The Federal Reserve enacted its second consecutive 0.75% interest rate hike last week in response to June’s soaring 9.1% inflation number and indicators of a still strong jobs market that added 372,000 jobs in June. Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, appeared on CNBC’s “Face the Nation” on Sunday, reiterating that the central bank is far more concerned about inflation than it is a recession.

“We’re going to do everything we can to avoid a recession, but we are committed to bringing inflation down, and we are going to do what we need to do,” Kashkari said on the show. “We are a long way away from achieving an economy that is back at 2% inflation. And that’s where we need to get to.”

The Fed still hopes that its fight to curb inflation will not result in recession, but Kashkari’s comments reflect earlier commentary from Fed Chair Jerome Powell that the central bank is going to keep the pressure on until it sees undeniable proof that inflation is receding.

“Whether we are technically in a recession or not doesn’t change my analysis,” Kashkari said. “I’m focused on the inflation data. I’m focused on the wage data. And so far, inflation continues to surprise us to the upside. Wages continue to grow.”

This means, for now, the Fed raises rates while quantitative tightening hits its stride in September, rolling off $60 billion in maturing Treasury securities monthly and $35 billion in maturing mortgage-backed securities monthly once tightening hits maximum reductions. What that means for markets is still somewhat unknown as the U.S. is in fairly unprecedented territory this inflationary cycle, but extended volatility is anticipated.

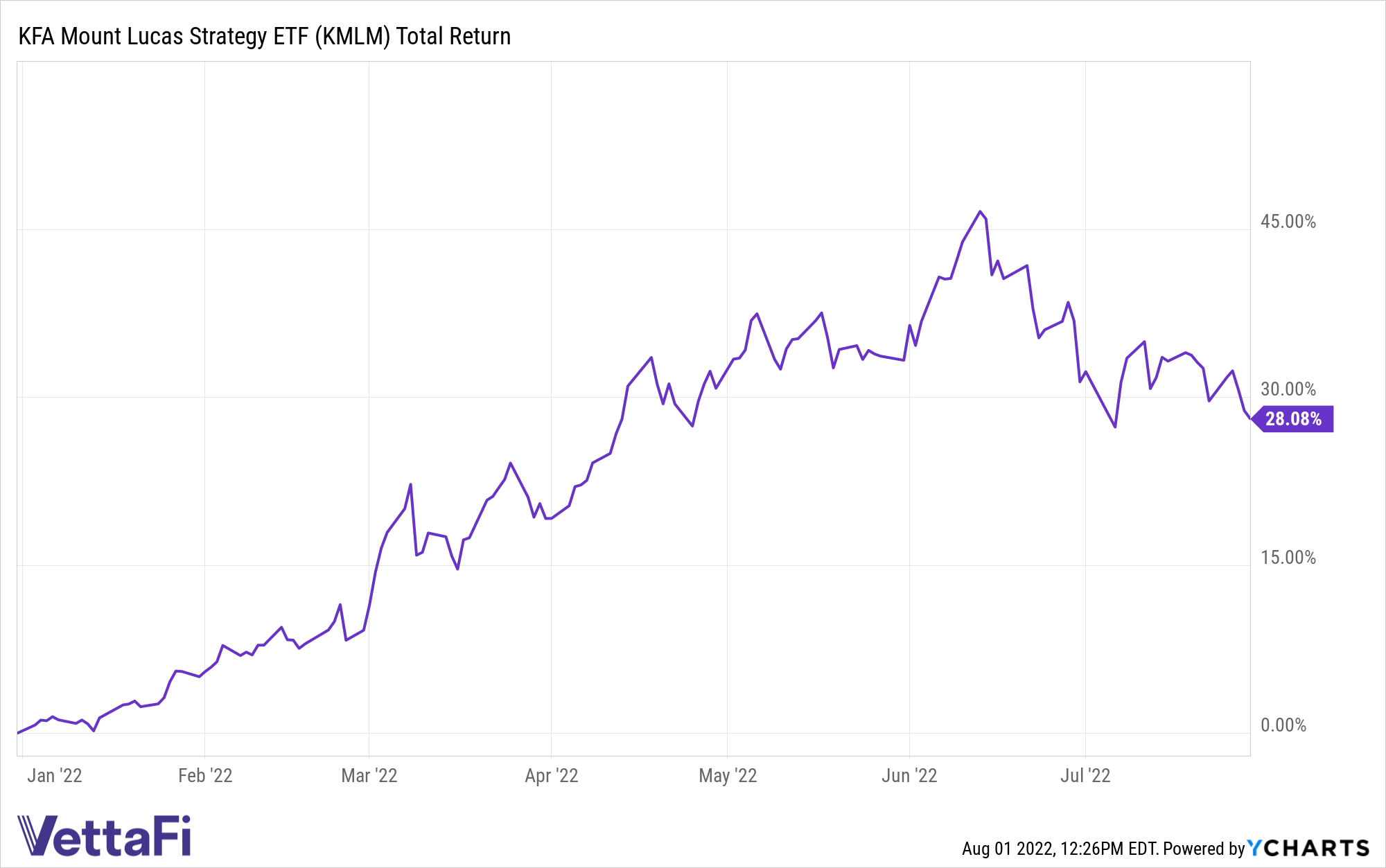

Managed Futures Perform in Volatility

Managed futures can provide non-correlated hedging opportunities during times of increased volatility for portfolios and the KFA Mount Lucas Index Strategy ETF (KMLM) from KFAFunds, a KraneShares company, invests in futures contracts in commodities, currencies, and global bond markets.

KMLM’s benchmark is the KFA MLM Index, and the fund invests in commodity currency and global fixed income futures contracts. The underlying index uses a trend-following methodology and is a modified version of the MLM Index, which measures a portfolio containing currency, commodity, and global fixed income futures.

The index and KMLM offer possible hedges for equity, bond, and commodity risk and have demonstrated a negative correlation to both equities and bonds in bull and bear markets. Investing in managed futures offers diversification for portfolios, and carrying them within a portfolio can potentially help mitigate losses during market volatility and sinking prices.

The index weights the three different futures contract types by their relative historical volatility, and within each type of futures contract, the underlying markets are equal dollar-weighted. Futures contracts will be rolled forward on a market-by-market basis as they near expiration.

Futures contracts in the index include 11 commodities, six currencies, and five global bond markets.

The index evaluates the trading signals of markets every day, rebalances on the first day of each month, invests in securities with maturities of up to 12 months, and expects to invest in ETFs to gain exposure to debt instruments.

KMLM carries an expense ratio of 0.90%.

For more news, information, and strategy, visit the China Insights Channel.