Large U.S. company stocks are beginning to look pricey relative to their historical trends as the ongoing bull market rally pushes into its ninth year. Consequently, investors may consider potential exchange traded fund opportunities outside of U.S. large-caps.

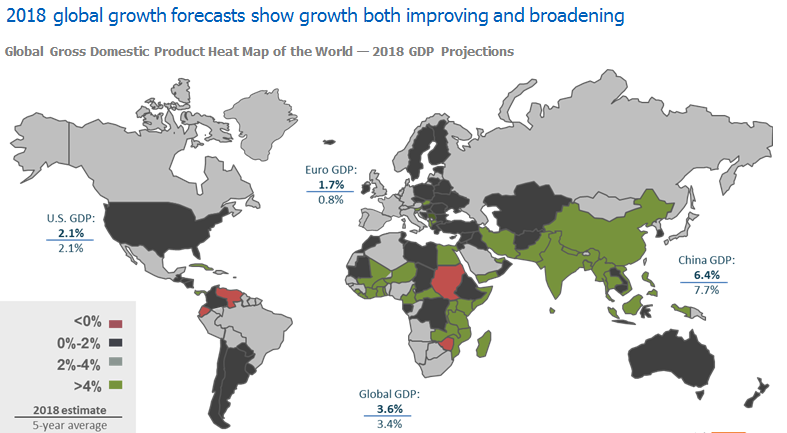

On the recent webcast (available On Demand for CE Credit), Opportunities Outside of U.S. Large Cap Companies, Salvatore Bruno, Chief Investment Officer and Managing Director of IndexIQ, pointed out that the global economic outlook is improving, with forecasts showing growth around the world is improving and broadening, especially in Southeast Asia.

“Growth is steady and improving in key areas outside the U.S.,” Bruno said.

Along with the growth prospects, investors may also find better value in global markets. Looking at 12-month forward price-to-earning ratios, the S&P 500 is relatively pricey compared to international benchmarks. The S&P 500 was trading at a 17.7 P/E as of the end of June, compared to its 15.4 30-year average. In contrast, the MSCI Europe was trading at a 14.8 P/E, compared to its 14.0 P/E 30-year average. The MSCI Japan was hovering around a 14.4 P/E, compared to its 27.8 P/E 30-year average. The FTSE World ex U.S. showed a 14.2 P/E, compared to its 16.2 P/E 30-year average.

Earnings growth will also further support market prices in global markets. For instance, trailing earnings have rebounded on the Euro Stoxx 50 Index while forward earnings push higher.

“Growing earnings may continue to provide a tailwind for European equities,” Bruno said.

However, as more look to global opportunities, investors should keep in mind potential currency risks that come with international investing.

“Currency valuations tend to revert to the mean over long periods of time, but fluctuate dramatically during shorter periods — increasing the impact of currency movements,” Bruno said.

Due to the currency fluctuations and the predictable nature of the foreign exchange market, it is difficult to pinpoint the best times to use a completely hedged or unhedged investment approach. Bruno warned that missed opportunities due to sharp currency swings have historically led investors to chase after performance through either fully hedged or nonhedged strategies. Alternatively, investors may consider a 50% hedged investment strategy as a way to still keep their feet in the water without worrying too much about risks.