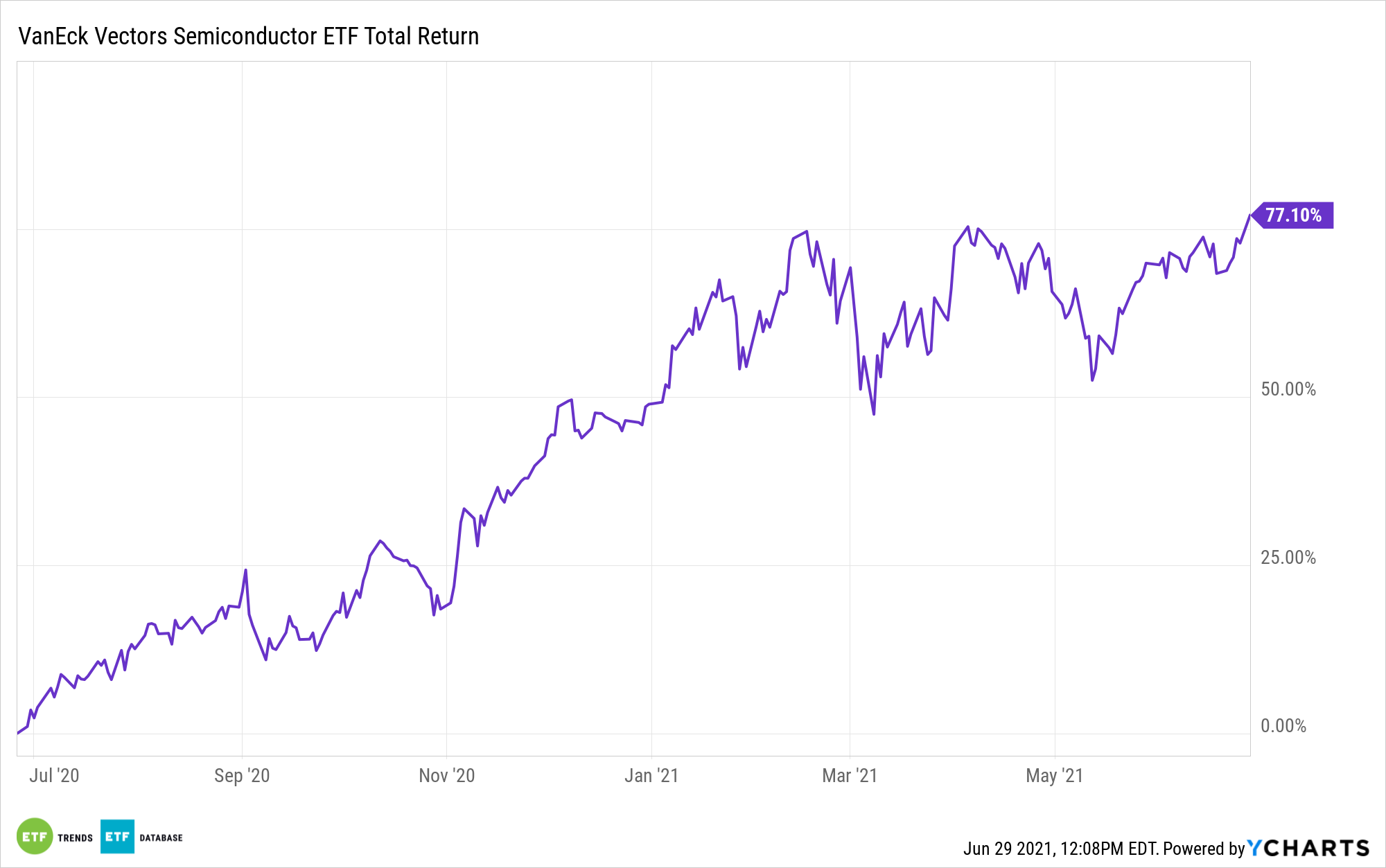

The 2021 semiconductor story has had three major components: soaring stocks, robust demand for chips, and supply shortfalls.

Those are among the factors sending the VanEck Vectors Semiconductor ETF (SMH) to a year-to-date gain of 16%. Of course, much of this year’s semiconductor shortage is attributable to an unforeseen spike in demand caused by the coronavirus pandemic.

“We believe the extraordinary demand for semiconductors over the past few months has been largely due to the effects of the pandemic,” according to VanEck research. “The work-from-home era has spurred sales of laptops, webcams, and other office gear, all of which come with customized chips. As consumers bought more personal electronics, companies ordered more chips to keep up with demand.”

Then came larger-than-expected demand for automobiles in the second half of 2020 that has carried over into 2021. As VanEck notes, other force majeure events beyond the pandemic have crimped supplies, including the freezing winter in Texas, a fire at a Japanese chip plant, and a drought in Taiwan. The last point is particularly relevant because chip production is water-intensive, and Taiwan Semiconductor Manufacturing Co (TSMC), the world’s largest semiconductor foundry, is SMH’s largest holding at a weight of 14.17%.

Don’t Worry About SMH

A post-pandemic environment doesn’t mean the bullish thesis for SMH and chip stocks will end. In fact, the supply shortage could have another year or more left.

“Many companies are also pouring money into expansion efforts, but even new plans that have already been announced will not begin production until 2022, meaning the supply shortage is sure to last well into next year,” adds VanEck.

Supply shortages aside, what’s truly compelling about SMH from a long-term perspective is the emergence of highly creative chip-dependent technologies. Think artificial intelligence, autonomous transportation, cryptocurrency mining, data centers, smartphones, and much, much more.

Many of these disruptive industries have long runways for growth ahead, meaning SMH holdings can drive sales and profits higher without the influence of once-in-a-lifetime crises.

“Although the shortage is causing trouble in many industries, we believe the semiconductor field is seeing a burst of creativity, with innovative designs gaining traction and heralding an exciting, high-efficiency future for the industry,” concludes VanEck.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.