When Innovator launched the first defined outcome or “buffered” ETFs in August of 2018, I will admit I was a bit skeptical. Historically, ETFs that mirrored the kinds of outcomes long the province of structured products hadn’t been very successful at gathering assets. But I was hopeful: I believed then, and I believe now, that ETFs that shape the pattern of returns available in the risk markets are incredibly useful tools.

With over $4 billion in assets (half of that coming just this year), I think it’s safe to say my skepticism was unnecessary, and my enthusiasm rewarded. But with over 50 buffered ETFs available in the market now, we thought it would be useful to put together a guide to how the products work, how you might use them, and what’s available.

How They Work

At the core, each of the offerings in the market place uses options to give you:

- *some* level of participation in the upside of a risk-asset,

- while giving you some level of downside protection.

That downside protection isn’t free — you pay for it by accepting some level of a cap on your potential upside. Importantly, all of the products launched to date assume a one-year holding period. So let’s tease each of those features apart, and explain where they come from.

To mold the patterns of returns between now and a year from now, you have to go to the derivatives markets. I know, I know, “derivatives” has been a dirty word since the era of portfolio insurance, but all they are is tools to do precisely this: shape a pattern of returns over time. In the case of these buffered products, the derivatives being used are options, specifically, a kind of option known as a “FLEX” or “Flexible Exchange” option. FLEX options give the buyer the write, but not the obligation, to buy or sell a security or an index at a set price at a future point in time. The “Flexible” part means that the specific terms of the option are negotiated between the buyer and the seller, the “Exchange” part means they trade on an options exchange (like the Cboe), which also means they are cleared and settled just like options. That’s all a good thing — it means there’s no counterparty risk, any more than there is in buying or selling a stock on the NYSE.

To get the first thing we want, upside participation, the funds go out and just buy a call option on, say, the S&P 500, with a date a year out. So if you’re purchasing a June-dated buffered ETF, you own a bunch of calls on the S&P 500, dates June next year. If the market goes up, you get to buy at today’s prices, sell at next year’s prices when June rolls around, and you get the price return of the index. Importantly, these kinds of calls tend to be very cheap, because you’re only getting the price return (it’s presumed that whoever is writing the calls owns the stocks, and still collects those dividends, even if the stocks get called away when the option expires).

To get the downside buffer, the fund purchases puts, again, at today’s prices. Usually, this would be prohibitively expensive, so to fund buying the puts, the fund *sells* puts further down. So if they purchased puts with a strike price of $100, they might sell puts at a strike price of $90. That would provide the “buffer” for the first $10 of decline. But this generally still would leave the fund with a pretty expensive hedge, so to neutralize that expense, the fund also sells call options at a level where the premium collected offsets the remainder of the expense in buying the downside protection.

When you roll those four positions together, you end up with a pattern of returns which looks like this (cribbed from the Innovator website):

If there’s one thing to burn into your brain to understand these products, it’s this image. The dotted line is potential returns for the index, and the solid line is the fund’s pattern of returns. You get the upside to a cap, and you get no downside until you reach some buffer level. It’s important to realize that these are mathematically guaranteed outcomes if you hold the fund for the full period. There’s no “but what if …” gotcha in this. Once the options are in the fund, they merely payout this way 12 months later.

How to Use Them

While the above seems (and let’s face it, is) a bit complex, the use case here is blindingly simple. You want some exposure to the upside, but you’re nervous. Traditionally the way you deal with “nervous” is just by diversifying … owning less of the thing that makes you nervous. This gives you another choice. Instead of just selling a bunch of your risk assets and hoarding cash, you can forgo some upside to get some insurance. It’s that simple.

