![]() By Marc Odo, Swan Global Investments

By Marc Odo, Swan Global Investments

Investing in a Volatile Asset Class

In a world of low yields and sluggish growth in most of the developed world, many consider emerging markets investing an outlet for those seeking growth of assets. However, it is also widely known that investing in emerging markets is a venture fraught with risks.

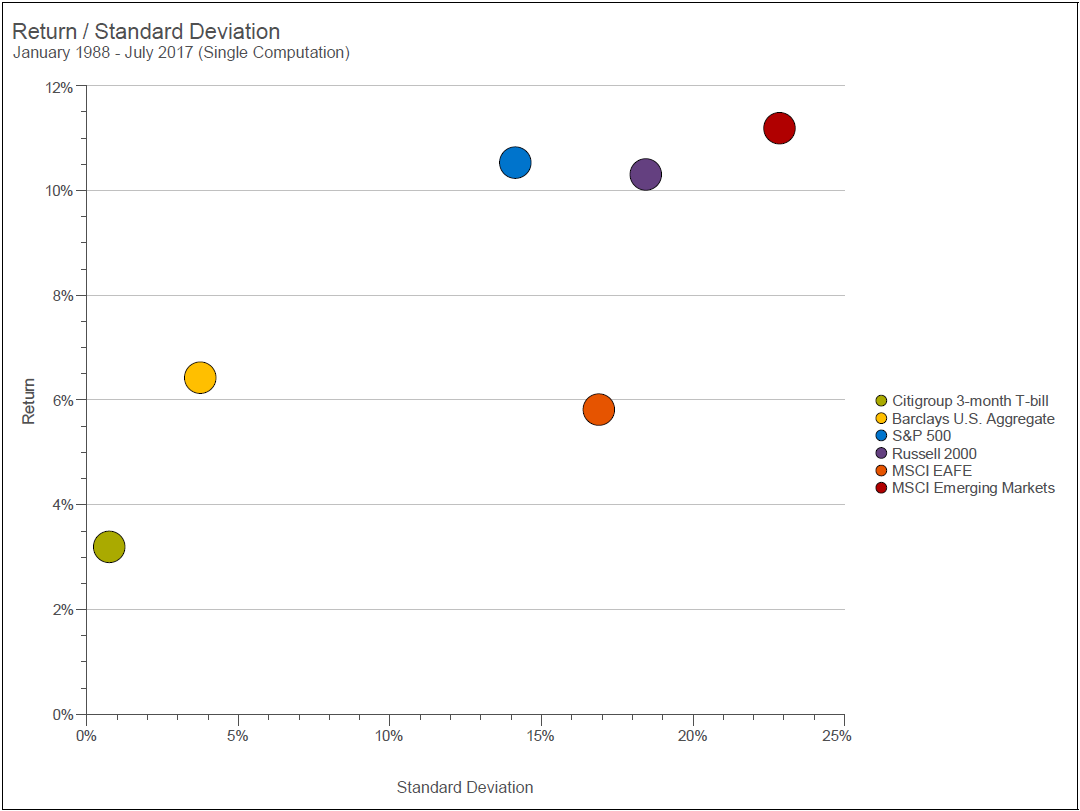

Standard financial theory states that the higher the risk, the higher the reward. An investor willing to take on volatility or the potential for losses should be compensated for accepting that risk.

Perhaps no asset class exemplifies this trade-off more than emerging markets. Since MSCI started tracking emerging markets in 1988, the asset class has clearly had highest returns and biggest risks of any of the major asset classes.

Source: Zephyr StyleADVISOR

Why Invest in Emerging Markets?

The advantages of emerging markets are well known. Frequently cited are such strengths as:

- Higher upside potential

- Demographic trends favoring emerging markets over many developed countries

- Burgeoning middle class and consumerism in emerging markets

- Growing share of global GDP

- Wealth of commodities and resources in emerging markets

- Diversification benefits to traditional portfolios

Very few people argue against the upside potential of emerging markets. And yet in spite of these advantages, many investors tend to shy away from emerging markets. Overall, emerging represents only 3% of U.S. mutual fund assets (according to a recent Calamos study). For many investors, the risks of emerging markets outweigh the rewards.

