Concluding Remarks

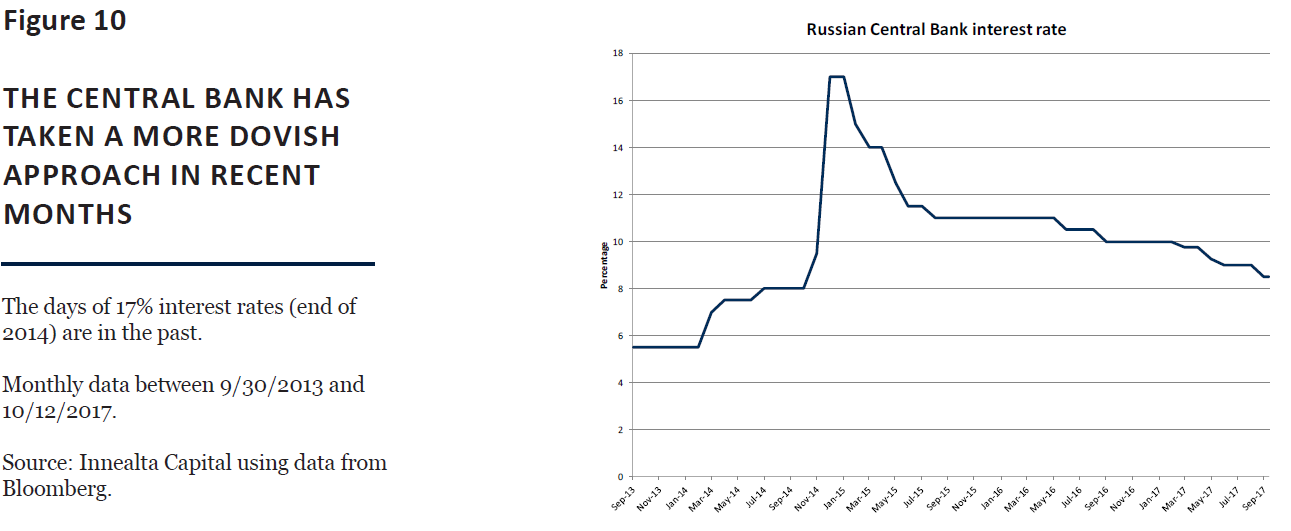

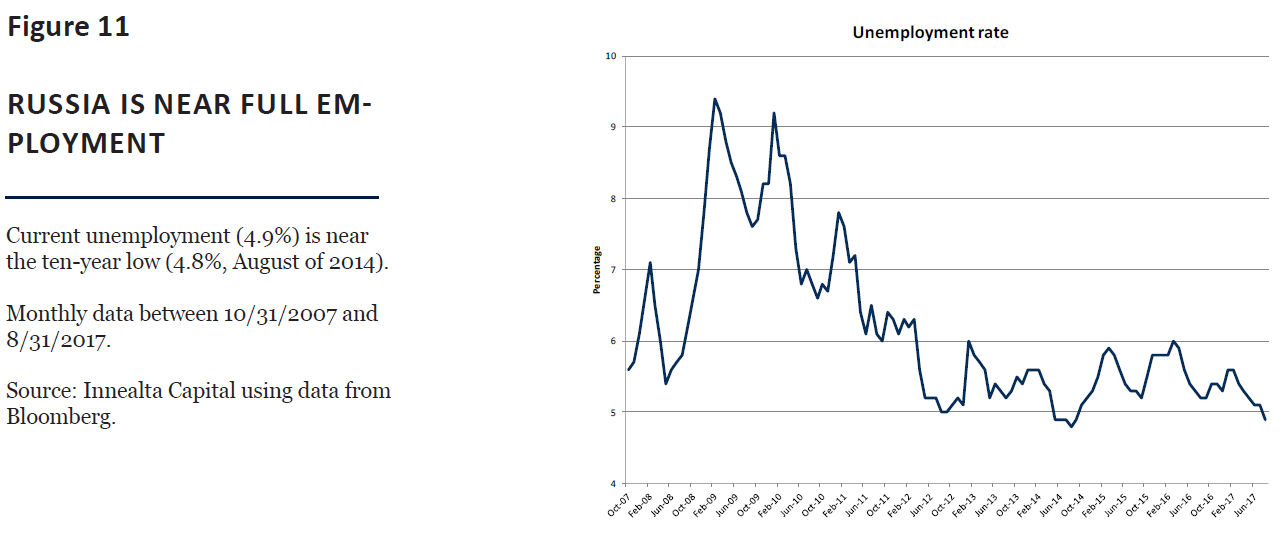

As we have seen, Russia is bouncing back from seven consecutive quarters of negative economic growth. All major indicators – GDP, inflation, oil prices, unemployment, fiscal deficit, and exchange rate – point in the direction of a stronger economy. We believe this trend will continue, especially after the agreement between main producers to limit oil supply.

