When you’re used to setting industry records and are known for innovation, an earnings call that is only about the earnings can seem rather humdrum, even if it’s positive. At least, that’s how investors seem to have viewed Tesla’s latest quarterly earnings call that recorded high gross margins and revenue that was slightly ahead of market expectations.

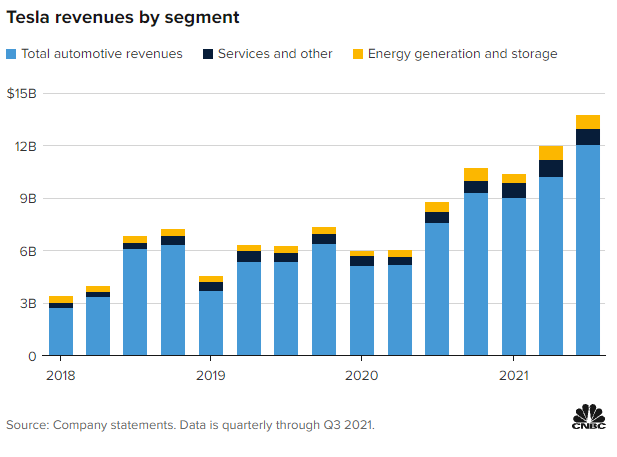

Tesla reported revenue of $13.76 billion on an expectation of $13.63 billion and $1.62 billion in (GAAP) net income this quarter, compared to $331 million in the same quarter last year, reports CNBC.

What’s more, Tesla reported gross margins of 30.5% on the automotive part of its business and 26.6% overall, both record highs in at least the previous five quarters. Bloomberg attributes this growth potentially to Tesla’s Shanghai factory, which, despite being caught up in the energy cutbacks and shutdowns happening in Chinese provinces, is still helping to boost production.

The increased margin is also being added from the switch to different battery technology that is cheaper and that Tesla intends to incorporate in vehicles globally. The Lithium Iron Phosphate (LFP) batteries will use iron in place of nickel, a much more abundant and therefore cheaper source, and are produced by CATL and BYD.

Image source: CNBC’s Tesla posts record revenue and profits in third quarter

Tesla was one of the only auto makers to report increased sales in this most recent quarter. Despite all of this, stocks remained relatively flat, falling slightly overnight. Earnings calls previously led by the dynamic CEO Elon Musk are now being headed by other executives as Musk had announced on the previous earnings call that he would no longer be leading them.

“Headwinds ranging from chip shortages to blackouts to port disruption all mean production is probably behind what management had hoped for,” said Nicholas Hyett, equity analyst for Hargreaves Lansdown, in a note. “But the extra scale has still given Tesla the raw materials to deliver a step change in profitability. Crucially that profitability now looks far more sustainable. Genuine and substantial free cash flow gives the group the firepower it needs to deliver on its ambitious expansion plans for the next few years.”

KARS Invests in the Future of Electric Vehicles

The KraneShares Electric Vehicles and Future Mobility ETF (NYSE: KARS) invests in Tesla and BYD, as well as many of the global leaders in the electric vehicle industry, including some in China, where the electric vehicle industry is booming.

KARS measures the performance of the Bloomberg Electric Vehicles Index, which tracks the industry holistically, including exposure to electric vehicle manufacturers, electric vehicle components, batteries, hydrogen fuel cells, and the raw materials utilized in the synthesis of producing parts for electric vehicles.

The index has strict qualification criteria. Companies must be part of the Bloomberg World Equity Aggregate Index, have a minimum free-float market cap of $500 million, and have a 90-day average daily traded value of $5 million.

Tesla (TSLA) is carried at a 5.81% weight and BYD at 2.4%.

The ETF has an expense ratio of 0.70%.

For more news, information, and strategy, visit the China Insights Channel.