Investors looking for the next batch of rising stars among developing economies have a credible option in Vietnam.

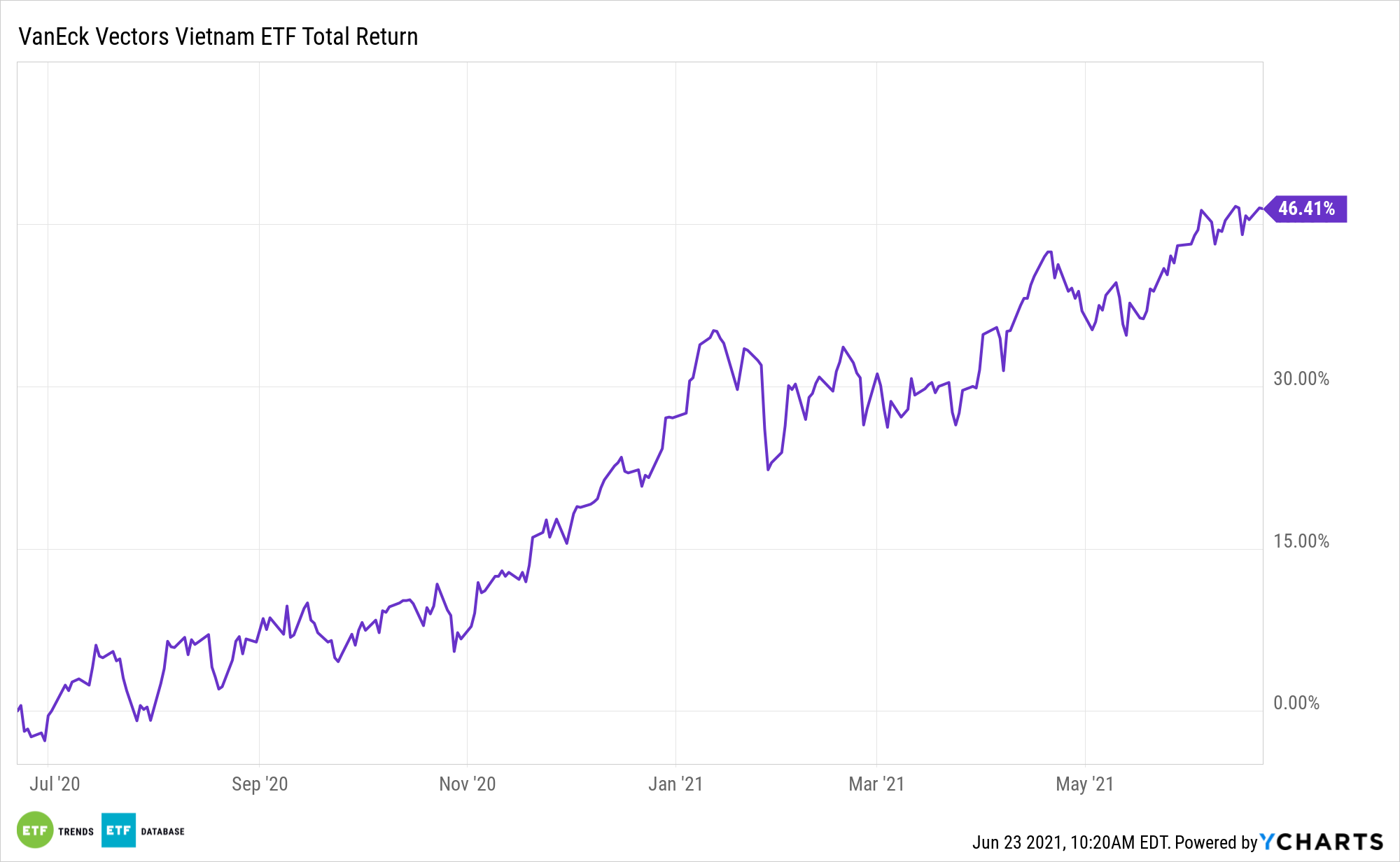

That country’s small but rising equity market is accessible via the VanEck Vectors Vietnam ETF (VNM) – an exchange traded fund that’s higher by more than 14% year-to-date. That puts VNM modestly ahead of the MSCI Frontier and Emerging Markets Select Index and well ahead of the MSCI Emerging Markets Index.

For tactical, long-term investors seeking international exposure, VNM is a viable option. Multiple financial factors back up that assertion.

Vietnam is “a country market that is also a well-positioned manufacturing hub ready to benefit from supply chain relocations due to US-China trade tensions, and boasting cheaper labor costs,” says FTSE Russell. “It enjoys substantial road, airport and seaport transportation infrastructure, all of which is being rapidly upgraded to cater for increasing export demand.”

The Catalysts Looming for VNM, Vietnamese Stocks

Vietnam is often overshadowed by continental behemoths China and India, as well as more established emerging markets such as Indonesia and Malaysia. However, the Vietnamese economy is on a torrid pace of growth. For over a decade, the Southeast Asian economy grew at a rate topping the world and the ASEAN-5 group.

What was once an extremely poor country now has a vibrant, expanding middle class. Those are among the factors that could position Vietnam for promotion from frontier to emerging markets status.

“It’s a market that is also currently on FTSE Russell’s watchlist as under consideration for advancement from frontier to secondary emerging market status,” notes FTSE Russell.

If that promotion occurs, it could potentially send Vietnamese stocks and VNM soaring because ETFs, index funds, and active fund managers that benchmark to FTSE emerging markets indices would need to buy Vietnamese equities. There’s also speculation that Vietnam is likely to be the next country added to the MSCI Emerging Markets Index. While the rumors are just talk, those index inclusions could stoke billions of dollars of flows into Vietnamese stocks, likely benefiting VNM in the process.

Yet VNM and Vietnamese stocks have their own benefits to offer.

“Some investors may be surprised to learn that the Vietnam market has in fact delivered better or similar in terms of per risk return by comparison with overall frontier equities, emerging market equities, development market equities, and global equities over the longer term,” adds FTSE.

Vietnam has easily topped broader benchmarks of global stocks over the past half decade.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.