What are the Risks?

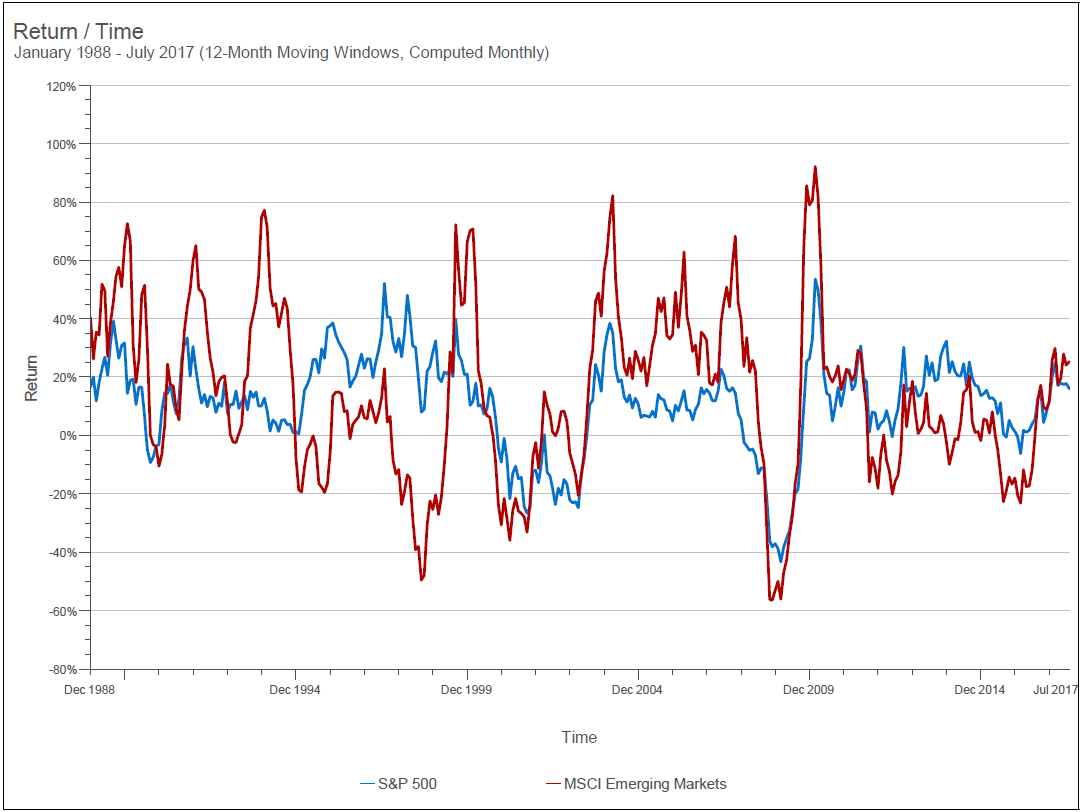

No doubt about it, the risks are real. Political risk, economic risk, currency risk, and market risk are all present in emerging markets. These risks occasionally manifest themselves in higher volatility and large sell-offs.

The chart below illustrates both the highs and lows of investing in emerging markets in the form of rolling, one-year returns.

Emerging Markets Investor Conundrum: How does one maximize the potential of emerging markets while minimizing the risks?

Given the dim outlook for a traditional 60/40 balanced portfolio, emerging markets are one of the few assets with the upside potential to meet the return needs of an investor.

The DRS and Emerging Markets

Swan believes it has a unique solution that can maximize return and minimize risk of emerging markets. It is the same strategy that has been successfully applied to U.S. Large Cap equities for 20 years: the Defined Risk Strategy (DRS). The DRS was built around the idea that the biggest risk to an investor’s wealth is the large scale, systematic sell-offs that occasionally befell the markets.

The DRS directly hedges against bear markets via long-term put options. Not only are the put options designed to protect during a bear market, the puts are also designed to be a source of capital for re-investing into the markets when the markets are trading at a discount after a large bear market sell-off.