China is set to account for 25% of global growth in 2021, according to the World Bank’s recently released Global Economic Prospects report.

The report also predicts global economic growth of 5.6% in 2021, the strongest economic recovery after a recession in 80 years.

China’s economy, one of the few that didn’t shrink in 2020, is predicted to grow 8.5% by the World Bank in 2021 as economies enter into recovery from the pandemic spurred recession. Elsewhere, among emerging markets, growth is predicted to be much more moderate, at 4.4%.

The U.S., in comparison, is expected to grow 6.8%.

“Growth in East Asia and Pacific (EAP) is projected to accelerate to 7.7 percent in 2021, largely reflecting a strong rebound in China,” said the World Bank in its prospectus.

The four key points that the World Bank see as influencing these predictions are high trade costs, which are roughly one-half higher in emerging market economies; rising inflation, which can heavily impact emerging markets; potential further Covid outbreaks; and food price volatility.

Investing in China’s A-Shares with KBA

With a robust Chinese economy predicted for the remainder of this year, investors are increasingly looking to gain access to China’s markets.

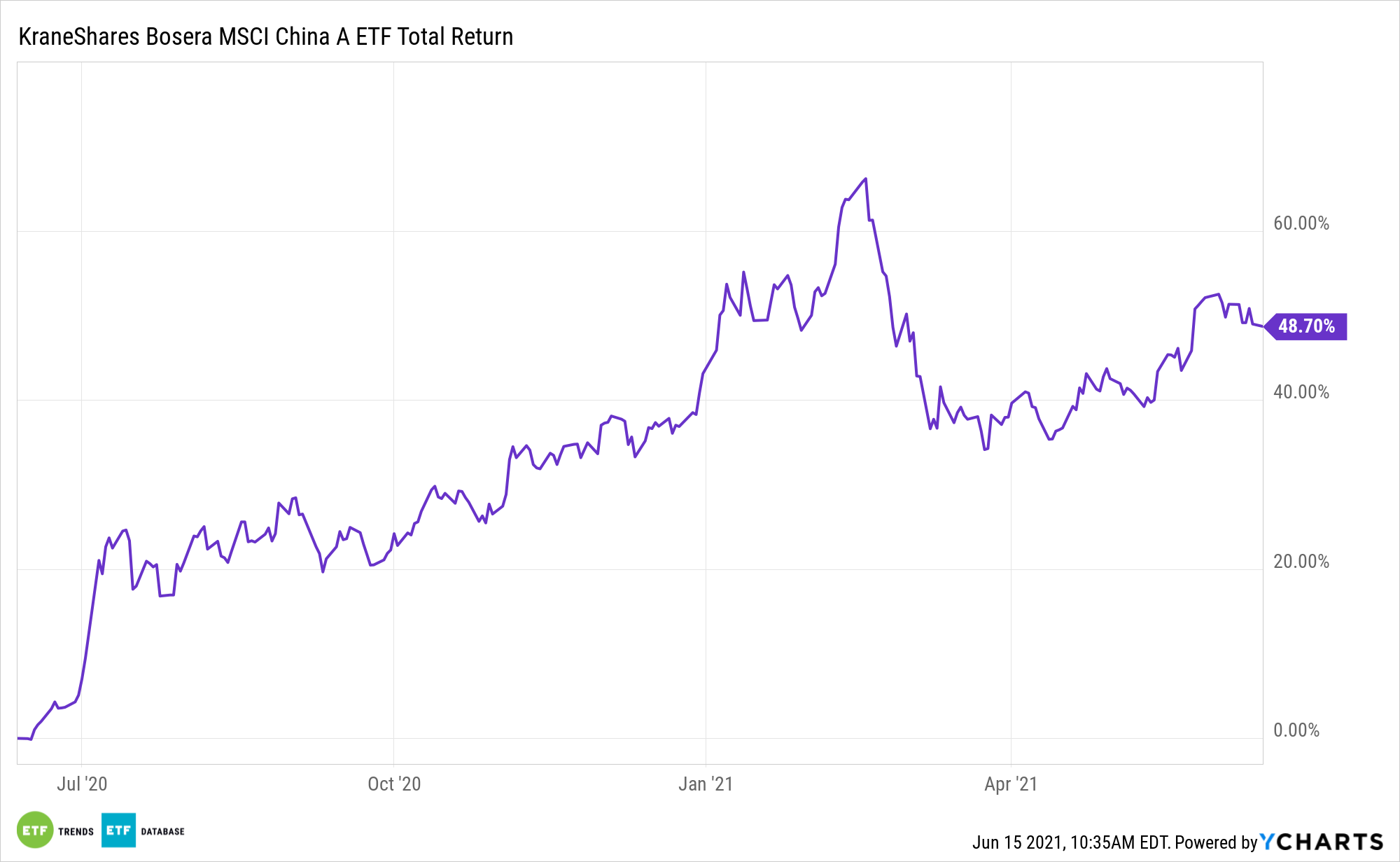

For investors looking for access to China’s A-share market, the KraneShares Bosera MSCI China A Share ETF (KBA) invests in Chinese A-shares—specifically, the MSCI China A Share Index.

The ETF captures mid cap and large cap representation of Chinese equities listed on the Shenzhen and Shanghai Stock Exchanges, which have been historically closed to U.S. investors. At $888 million in assets under management, KBA remains the largest MSCI-linked China A-share ETF available in the U.S.

KBA offers an exposure across a diversity of sectors, with 20.37% invested in financials, 19.38% in consumer staples, 12.5% in industrials, 12% in healthcare, and 11.85% in information technology.

“With over $1.5 trillion benchmarked to the MSCI Emerging Markets Index, full inclusion of Mainland Chinese equities could see significant flows into the securities KBA owns today,” as reported on the KraneShares website.

For more news, information, and strategy, visit the China Insights Channel.