A host of factors globally and within the European Union have converged to send carbon allowance prices rocketing up over the week.

This week saw the European Union Allowances (EUA) Dec 2021 futures closing up 4%. The EUA is the cap and trade program in Europe that sets a limit on carbon emissions allotted per year for companies operating within EUA jurisdiction. Companies exceeding these caps must purchase an EUA for each ton of carbon emissions above the threshold.

In the UK, carbon allowances were up 17% this week, and in the EU they were up 6% overall for the week.

Recently EUA prices have been climbing for a myriad of reasons, Luke Oliver, head of strategy and carbon markets expert for KraneShares, including growing acknowledgement that the EU will have to increase its coal consumption going into winter. Natural gas prices have surged to unexpected highs, when they were expected to fall, leading buyers to opt for coal; wth increased use of coal will come the need for more carbon allowances

“For some time, we have been telling investors that falling supply of EUAs, from both the stability reserve and increased tapering of the cap, will lead to potentially higher prices,” he told ETFTrends in an email. “Paired with higher gas prices and strong technicals, European carbon allowances have surged higher this week.”

Several technical indicators breached key levels this week, signalling for an increase, which in turn drives more buying as record levels are hit and options must be re-hedged. KraneShares believes that the fourth quarter of this year will bring about a shift from the current surplus of allowances to a deficit.

“The key is no one is selling as these buyers come to market,” added Oliver.

See also: It’s Going to Be an Expensive Winter for Natural Gas

Investing in Carbon Offsets With KRBN

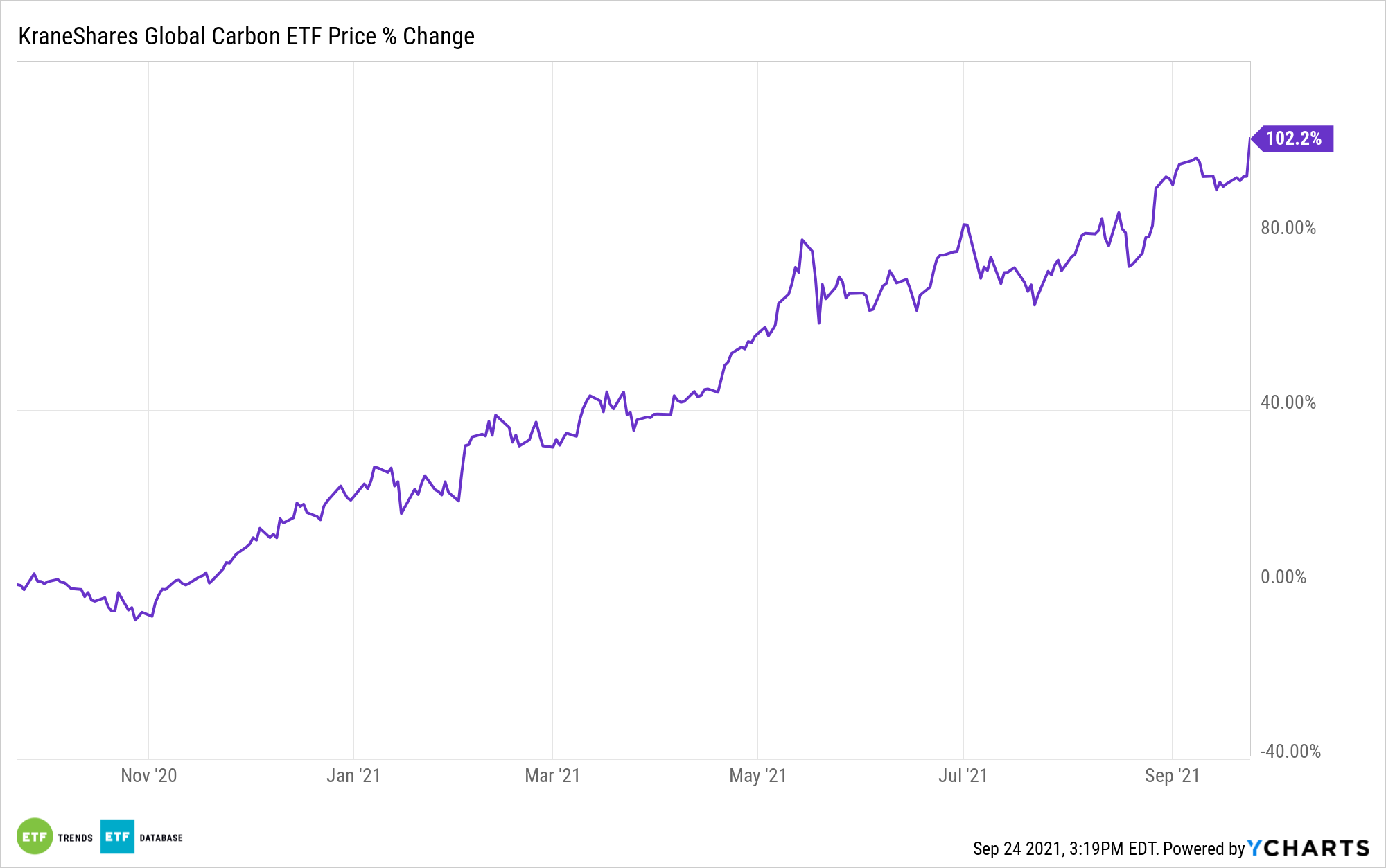

The KraneShares Global Carbon ETF (NYSE: KRBN) offers a first-of-its-kind take on carbon credits trading.

KRBN tracks the IHS Markit Global Carbon Index, which follows the most liquid carbon credit futures contracts in the world.

This includes contracts from the European Union Allowances (EUA), California Carbon Allowances (CCA), and Regional Greenhouse Gas Initiative (RGGI) markets. North American pricing data is supplied by IHS Markit’s OPIS service, while European prices are supplied by ICE Futures Pricing.

Of note, 74% of KRBN’s current exposure is in EUA.

KRBN invests in its futures contracts via a Cayman Islands subsidiary, meaning that it can avoid distributing the dreaded K-1 tax form to its shareholders.

KRBN carries an expense ratio of 0.78% and has over $800 million in net assets.

For more news, information, and strategy, visit the China Insights Channel.