In their inaugural edition of “ETF Market Matters,” global investment firm BlackRock introduced imputed flow, the measure of the influence of exchange-traded-fund flows on the trading of individual stocks, as a new metric that could give investors detailed information regarding the performance of a specific stock.

From a reverse standpoint, the weighting of an individual stock could influence the performance of an ETF, which could have a mutual benefit for the individual stock itself. An ETF increasing its holdings of a specific stock could signal bullishness moving forward and vice versa in a reduction in weighting.

![]()

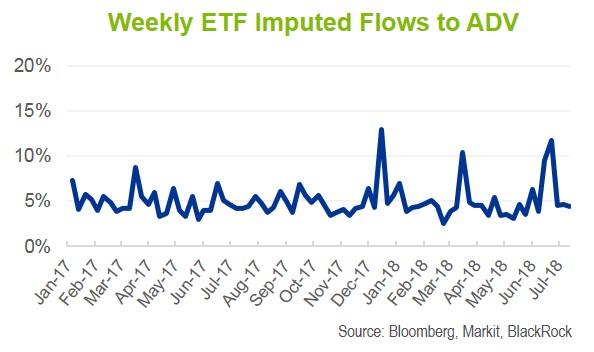

Per BlackRock, “ETF share creations and redemptions resulted in 4.1% of U.S. equity trading. In other words, more than 95% of individual stock trading took place independently of primary ETF activity.” The larger collective of individual stock traders would certainly benefit from understanding if specific ETFs corroborate with the movement of equities or if it’s a non-factor.

Related: Why ETFs Don’t Contribute to Junk Bond Market Volatility