The end of the year means tax-loss harvesting for portfolios is in full swing, with advisors attempting to capture losses this year to offset any capital gains made. In a dismal year for stocks and bonds, the options for tax-loss harvesting are more numerous than they have been in the last two decades, but when looking to reallocate into similar exposures, it’s important to keep an eye to the coming year and position portfolios for continued market challenges.

Markets have rallied on hopes of the Federal Reserve easing off the gas pedal of interest rate hikes this month, but in a speech yesterday, Powell cautioned that the more important gauge to keep sights on is how high rates will have to go and, more importantly, how long they will need to stay elevated to adequately tame inflation.

“It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy,” warned Powell in a speech on Wednesday. “We will stay the course until the job is done.”

It’s familiar rhetoric which means that monetary policy will likely remain constrictive for much of 2023. It also makes the opportunity to shift equity allocations from tax-loss harvesting into better-positioned strategies for economic hardships that much more appealing.

Tax-Loss Harvest Out of Broad Equity Losses and Into Quality

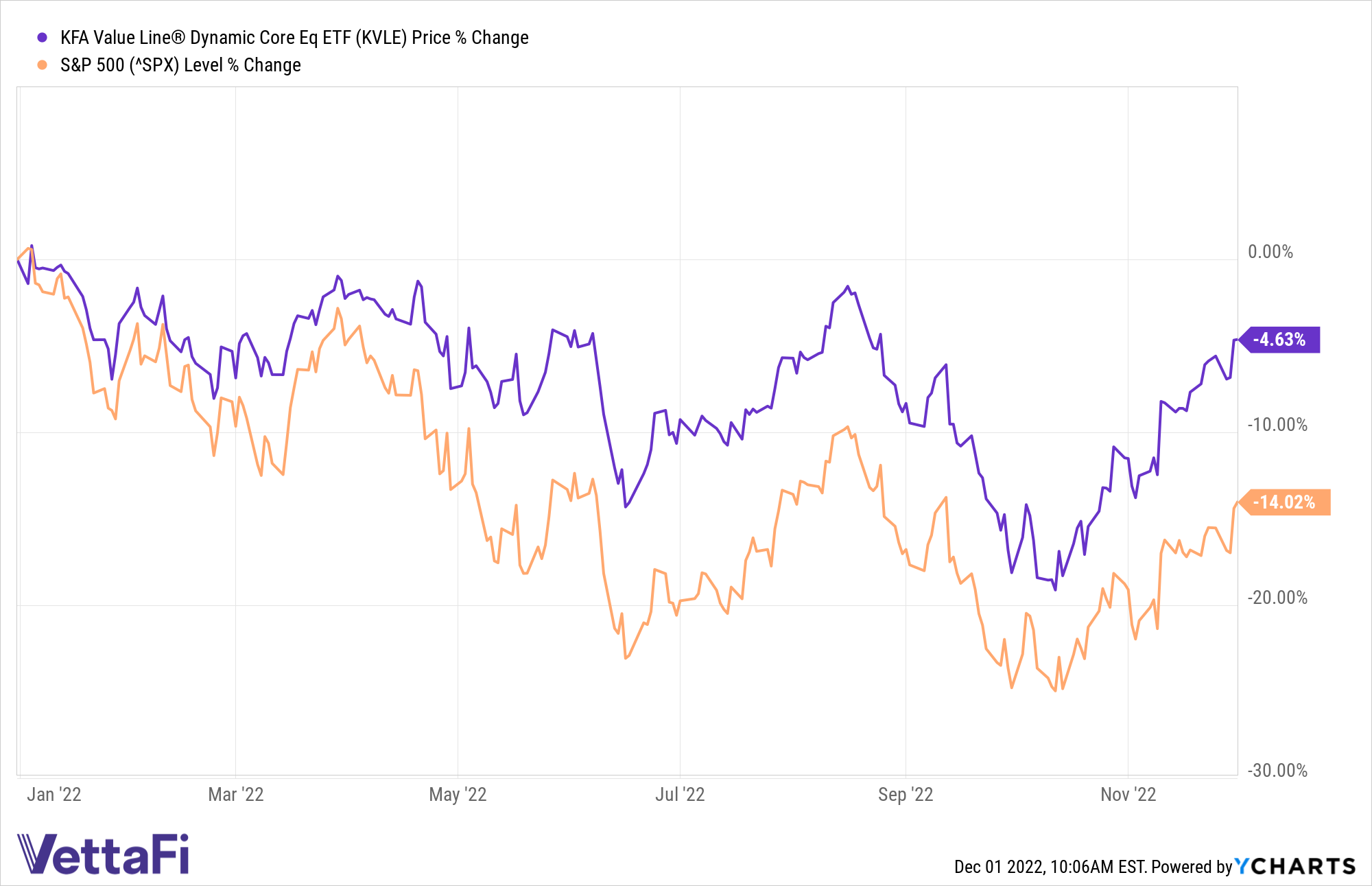

For advisors looking to tax-loss harvest losses in equities this year and move into a fund that captures dividend-generating companies with a focus on value, the KFA Value Line Dynamic Core Equity Index ETF (KVLE) is worth consideration. KVLE invests in higher-yield companies while diversifying in a way that a “theme” portfolio does not.

The fund is a core equity portfolio of securities that are tilted to favor dividend yield, and it seeks to increase yield while avoiding investing solely in high yield sectors and stocks. It’s an approach that has yielded consistently better performance than the S&P 500 in 2022.

KVLE is benchmarked to the 3D/L Value Line Dynamic Core Equity Index and utilizes optimization technology to emphasize securities with solid dividend yields with the highest rankings in Value Line Safety and Timeliness. The fund uses a smart beta strategy in seeking more cost-efficient alpha and a risk management strategy that seeks to limit the effects of major market declines while also being positioned to capture positive returns.

KVLE carries an expense ratio of 0.55%.

For more news, information, and analysis, visit the China Insights Channel.