China’s electric vehicle market is experiencing setbacks from global chip shortages, but local Chinese brands are continuing to make strides as they grow in market share and innovation.

BYD Auto Co, Ltd., a Chinese electric vehicle maker, reported a net profit decline of 29% but a 54% increase in revenue for the first six months of this year in its earnings report at the end of August, reported The Wall Street Journal.

Last year, BYD was boosted by mask sales as it shifted to accommodate the COVID-19 crisis, creating mask production lines at the beginning of 2020 that were producing millions of masks at the height of demand. This year sees a return to its fundamentals as it focuses back on electric vehicle (EV) production and sales.

So far, BYD has sold close to 200,000 new energy cars, including their plug-in hybrid line, through the end of July. This reflects a 28% increase over pre-pandemic sales in 2019 over the same time. In addition, they have added three new hybrids using BYD technology, DM-i.

New energy car sales now comprise 14.8% of car sales in China, up from 5.8% in 2020, and are estimated to be even higher in major cities where electric vehicle registration is more lenient than the process for combustion cars. This is a direct reflection of a more robust EV market where competition has created a broader range of options for consumers.

Add in the reduced cost of components for EVs as China has many suppliers of its own, and the cost of going electric is sometimes the same as gas-powered options, creating greater appeal. BYD is offering its new hybrids within the price ranges of the combustion equivalents, buoyed by the use of its own blade battery to drive down costs.

KARS Invests in the EV Evolution

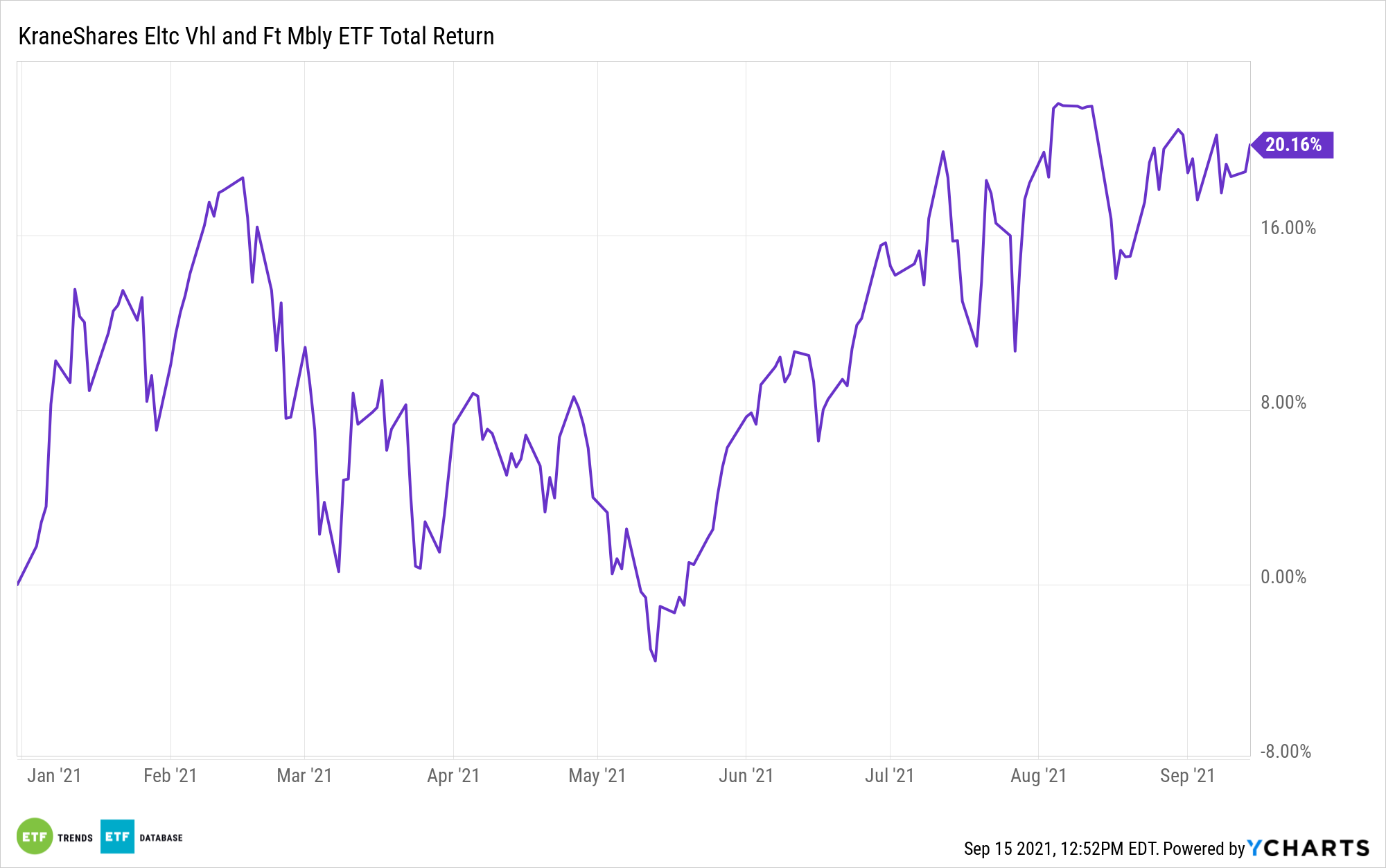

The KraneShares Electric Vehicles and Future Mobility ETF (NYSE: KARS) invests in BYD and many of the leaders in the electric vehicle industry in China.

KARS measures the performance of the Bloomberg Electric Vehicles Index, which tracks the industry holistically, including exposure to electric vehicle manufacturers, electric vehicle components, batteries, hydrogen fuel cells, and the raw materials utilized in the synthesis of producing parts for electric vehicles.

The index has strict qualification criteria. Companies must be part of the Bloomberg World Equity Aggregate Index, have a minimum free float market cap of $500 million, and have a 90-day average daily traded value of $5 million.

Top holdings for KARS include Tesla Inc at 5.24%, top Chinese electric vehicle (EV) producer Nio Inc at 4.80%, and BYD at 2.25%.

The ETF has an expense ratio of 0.70%.

For more news, information, and strategy, visit the China Insights Channel.