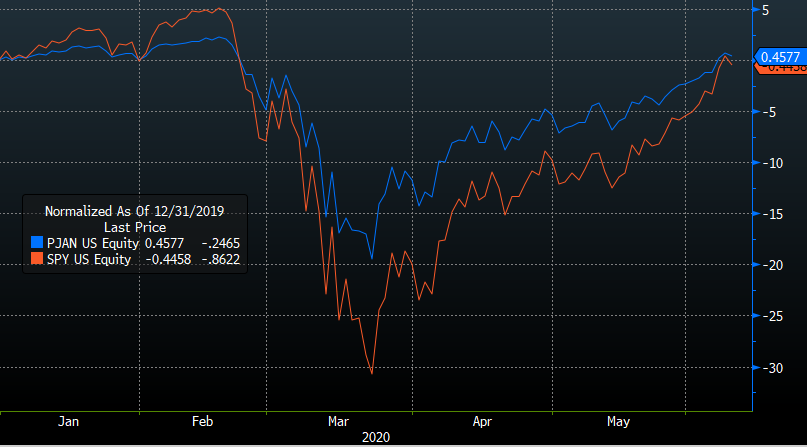

And it works. Let’s look at some recent history. Let’s say you bought the Innovator S&P 500 Power Buffer ETF – January (PJAN) At the beginning of the year and held it through the recent market drawdown. Here’s how you did…

On January 1st, PJAN promised a 15% buffer — that is, you won’t receive the first 15% of drawdown over the full year. In return for that, you had a cap of 8.5%. Your full year experience, when you check on New Year’s Eve, will be that of the S&P 500 price return up to the cap (if the market’s up) or the S&P price return after the first 15% drop. (So if the market closes down 20% for the year, you’ll be down 5%).

But in the middle, the effect of holding is to dampen volatility, which is precisely what happened so far this year. While the S&P peaked at up 5% in February, you were up only a few percents. If the market had stayed flat all year from February, your position would slowly have risen to that 5% (because it’s below the cap). However, when the market collapsed down 30%, your position was only down about 19%. If the market had stayed down 30% for the whole rest of the year, your position would slowly have recovered to down 15% (and thus, be 15% better than the market).

That’s all there is to it: you have a known, defined pattern of returns for the full year, and lower volatility ride along the way. And you can, of course, buy and sell each fund anytime you like, just make sure you check the issuer’s websites to understand what your current cap and buffer is on the day you’re buying it — it will shift as the market moves in between yearly re-balances.

The Playing Field

While these are relatively new products in the ETF space, the idea behind these products is nothing new, having been baked into structured products, SMAs, and even some mutual funds for years. But in the ETF space, things have moved quickly since Innovator’s first launch in 2018. First Trust is now launching products regularly and has captured 30% of the assets in the space, and just this June, Allianz Investment Management made its first foray into the U.S. ETF market by launching two buffered funds of its own.

| # of Funds | AUM ($,M) | YTD Net Flows ($, M) | Average ER % | |

| Allianz | 2 | 5 | 0.10 | 0.74 |

| First Trust | 9 | 1,228 | 1,089 | 0.85 |

| Innovator | 46 | 2,947 | 1170 | 0.79 |

| Total: | 57 | 4,181 | 2,260 | 0.80 |

All three firms currently offer products targeting the S&P 500, which makes perfect sense. Innovator also has products covering the Nasdaq 100, the Russell 2000, and MSCI’s Emerging Markets and EAFE indexes. They’ve filed for additional products targeting fixed-income indexes as well.

The Bottom Line

It’s easy to look at the ETF landscape and wonder if we have enough, or even too many products. There is admittedly a lot of “me too” product out there, as well as a lot of very narrow funds that slice and dice the markets into ever smaller micro-portfolios. But don’t confuse that with these buffered products. These products solve a very, very real-world problem by letting investors stay invested when they might otherwise hit a panic button and sell. It’s harder than ever to remain a long term investor. These folks are making it easier. The one caveat? Cost. None of these products are cheap. While they’re uniqueness (and the legitimate work it takes to manage and trade them) may justify that for now, I suspect that just as we’ve seen in the rest of the ETF market, the competition will only make them cheaper and better for investors.

To access the full list of ETFs visit, https://etfdb.com/themes/buffered-etfs/.