The whipsaw of volatility continued on Thursday as the Dow plunged as much as 600 points before it resuscitated itself back to life and well into positive territory. The Dow finished over 250 points after Wednesday saw it reach a historic 1,000-point gain.

The initial trade war concerns quickly left the minds of investors an hour before Thursday’s session closed, capping off another wild ride in the markets.

“The uncertainty will continue to weigh on the market,” said Dave Campbell, principal at BOS. “I think that’s going to help drive the volatility as we roll forward because I don’t think it’s going to be a clean path to an agreement or some kind of resolution.”

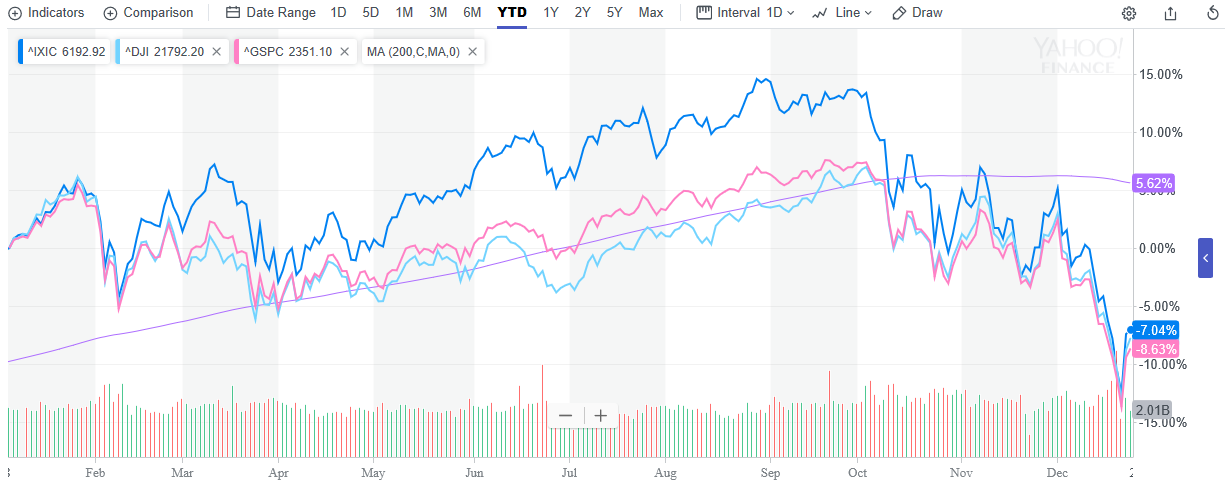

The S&P 500 and Nasdaq Composite both finished in the green, climbing 0.84 percent and 0.4 percent, respectively. The major indexes are still below their 200-day moving averages after hovering above that level for most of 2018.

JP Morgan Sees Window of Opportunity

As 2018 becomes 2019, investors can wash their hands of the last few months of volatility, and according to multinational investment bank JP Morgan, it’s the perfect time to reload on U.S. equities.

With one and a half sessions left in the month, it’s been a December to forget–the Dow Jones Industrial Average has slid 10.42 percent, while the S&P 500 has lost 10.60 percent. In a one-month span, the Nasdaq Composite has shed 10 percent.