver Shares (NYSEArca: SIVR), ETFS Physical Platinum Shares (NYSEArca: PPLT) and ETFS Physical Palladium Shares (NYSEArca: PALL). ETF investors can also use the ETFS Physical Precious Metals Basket Shares (NYSEArca: GLTR) as a catch-all of all four precious metals.

Furthermore, investors interested in diversifying their portfolios with commodities exposure have a number of ETF options available to them, including the actively managed ETFS Bloomberg All Commodity Strategy K-1 Free ETF (NYSEArca: BCI) and ETFS Bloomberg All Commodity Longer Dated Strategy K-1 Free ETF (NYSEArca: BCD).

Financial advisors who are interested in learning more about ETF Securities’ market outlook for the rest of the year can watch the webcast here on demand.