The pandemic has led to a boom in online shopping and e-commerce, but retailers are focusing more than ever on brick and mortar stores, particularly as the shopping center as a hub for consumers flourishes.

The push to in-person shopping comes as rent is increasingly cheaper from pandemic closures, the price for companies to attract customers has suffered from an extremely competitive online market, and customers are more willing to shop in smaller venues than bigger indoor ones because of pandemic behavioral trends, reports Forbes.

Most companies, including many online ones, have plans or are in development to open brick and mortar stores in what are being dubbed as “power centers” of stores that are tethered by an existing big-box retailer.

“The demand for space right now is higher than I’ve seen it in 15 years,” said David Lukes, CEO of Site Centers, a $3 billion landlord.

The benefits to in-person shopping include a more personalized experience, and companies are able to gather more in-depth information and data, such as demographics, feedback on products, and what is trending for that particular area.

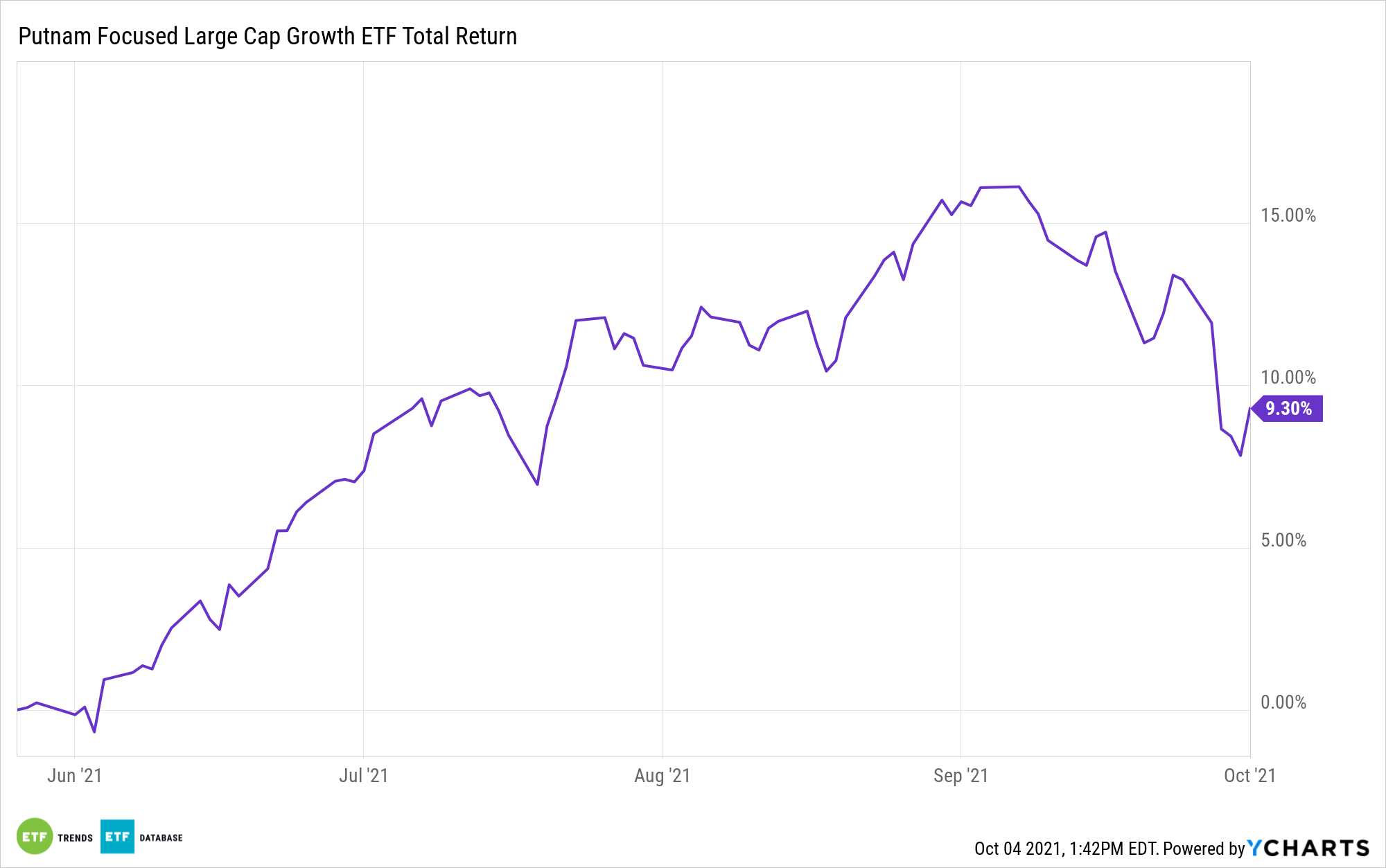

Putnam Invests Thematically in Growth

The Putnam Focused Large Cap Growth ETF (PGRO) is an actively managed, non-diversified fund that focuses on large, growth-oriented U.S. companies that profit in the midst of recovery and a growing economy, and it invests along 12 different growth themes.

The fund selects companies similar in size to those in the Russell 1000 Growth Index, whose market caps are between $2 billion and $2.1 trillion. Putnam Investment considers a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows, and dividends when buying and selling investments.

As a semi-transparent fund using the Fidelity model, PGRO does not disclose its current holdings daily. Instead, it publishes a tracking basket of previously disclosed holdings, liquid ETFs that mirror the portfolio’s investment strategy, and cash and cash equivalents. The tracking portfolio is designed to track the actual fund portfolio’s overall performance closely, and actual portfolio reports are released monthly.

One of the growth themes, the “Amazon effect,” recognizes that U.S. e-commerce sales could potentially pass brick and mortar store sales by 2040 as increasingly more consumers shop online, which adversely affects retail companies.

Putnam Investments invests in retail box stores that offer products and services that don’t necessarily translate well into an e-commerce setting; this includes products that may weigh too much, products that require fast delivery or delivery with a greater frequency than is feasible for online costs, or else offer services that can’t be duplicated online. Home Depot, Inc. (HD) is one such big-box retailer that offers products and services that will continue to flourish in the midst of online competition, and it is carried at a weight of 0.48% in the fund.

As of the end of August, PGRO had holdings in Microsoft (MSFT) at 9.90%, Apple (AAPL) at 8.20%, and Amazon.com (AMZN) at 7.28%.

PGRO has an expense ratio of 0.55% and had 39 holdings as of the end of August.

For more news, information, and strategy, visit the Big Ideas Channel.