The challenge now is to consolidate this recovery and project it into the long-term, particularly given Russia’s dependence on strong oil prices. Amongst the most urgent tasks, besides diversification, we can count two: (i) institutional reforms that reduce corruption, increase investors’ confidence, and help improve the overall business climate in the country, and (ii) normalization of relations with the West.

The challenge now is to consolidate this recovery and project it into the long-term, particularly given Russia’s dependence on strong oil prices. Amongst the most urgent tasks, besides diversification, we can count two: (i) institutional reforms that reduce corruption, increase investors’ confidence, and help improve the overall business climate in the country, and (ii) normalization of relations with the West.

On the political front, we can expect President Putin to run for reelection in March 2018, seeking – and probably winning – a second consecutive six-year term. Regarding internal political risks, we cannot discount the possibility that the middle and lower classes become tired of corruption and income inequality – which are remarkably linked in the case of Russia –, leading to social turmoil. A report by Credit Suisse from October 2015 stated that “the top decile of wealth holders owns 87% of all household wealth in Russia.” That is considerably higher than the US (76%) and China (66%). External political risks come mainly from Russian military intervention, be it in neighboring countries (like in Georgia or Ukraine) or beyond (e.g., Syria).

This article was written by Innealta Capital, a participant in the ETF Strategist Channel.

Important Information

The information provided comes from independent sources believed reliable, but accuracy is not guaranteed and has not been independently verified. This presentation includes opinions of Innealta Capital (Innealta), a division of AFAM Capital, Inc., and the performance results of such recommendations are subject to risks and uncertainties. All opinions and views constitute our judgments as of the date of writing and are subject to change at any time without notice.

This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security, or a solicitation, or an offer, or a recommendation, to buy a security. Investors should consult with an investment advisor to determine appropriate investment vehicles. Investment decisions should be made based on the investor’s specific financial needs and objectives, goals, time horizon and risk tolerance.

Any investment is subject to risk. Exchange traded funds (ETFs) are subject to risks similar to those of stocks, such as market risk. The value of an investment and the return on invested capital will fluctuate over time and, when sold or redeemed, may be worth less than its original cost.

Country/Regional risk is the chance that world events such as political upheaval or natural disaster will adversely affect the value of securities issued by companies in foreign countries or regions.

Country/Regional risk is especially high in emerging markets. Emerging markets risk is defined as the chance that stocks of companies located in emerging markets will be substantially more volatile, and substantially less liquid, than the stocks of companies located in more economically developed foreign markets.

The MSCI BRIC Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance across the following 4 Emerging Markets country indexes: Brazil, Russia, India and China.

The MICEX Index is cap-weighted composite index calculated based on prices of the 50 most liquid Russian stocks of the largest and dynamically developing Russian issuers presented on the Moscow Exchange. MICEX Index was launched on September 22, 1997 at base value 100. The MICEX Index is calculated in real time and denominated by Moscow Exchange in Russian rubles. (Source: Bloomberg.) It is not possible to invest directly in an index.

The Harmonized System is an international nomenclature for the classification of products. It allows participating countries to classify traded goods on a common basis for customs purposes. At the international level, the Harmonized System (HS) for classifying goods is a six-digit code system.

AFAM Capital, Inc. is a registered investment adviser. Al Frank Asset Management and Innealta Capital are divisions of AFAM Capital. AFAM is the investment advisor to individually managed client accounts and certain mutual funds. For more information, please visit afamcapital.com. Registration as an investment advisor does not imply any certain level of skill or training.

Innealta is an asset manager specializing in the active management of portfolios of ETFs. Contact your financial advisor for additional information.

For advisor use only. The material provided herein has been provided by AFAM Capital, Inc. and is for informational purposes only. AFAM Capital, Inc. serves as investment adviser to one or more mutual funds distributed through Northern Lights Distributors, LLC member FINRA/SIPC. Northern Lights Distributors, LLC and AFAM Capital, Inc. are not affiliated entities.

357-AFAM-10/24/2017

3895-NLD-10/24/2017