Asian markets ended last week up, buoyed in part by a rally in healthcare firms, according to Reuters.

The blue-chip CSI300 Index, which tracks the top 300 stocks traded on the Shenzhen Stock Exchange and the Shanghai Stock Exchange, closed out the week 2.3% higher.

In particular, the CSI300 financials index rose by 3.3% and the CSI300 healthcare index jumped by 2.4%.

How to Play Chinese Healthcare Stocks

The Chinese healthcare market is one of the fastest growing in the world, according to KraneShares, growing at a 5-year compounded annual rate of 11%, compared to a 4% rise in the United States and a 4% decline in Japan.

China’s healthcare sector is primed for continued growth, when taking into account the aging population, rising incomes, and increasing urbanization in China.

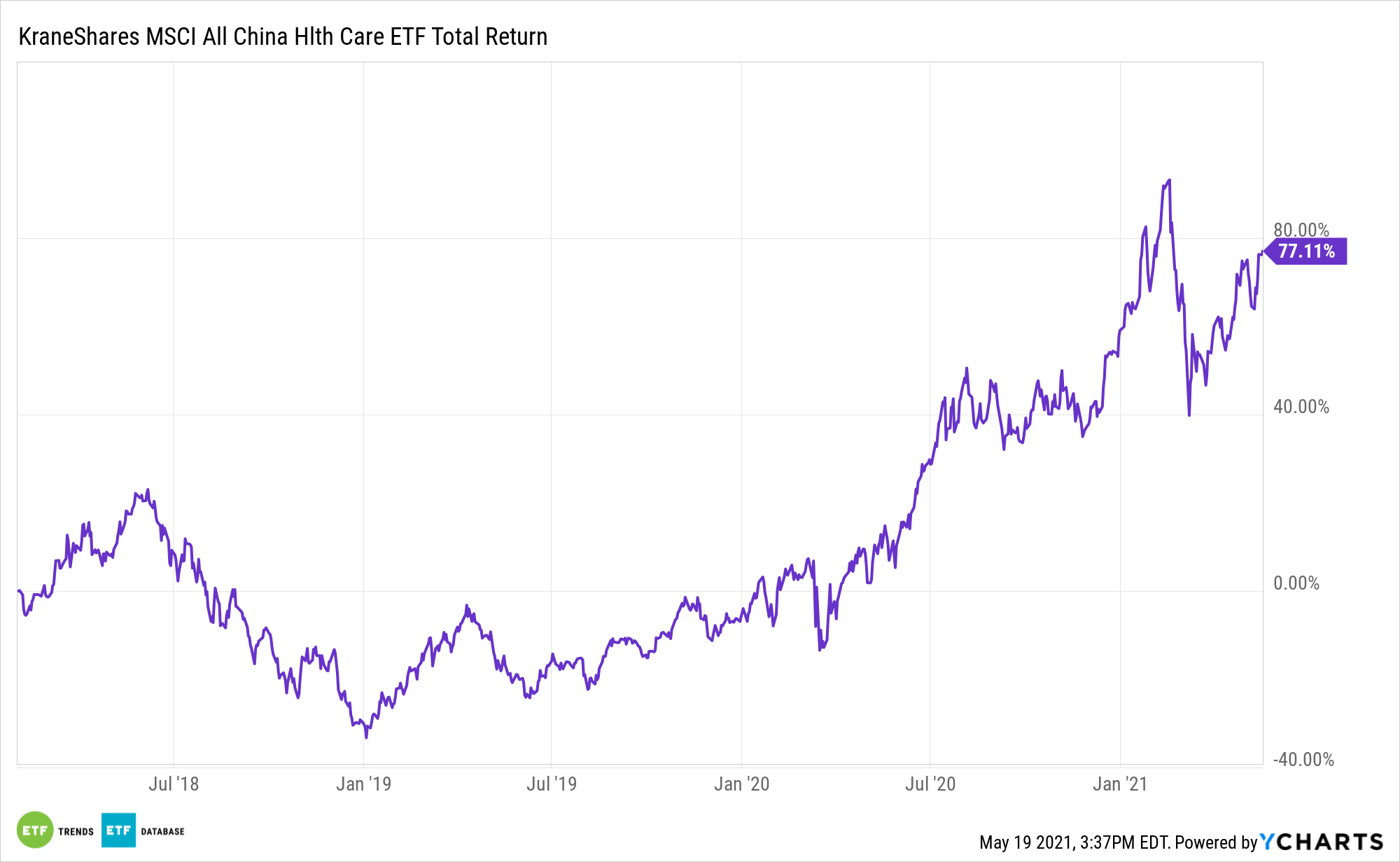

The KraneShares MSCI All China Health Care Index ETF (NYSE:KURE) offers investors access to the Chinese healthcare sector. KURE invests 100% in Chinese healthcare equities..

The fund measures the performance of the MSCI All China Health Care 10/40 Index and captures large- and mid-cap representation in China A-shares, B-shares, H-shares, red-chips, P-chips, and foreign listings, per the index methodology.

The “10/40” index applies limits to the weights and holdings, such that the weight of each group entity in the index is capped at 10%, while the cumulative weight of all group entities with a weight that is greater than 5% does not exceed 40% of the entire index.

KURE’s index currently allocates 34% of its weighting to pharmaceutical companies, 21% to biotechnology firms, and 17% to life sciences tools & services companies.

58% of the ETF’s stocks are listed in mainland China, while 35% of them are listed in Hong Kong. The remaining 7% are listed in the U.S.

Currently, KURE’s top three portfolio holdings include Wuxi Biologics, at 8.6%; Shenzhen Mindray Bio-Medical Electronic Co, at 5.5%; and Jiangsu Hengrui Medicine, at 5.0%.

All three companies are up significantly year-over-year. Wuxi Biologics, which provides open-access tech platforms for biologic drug development, is currently up 69% over the past 12 months; Shenzhen Mindray Bio-Medical Electronic Co is up 31%; and Jiangsu Hengrui Medicine is up 25%.

For more news, information, and strategy, visit the China Insights Channel.