A stronger-than-anticipated jobs report for May has sent markets sliding once again as investors digest further support for financial tightening by the Federal Reserve.

In May 390,000 jobs were added, with the unemployment rate holding steady at 3.6%, above expectations by economists, reported the Wall Street Journal. Wages rose by 5.2% in May, a slowdown from 5.5% in April, and a possible signal that the labor shortage could be diminishing, thereby reducing inflationary pressures.

It’s a labor market that is “boiling,” according to Ian Shepherdson, chief economist for Pantheon Macroeconomics; “It’s just not boiling as vigorously as it was.”

Despite the background potential hope that the jobs market could be peaking, the high numbers will likely be one more notch in the tightening belt the Fed has wrapped around the economy.

Markets responded negatively to the report, with the S&P 500 down 1.7%, the Nasdaq Composite down 2.6%, and the Dow Jones Industrial Average down 1.1%, while the 10-year Treasury yield was above 2.96% according to CNBC.

“Numbers this strong would likely reverse any hopes the Fed would consider a pause in rate hikes after the June/July increases because it would signal the labor market remains very tight,” Tom Essaye of the Sevens Report told CNBC.

Managed Futures Perform During Volatility

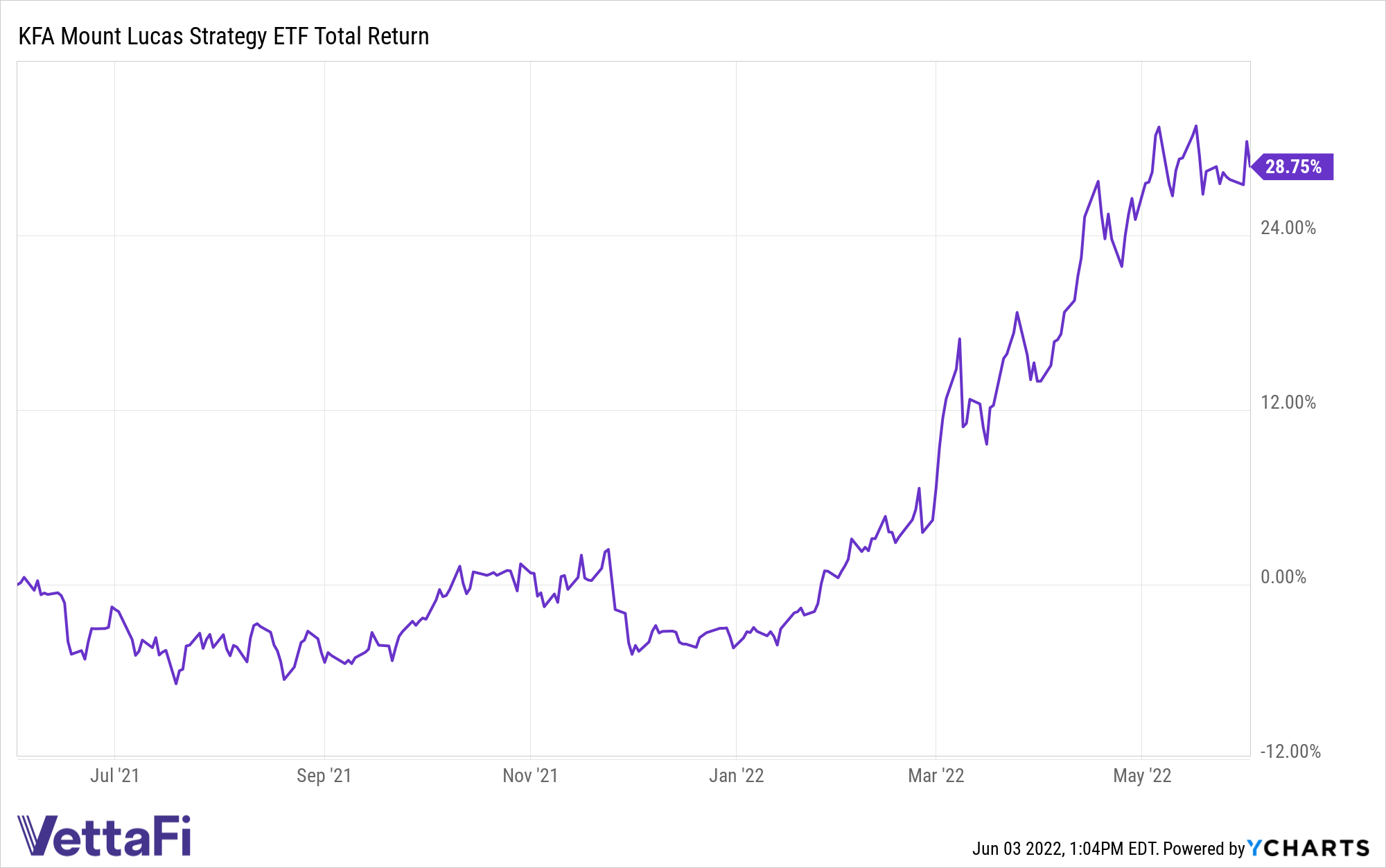

Managed futures can provide non-correlated hedging opportunities for portfolios and the KFA Mount Lucas Index Strategy ETF (KMLM) from KFAFunds, a KraneShares company, invests in futures contracts in commodities, currencies, and global bond markets.

KMLM’s benchmark is the KFA MLM Index, and the fund invests in commodity currency and global fixed income futures contracts. The underlying index uses a trend-following methodology and is a modified version of the MLM Index, which measures a portfolio containing currency, commodity, and global fixed income futures.

The index and KMLM offer possible hedges for equity, bond, and commodity risk and have demonstrated a negative correlation to both equities and bonds in bull and bear markets. Investing in managed futures offers diversification for portfolios, and carrying them within a portfolio can potentially help mitigate losses during market volatility and sinking prices.

The index weights the three different futures contract types by their relative historical volatility, and within each type of futures contract, the underlying markets are equal dollar-weighted. Futures contracts will be rolled forward on a market-by-market basis as they near expiration.

Futures contracts in the index include 11 commodities, six currencies, and five global bond markets.

The index evaluates the trading signals of markets every day, rebalances on the first day of each month, invests in securities with maturities of up to 12 months, and expects to invest in ETFs to gain exposure to debt instruments.

KMLM carries an expense ratio of 0.90%.

For more news, information, and strategy, visit the China Insights Channel.