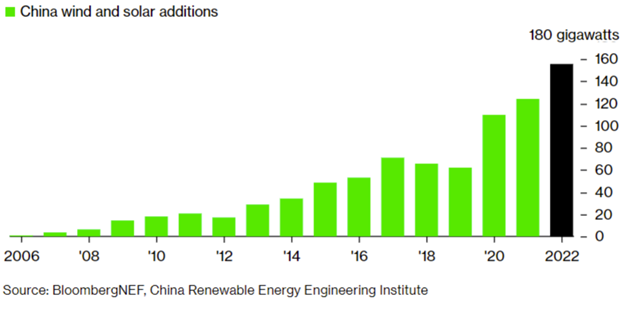

According to the China Renewable Energy Engineering Institute, one of the top think tanks in China when it comes to renewable energy, the country will grow its renewable energy infrastructure of solar panels and wind turbines 25% this year in one of the most bullish predictions for the space thus far, reported Bloomberg. The growth is happening alongside talks from government officials looking to boost financial support of solar power as it seeks to reach peak carbon emissions by 2025.

Yi Yuechun, vice-dean of the Institute, has said that this year alone, China will be building out a record-setting 156 gigawatts of renewable energy through new solar panels and wind turbines. It’s a huge jump from last year for the world’s leading solar panel producer and China continues its massive transition renewable energy and net-zero emissions by 2060.

Image source: Bloomberg

Not only is China expanding, it is also staying on the front edge of innovation in its use of solar technology. A fishery in Cangzhou, located in China’s Hebei region, has just completed building a 70 megawatt solar plant — on top of a giant pond that is used as a fishery. The solar panel installation was completed in June, and once it is connected to the grid, the fishery will be used for fish and shrimp.

This hybrid system has become increasingly popular and offers a number of benefits, such as conserving land space, helping to provide shade for the water and reduce temperatures on hot days, cutting back on evaporation that kills fish, and helping the solar panels themselves run up to 15% more efficiently due to the cooling effects of sitting on water. It’s just one of the solutions to climate change as innovation continues to be driven by the necessities of the dire situation.

Investing in China’s Energy Transition and ESG Industry Leaders

The KraneShares MSCI China ESG Leaders ETF (KESG) invests in the leading ESG companies within China, and because of its sector diversification, it has been able to mitigate much of the regulatory risk within China in the past year. The fund invests in a number of solar and renewable energy companies driving change within China.

The fund seeks to track the MSCI China ESG Leaders 10/40 Index, an index that is free float-adjusted and market cap-weighted. It includes companies with high ESG ratings compared to their peers within their industries. The index includes all types of publicly issued shares from Chinese issuers from all market caps and screens out any issuers that have any controversies according to the UN Declaration of Human Rights, the International Labor Organization Declaration on Fundamental Principles and Rights at Work, and the UN Global Compact. The index also screens out any companies that are involved in alcohol, tobacco, civilian firearms, gambling, nuclear power, and conventional and controversial weapons.

The index is comprised of securities from the following sectors: consumer discretionary, industrials, financials, communication services, healthcare, real estate, utilities, consumer staples, information technology, materials, and energy. Securities included make up the top 50% market cap of their respective sectors, and no single security can make up more than 10% of the underlying index, while no sector accounts for more than 40% of the index.

KESG has an expense ratio of 0.58%.

For more news, information, and strategy, visit the Climate Insights Channel.