Electric vehicle growth might be slowing marginally this year, but it’s still on track to beat last year’s record of over 10 million deliveries. The KraneShares Electric Vehicles and Future Mobility ETF (NYSE: KARS) is already off to a good start for the year and offers investment opportunity across the EV value chain.

Sales for electric vehicles in 2022 are estimated to be about 10.6 million, a 57% increase over 2021. Bloomberg is currently forecasting a slower rate of growth in 2023 with total deliveries (the metric that EV manufacturers like Tesla track instead of sales) of 13.6 million, a number that is still reflective of increased global EV demand despite the economic uncertainty hanging over much of the year.

EVs had a strong night overnight in China, explained Brendan Ahern, CIO of KraneShares, in the China Last Night blog: “Electric vehicles (EVs) had a great session in Hong Kong as BYD led gains in the industry, up +6% on speculation that Ford may sell its German plant to the EV company.”

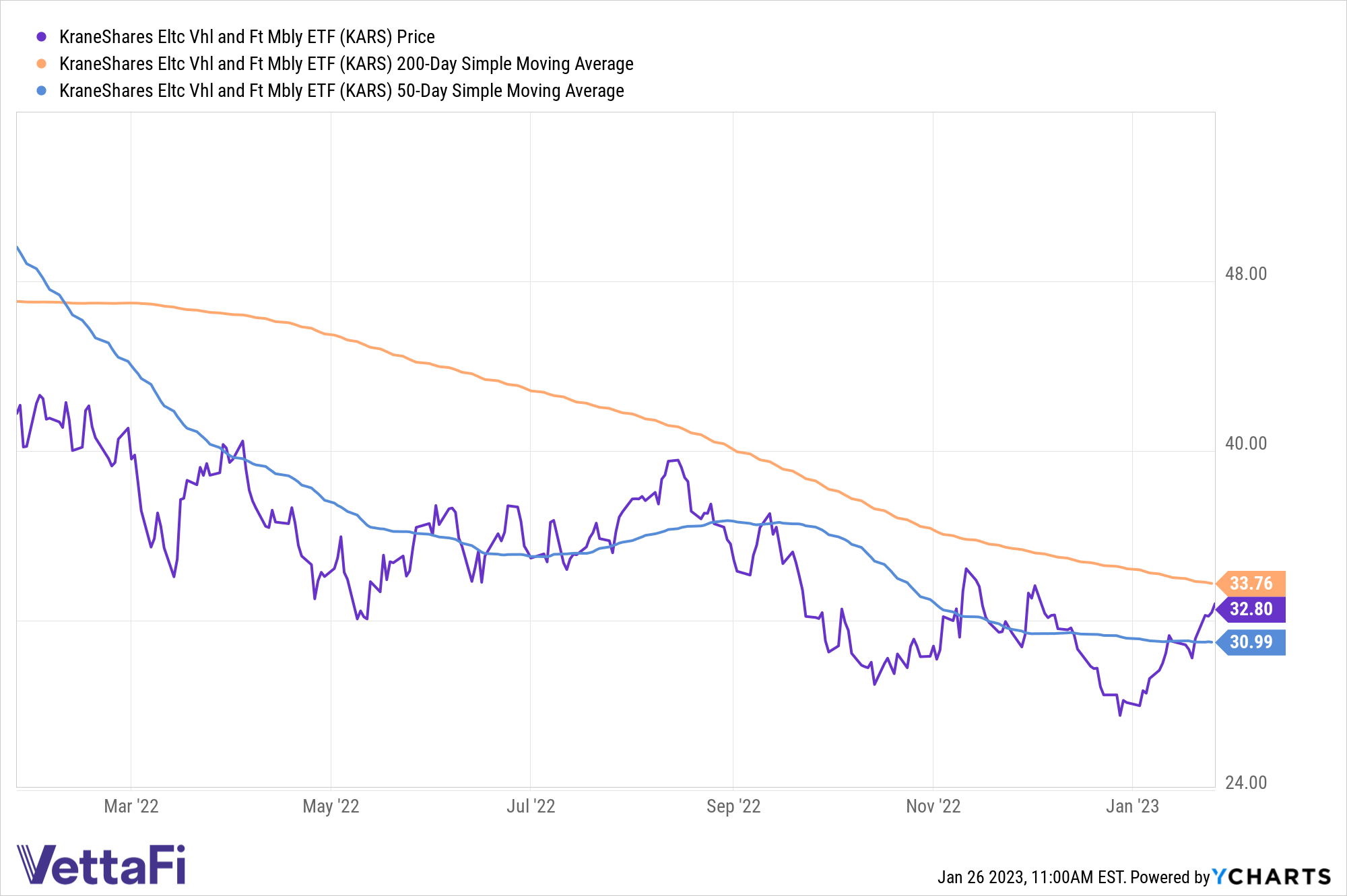

The KraneShares Electric Vehicles and Future Mobility ETF (NYSE: KARS) offers a good solution for investors looking to capture the potential growth of major EV producers globally. Year-to-date, the fund is up 16.56%, is currently trading above its 50-day simple moving average, and is trending upwards towards its 200-day SMA. For trend-followers, such a cross signals that the ETF is a buy.

The fund takes not just a global approach to EV exposure but also invests along the entirety of the value chain, offering diversification for EV investors. KARS invests in battery manufacturers such as Contemporary Amperex Technology Co. (CATL) at a 4.91% weight and BYD at a 2.77% weight.

KARS measures the performance of the Bloomberg Electric Vehicles Index, which tracks the industry holistically, including exposure to electric vehicle manufacturers, electric vehicle components, batteries, hydrogen fuel cells, and the raw materials utilized in the synthesis of producing parts for electric vehicles.

KARS invests in many familiar car companies such as Tesla, Ford, and Mercedes-Benz, and major Chinese EV manufacturers such as Li Auto, Nio, and BYD. It also goes a step beyond and invests in the companies that contributed to the EV value chain, such as Samsung, LG, Panasonic, and Albemarle.

It has an expense ratio of 0.70%.

For more news, information, and analysis, visit the Climate Insights Channel.