The Chinese internet sector has had a rocky year with regulations working to redefine the space and the companies that inhabit it. In the midst of it all is the KraneShares CSI China Internet ETF (KWEB) experiencing record inflows as it continues to weave new companies into its portfolio. The following is a breakdown of what companies have been added and when.

Kuaishou Technology (1024 HK) was added on the rebalance in February and is a content community and social platform for mobile users. It hosts a place for its users to create, share, and watch short videos and is akin to TikTok. Kuaishou Technology derives its money from livestreaming, advertising, e-commerce, and virtual gifts, according to CNBC, and is carried at a 2.56% weight.

Yidu Technology (2158 HK) was added on the June rebalance and is a medical data intelligence platform. It works to provide healthcare solutions that are created using big data and artificial intelligence tech, and it utilizes cloud technology as well. Yidu Tech is carried at a 0.49% weight.

XD Inc (2400 HK) was added on the June rebalance and is an investment holding company that is involved in mobile and web video games. The company has two different parts of its business: a game publishing and operating service, and an information services segment that has online marketing services for video game developers and others within the game industry, according to Reuters. XD Inc is carried at 0.37% weight.

Youdao Inc (DAO) was added on the June rebalance and is a software applications developer and marketer. Amongst the services they provide as an intelligent learning company are personal cloud, e-commerce shopping, language translation, and more, per Bloomberg. Youdao is carried at 0.27% weight.

360 Digitech Inc (QFIN) was added on the June rebalance and is a fintech platform that helps lenders reach underserved markets and utilizes funding partners to finance, according to Reuters. 360 Digitech offers risk management and credit data services for its users who otherwise might not have access. QFIN is carried at 0.68% weight.

21 Vianet Group Inc (VNET) was added on the June rebalance and is the biggest carrier-neutral internet provider in China, per their website. They provide cloud services, hosting and related services, and business VPN services. VNET is carried a 0.63% weight.

17 Education & Technology (YQ) was added on the June rebalance and is an online education company that has reworked its business model to be in compliance with the new after-school tutoring regulations. It is the leading education tech company within China that offers an in-school and after-school blended model, according to their website. YQ is carried at a 0.03% weight.

Zhihu Inc (ZH) was added on the June rebalance and is a website for questions and answers for its community, similar to Quora in the U.S. The company uses a rigorous credential verification process for any experts that are providing answers on the site, per their website. ZH is carried at a 1.16% weight.

Full Truck Alliance (YMM) was added on the July rebalance and is the largest digital freight platform globally based on gross transaction value, per their website. The company is a logistics manager that connects trucks to shippers and allows for on-demand requests and fulfillment. YMM is carried at 4.75%.

KWEB a Great Buy Into China’s Growing Internet Sector

The KraneShares CSI China Internet ETF (KWEB) continues to be one to watch as the Chinese tech sector — particularly the internet industry — works to meet regulations and recover from its recent setbacks.

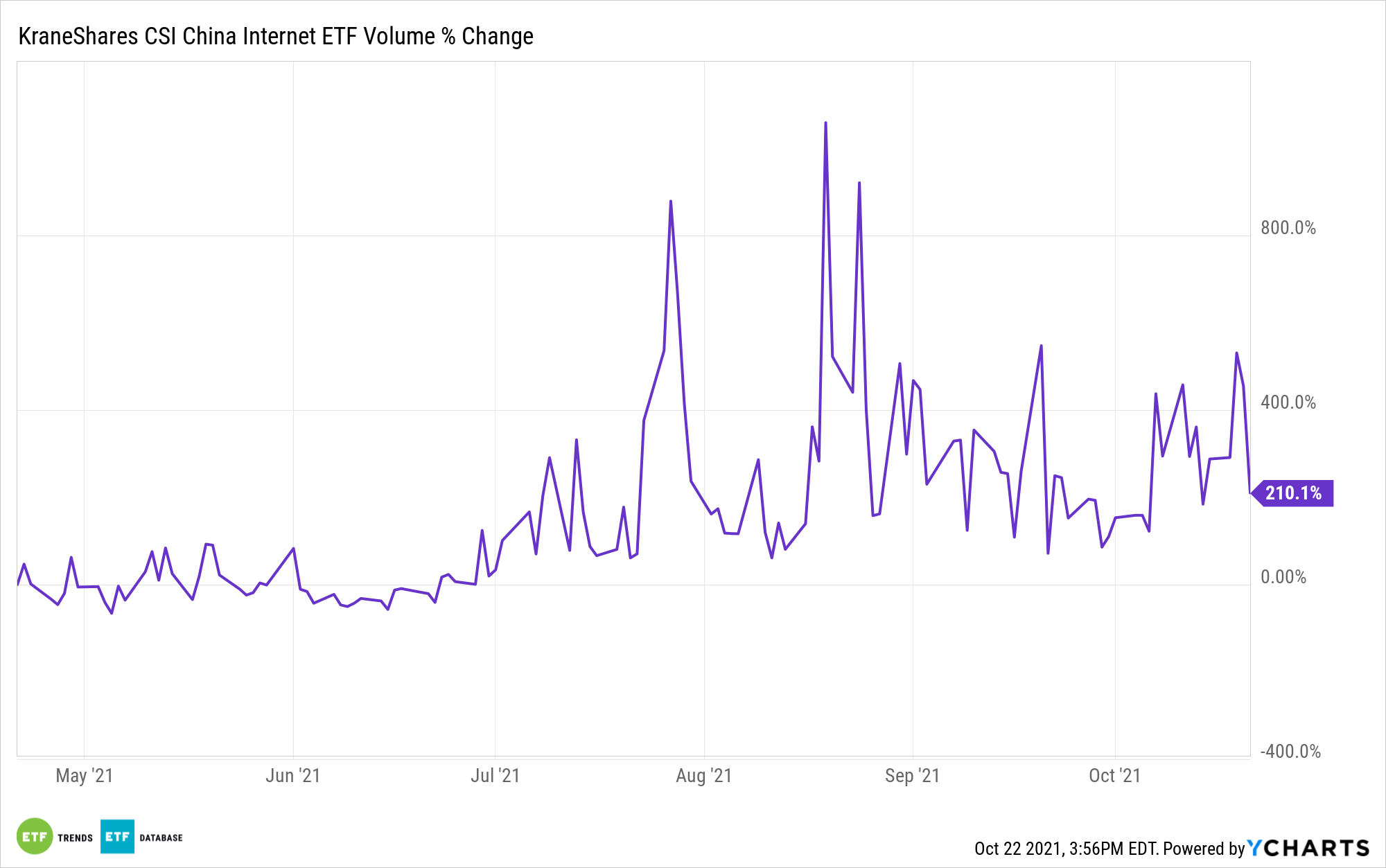

KWEB saw $880 million in net inflows at one point last month as investors bought the dip and were looking long-term.

KWEB tracks the CSI Overseas China Internet Index and measures the performance of publicly traded companies outside of mainland China that operate within China’s internet and internet-related sectors.

This includes companies that develop and market internet software and services, provide retail or commercial services via the internet, develop and market mobile software, and manufacture entertainment and educational software for home use.

KWEB provides exposure to the Chinese internet equivalents of Google, Facebook, Amazon, eBay, and the like, all companies that benefit from a growing user base within China, as well as a growing middle class.

Its top holdings include Tencent at 10.83%, Alibaba (BABA) at 9.18%, and Meituan at 9.04%.

The ETF has an annual expense ratio of 0.70%.

For more news, information, and strategy, visit the China Insights Channel.