![]() By Doug Sandler, CFA, RiverFront Investment Group

By Doug Sandler, CFA, RiverFront Investment Group

Bull Market Presents Opportunity to Address a Major Portfolio Risk, in our View

In our opinion, concentrated positions present one of the biggest obstacles standing in the way of an investor achieving their long-term investment goals. The most sophisticated financial planning tools and the most capable portfolio management teams cannot insulate an investor from the risks presented by these positions. While many investors would prefer to address a concentrated position ‘tomorrow’ when share prices are higher or their tax status is more favorable, it is important to recognize that time is not always on the investor’s side. In this day of 24-hour news and ubiquitous information, the fortunes of any company can change rapidly without warning alarms. We have seen too many investors losing too much money over the years from being blindsided by a concentrated position.

What is a Concentrated Position?

The term “concentrated position” could mean different things to different people. We define concentration as any single position that is three or more times larger than an average position in a portfolio. (Our definition does not apply to mutual funds, exchange-traded funds [ETFs] or other potentially diversified investment vehicles.) Concentrated positions can end up in a portfolio for many different reasons: they can come from a successful investment; they can be inherited from a parent or grandparent; or, they can represent a percentage of ownership in a current or former employer.

Why Concentrated Positions Can Be Dangerous

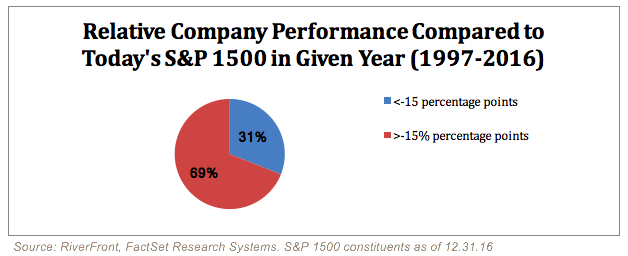

1. Concentrated positions can make portfolios more susceptible to “lightning strikes”: A concentrated position can be like a tall tree in a lightning storm. While this risk may be obvious, what might surprise investors is the frequency at which portfolio “lightning strikes” occur. The risk that a single position could underperform the market by a significant margin – say 15% annually – is not insignificant. For example, over the last 20 years, on average 31% of the companies comprising the current S&P Composite 1500 Index have underperformed the index by more than 15 percentage points in a single year. In fact, in years like 1998, 1999, 2007, 2008 and 2015; more than 40% of companies underperformed by that margin. Furthermore, those companies that underperformed did so by an average of 31 percentage points in the year they underperformed. This is one of the many reasons that concentrated positions are often not permitted in the institutional management world and can be viewed as a potential breach of fiduciary duty.

2. Concentrated positions in the stock of one’s employer can be especially dangerous, in our view. We invest for many reasons, but one of the primary objectives is to protect against an uncertain future. A properly structured investment portfolio can act as an income supplement during periods of wage softness or unemployment. For this reason, we think a concentrated position in the stock of an employer is especially dangerous. There is typically a strong correlation between the performance of a company’s stock and the compensation and job security of that company’s employees. During those periods when job security is low and compensation most under pressure, an investor with a portfolio dominated by the stock of their employer could likely find their financial hardships exacerbated. In the last ten years, ex-employees of some of America’s most well-known companies have had to learn this lesson the hard way.

3. Concentrated positions can force sub-optimal strategies: Generally speaking, an investment plan with significant limitations and restrictions is more likely to produce sub-optimal risk-adjusted performance. In our view, investors who ask their financial advisors to manage around or ignore a concentrated position are making a choice to hold a potentially inferior portfolio and accept inferior risk-adjusted returns. The more a concentrated position underperforms, the more difficult it becomes to execute a well-devised investment plan. A 20% position in a stock that underperforms the market by 20% in a single year costs the entire portfolio 400 basis points. Concentrated positions also present the greatest risk to those investors who regularly rely on withdrawals from their portfolio to supplement their income. An investor who takes systematic withdrawals will be forced to increasingly eat into the healthy portions of their portfolio to compensate for the decline in their concentrated position. Diversification does not ensure a profit or protect against a loss.

Doug Sandler, CFA, is Chief U.S. Equity Officer at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations. Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.