In the past year, as the Federal Reserve has been aggressively raising interest rates, many advisors and end clients have turned to a suite of ETFs that provided above-average income as well as risk-controlled capital appreciation potential through equities. They are known as covered call ETFs, as they involve writing call options on the securities held by the ETF. Indeed, the largest of these ETFs, the JPMorgan Equity Premium Income ETF (JEPI), had the third-most net inflows in the first quarter of 2023 industrywide with nearly $6 billion, while others have gathered over $1 billion in the past year.

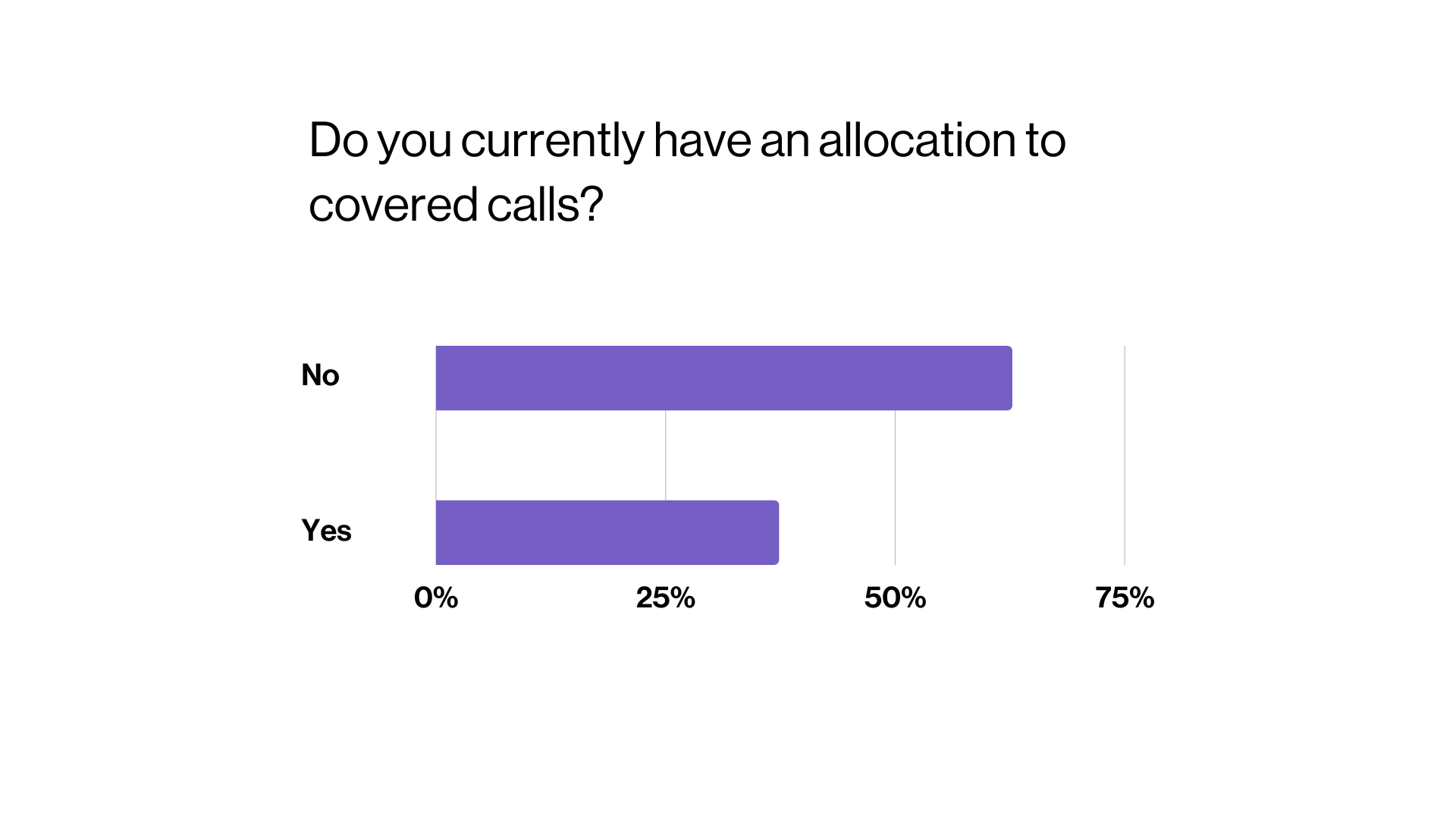

During a VettaFi webcast in late March with KraneShares about its new covered call ETF, the KraneShares China Internet and Covered Call Strategy ETF (KLIP), we asked advisors whether they currently had an allocation to covered calls, not specific to ETFs. While the majority (63%) said no, it was surprising that a strong minority of the respondents (37%) said yes, given that KLIP has just $5 million in assets.

Outside of the ETF wrapper, covered calls are a sophisticated approach used by those advisors and investors comfortable with options trading. But covered call ETFs take the complexity and restrictions away and outsource the responsibility of managing the process to the fund company. Some covered call ETFs are actively managed, with the fund company having discretion over what securities to own, while others take a broader index-based approach. Let’s discuss some of the larger products.

Outside of the ETF wrapper, covered calls are a sophisticated approach used by those advisors and investors comfortable with options trading. But covered call ETFs take the complexity and restrictions away and outsource the responsibility of managing the process to the fund company. Some covered call ETFs are actively managed, with the fund company having discretion over what securities to own, while others take a broader index-based approach. Let’s discuss some of the larger products.

The $24 billion JEPI is an example of an active offering. ETF manager Hamilton Reiner told VettaFi last year that the strategy sought 7%–9% annualized income, distributed monthly, with two-thirds of the volatility and beta of the S&P 500; as of mid-April 2023, the fund had a 12-month yield of 11.3%. JEPI owns shares of 133 defensive equities, including AbbVie, Hershey, and Progressive, while writing out-of-the money S&P 500 Index call options to generate enhanced income. JEPI lost 1.4% in the one-year period that ended April 6, which is less than the 6.9% decline of the iShares Core S&P 500 ETF (IVV).

The Global X Nasdaq 100 Covered Call ETF (QYLD) takes a broader passive approach. The $7 billion fund buys all of the stocks in the Nasdaq-100 Index, including Amazon.com, Apple, and Microsoft, and sells call options on the growth index. The fund’s 12-month yield was recently 12.8%. QYLD was down 7.1% in the recent one-year period.

Global X and JPMorgan also offer alternative versions that are quite popular. The Global X S&P 500 Covered Call ETF (XYLD) has $2.5 billion in assets invested in all the stocks in IVV, enhanced by selling call options. XYLD’s 12-month yield was 13.2%.

Meanwhile, the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) launched in May 2022 and already has $2.2 billion in assets. JEPQ owns 85 holdings selected through active management and sports an 11.3% yield.

Another widely held actively managed covered call ETF is the Amplify CWP Enhanced Dividend Income ETF (DIVO). The $2.8 billion fund is more concentrated than its peers, with just 27 holdings of large-caps with historical dividend and earnings growth like McDonald’s, Microsoft, and UnitedHealth Group. Covered call options are written opportunistically on individual stocks, not the broader market. DIVO, which had a recent yield of 4.7%, was up 0.9% in the past year.

The above ETFs are writing call options against individual stocks, but KLIP owns the KraneShares CSI China Internet ETF (KWEB) and can benefit from the ETF’s liquidity, rather than recreate the Chinese equity exposure in a more cumbersome manner.

For more news, information, and analysis, visit VettaFi | ETF Trends.