With the value factor garnering so much attention this year, investors should remember that the concept isn’t just confined to stocks. In the fixed income space, there are bonds that are overvalued and those that sport attractive valuations.

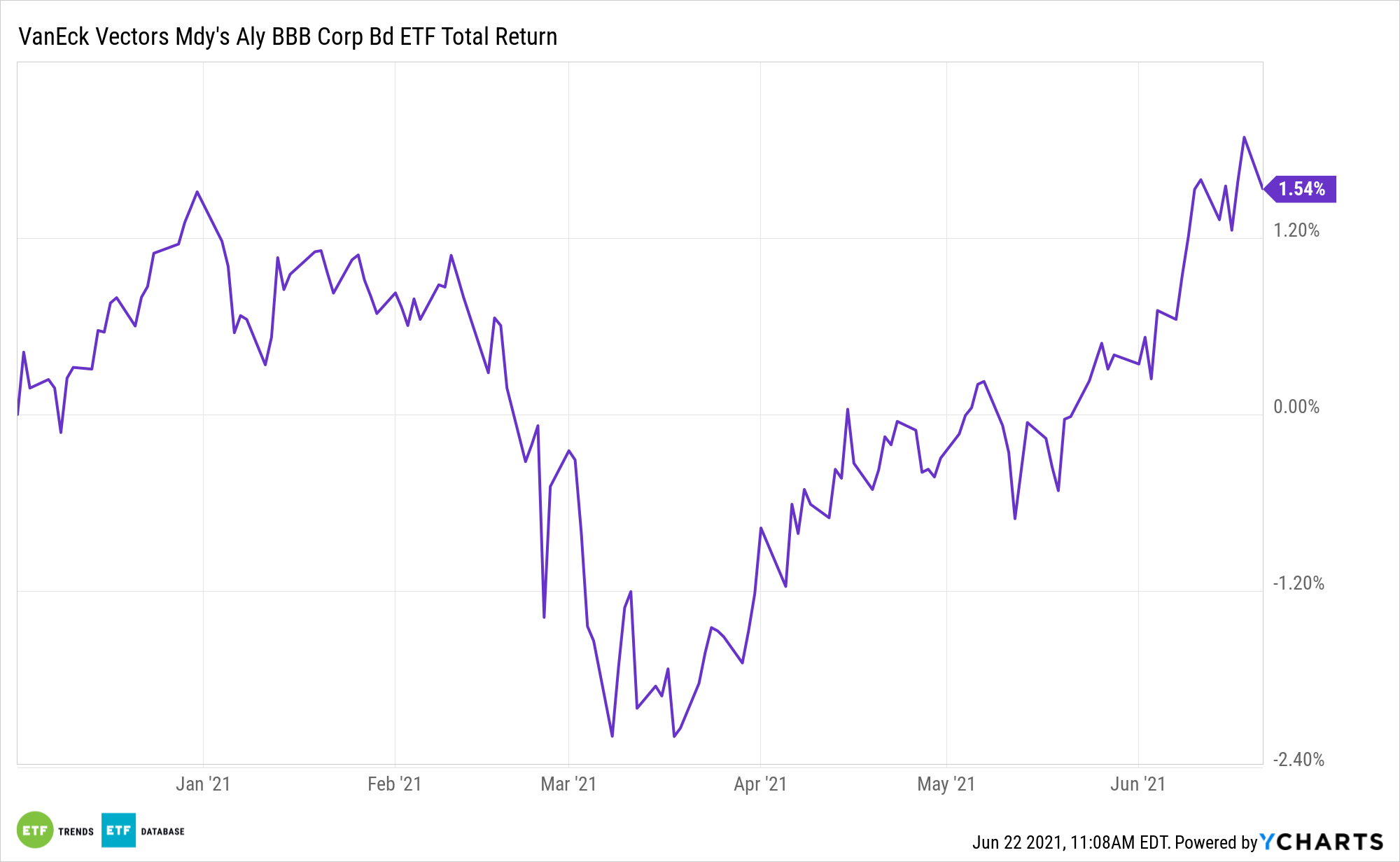

This is particularly true in the investment-grade corporate bond landscape, and that scenario underscores potential benefits with the VanEck Vectors Moody’s Analytics BBB Corporate Bond ETF (MBBB). MBBB offers investors a potentially superior mousetrap relative to traditional corporate bond exchange traded funds and index funds, which usually weigh holdings by issue size.

MBBB, which follows the MVIS® Moody’s Analytics® US BBB Corporate Bond Index, refreshes the investment-grade corporate bond proposition by focusing on valuation and low default risk as its primary evaluation criteria. Additionally, MBBB goes beyond credit ratings as a determinant of a bond’s value traits. Part of the opportunity set offered by the VanEck fund is rooted in the fair value spread.

“The fair value spread is the compensation that investors should demand to hold a bond, based on the model’s assessment of prospective risk,” writes William Sokol, VanEck senior ETF product manager. “Any difference between market pricing and fair value represents a market mispricing of risk: either a bond is ‘cheap’ and attractive, or ‘rich’ and should be avoided.”

MBBB Highlights

MBBB, which debuted last December, holds 123 bonds. Although its components have lower average default and downgrade risk, the fund offers a higher average credit spread – the compensation investors receive for taking on bond risk relative to Treasuries.

MBBB’s methodology can unearth real value opportunities in the investment-grade corporate bond arena – something traditional funds in this segment don’t do. Sokol uses the example of casino giant Las Vegas Sands (NYSE: LVS) to highlight some MBBB perks.

Excess spread previously offered by Sands bonds “has gradually dissipated over the past six months as market spreads have tightened significantly, benefitting holders of this bond, while fair value spread has remained relatively constant. Because only bonds with the highest excess spread are eligible for inclusion, this bond left the MVIS Moody’s Analytics US BBB Corporate Bond Index in March 2021,” according to Sokol.

Said another way, there was a time when the gaming company’s bonds were attractively valued, but that time has passed and the bonds were eliminated from MBBB’s underlying index.

MBBB has a 30-day SEC yield of 2.19%.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.