The VanEck Vectors Uranium+Nuclear Energy ETF (NLR) turned 14 years old last month, but it still leads a relatively anonymous existence.

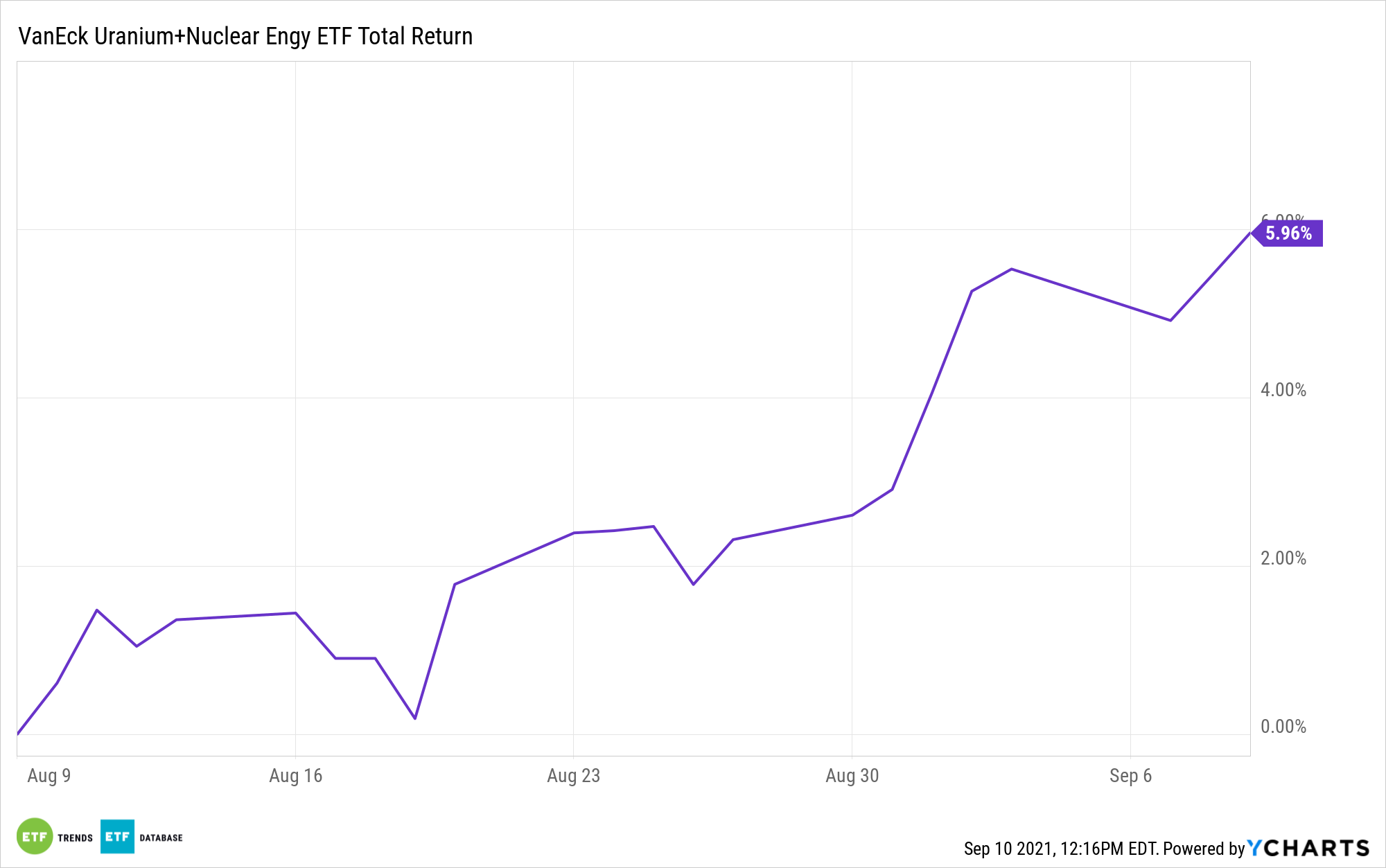

With uranium prices soaring and more experts believing that nuclear power is a key part of the clean energy conversation, NLR is poised to shed its overlooked status, as indicated by a 5.32% gain over the past month that has the exchange traded fund flirting with record highs.

NLR follows the MVIS Global Uranium & Nuclear Energy Index. Despite having just 24 holdings, NLR reaches deep into the uranium ecosystem due to its index’s methodology.

The index focuses on companies engaged in “(i) uranium mining or uranium mining projects that have the potential, in MV Index Solutions GmbH’s (the “Index Provider”) view, when such projects are developed are expected to generate at least 50% of a company’s revenues or are expected to constitute at least 50% of such company’s assets; (ii) the construction, engineering and maintenance of nuclear power facilities and nuclear reactors; (iii) the production of electricity from nuclear sources; or (iv) providing equipment, technology and/or services to the nuclear power industry,” according to VanEck.

NLR: Right Place, Right Time

In many regards, NLR is a testament to an issuer sticking by an ETF and not pulling the plug simply because the underlying thesis falls out of favor.

More than a decade ago, uranium stocks were repudiated following the March 2011 earthquake and tsunami disaster in Japan. The group subsequently spent years languishing. That’s changing as more governments see opportunities with nuclear power to drive carbon-reduction agendas.

“The World Nuclear Association said the globe’s roughly 440 nuclear reactors require some 79,500 metric tons of uranium oxide concentrate each year and in a 2019 report, it forecast a 26% increase in uranium demand from 2020 to 2030,” reports Myra Saefong for Barron’s.

A positive for NLR is that demand for uranium is soaring even as prices for the material reside at six-year highs. The fund’s components must derive at least half of sales from the nuclear power industry to be included in the underlying index.

“Demand from nuclear reactors is expected to increase by a few percentage points per year as new reactors come online, says John Ciampaglia, CEO of Sprott Asset Management. There’s also strong demand from non-utility buyers,” according to Barron’s.

About two-thirds of NLR components are U.S. or Japanese equities. The weighted average market capitalization of those holdings is $28.3 billion, according to issuer data.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.