With Christmas two weeks away, the holiday vibes remind us that now is the time of year to strengthen familial and friendly bonds, but the capital markets are also reminding us that it’s a great time to fortify bonds in your portfolio.

Monday’s volatility that saw a 507-point loss cut down to size to end the session with a 34-point gain by the Dow Jones Industrial Average was a reminder to investors of the market’s unforgiveness–even with the holidays in full swing. As such, there has been a marked shift by investors towards safer-haven assets like fixed-income as volatility continues to whipsaw the major indexes.

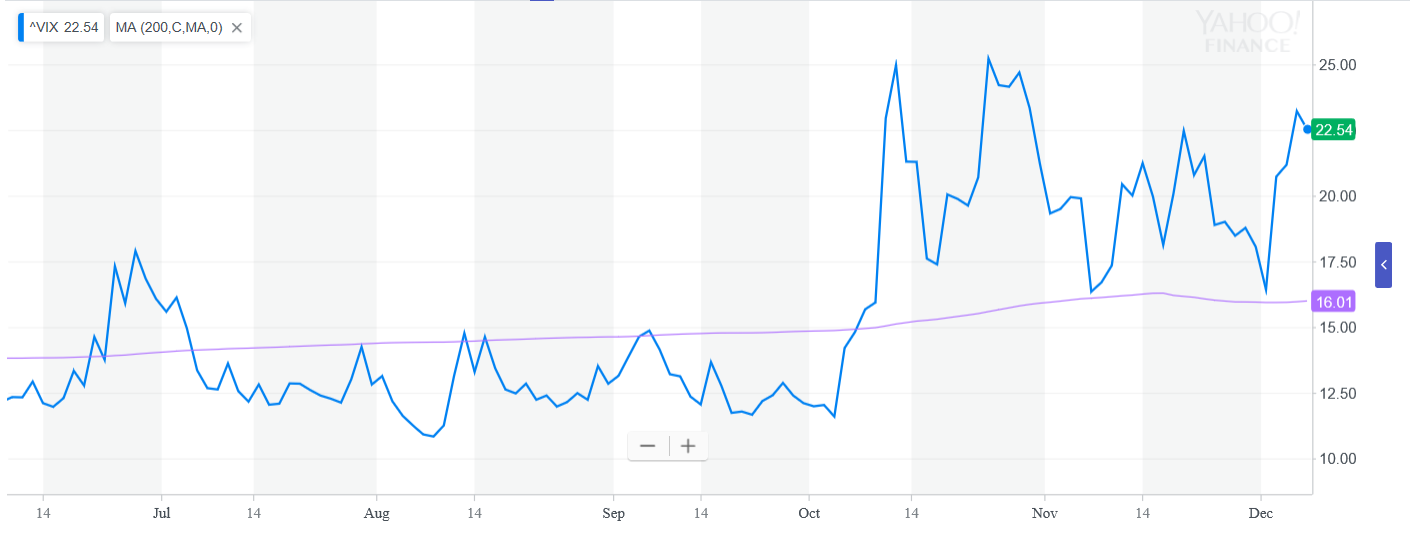

With the VIX Index surpassing its 200-day moving average since early October, fixed-income has once again become the default play as skittishness in U.S. equities are fueling an appetite for bonds. As volatility continues to rain down on the capital markets, the move to bonds has been followed by inflows into the exchange-traded fund (ETF) space for fixed income, particularly of the short duration variety.

With U.S. equities in limbo as investors are undecided on whether to enter the markets on the recent dip or remain in cash, a move to bonds has been the most recent default move. In fact, according to financial research firm EPFR Global, short-term debt funds saw an influx of $1.86 billion for the week ending Dec. 5 as opposed to an outflow of $22.4 million in long-term debt.