The annual “618 sales event” in China put on by JD.com (JD) is off to a strong start this year. The increase in sales over last year showcases China’s buyer recovery potential, though that recovery has been slower and choppier than anticipated.

JD.com hosts the shopping festival each summer and reported that 23% more brands hit 100 million yuan ($14 million USD) in sales within 10 minutes of opening over last year, reported Brendan Ahern, CIO of KraneShares, in the China Last Night blog.

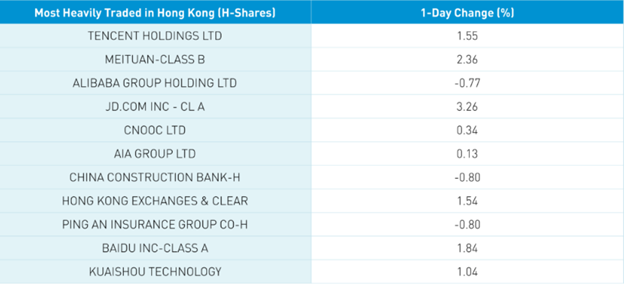

“JD.com’s strong start was evidenced by Hong Kong’s most heavily traded stocks today, which were concentrated in E-Commerce names,” Ahern wrote.

Image source: China Last Night blog

These included Meituan at 2.36% gains, Tencent at 1.55%, JD.com at 3.26% gains and more.

E-commerce is a sector that benefits greatly from a recovering consumer. The e-commerce companies on the rise overnight in Hong Kong are also major internet giants and dominate China’s growth companies.

Invest in China’s Buyer Recovery With the Giants

The combination of two ETFs from KraneShares allows a unique opportunity to gain exposure to the growth giants in China while also taking advantage of the enhanced volatility the space can have.

The KraneShares CSI China Internet ETF (KWEB) tracks the CSI Overseas China Internet Index. The index measures the performance of publicly traded companies outside of mainland China that operate within China’s internet and internet-related sectors. The fund contains many of the tech giants that are likely to benefit from and drive economic recovery in China this year.

The fund includes companies that develop and market internet software and services. It also includes companies that provide retail or commercial services via the internet, and develop and market mobile software. Entertainment manufacturers and companies that develop educational software for home use are included as well.

Top allocations for the fund include Tencent at 11.93% weight and JD. com at 4.35% weight as of 06/01/23.

KWEB has an expense ratio of 0.70%.

Capitalize on the Volatility in China’s Growth Companies

The KraneShares China Internet and Covered Call Strategy ETF (KLIP) seeks to provide monthly income. It employs a strategy that writes options on KWEB and capitalizes on the historically increased volatility that China’s tech sector has over the U.S. tech sector.

The fund has a current yield of 56.01% as of 05/31/23. Current yield is a measure of the most recent distribution, annualized, and then divided by the most recent NAV.

KLIP writes/sells covered calls on KWEB. Because of the increased volatility, KLIP has the potential to offer a higher yield than investing in tech in the U.S. or other technology sectors globally. A covered call entails holding the underlying security while writing calls on that security. This earns a premium from selling the covered call that can be utilized to generate income for the fund.

KLIP is benchmarked to the CSI Overseas China Internet Index. The index tracks publicly traded Chinese-based internet companies. KLIP can be used alongside KWEB in a portfolio to capture China’s growth in the internet sector. It also benefits from any volatility in the sector while generating income.

KLIP has an expense ratio of 0.95%.

For more news, information, and analysis, visit the China Insights Channel.