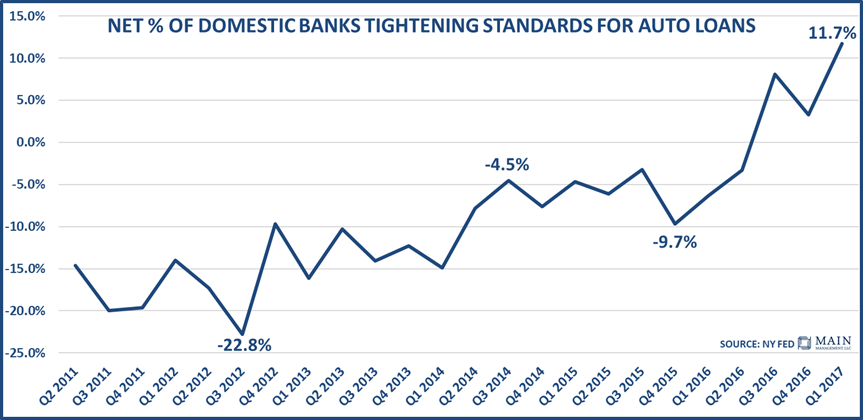

As automotive companies went flat out to meet consumer demand and as lenders were eager to meet that demand, excesses have begun to creep in. Sales have begun to slow and inventories have begun to pile up, which in turn, has led to higher delinquencies and ultimately the prospect of higher loan losses. These trends have led the banks to retreat from the market somewhat and tighten their auto loan standards, putting further pressure on sales.

TRENDS TO WATCH

The aggressive stance by lenders in the past few years has come to a halt as the fundamentals have frayed. As mentioned, inventories have risen. Despite record sales in 2016, the number of vehicles in inventory has reached 3.9 million, which amounts to a 66-day supply at year-end. The inventory has swelled to around 74 days’ supply which is the highest level since 2009. The inventory would last 2.23 months at the year-end pace of sales according to the Census Bureau. That level is not as high as it reached in the depth of the recession but, nonetheless, it is very elevated. Of course, the car companies would like to reduce inventories so they are now offering larger and larger incentives to move units. GM’s incentive spending is currently 11.7% of their transaction prices versus 10.3% a year ago. GM has reported an inventory-to-sales ratio of 100 days, up from 71 days as recently as last April.

Source: www.zerohedge.com/sites/default/files/images/user230519/imageroot/2017/05/02/2017.05.02%20-%20Auto%20Inventory.jpg

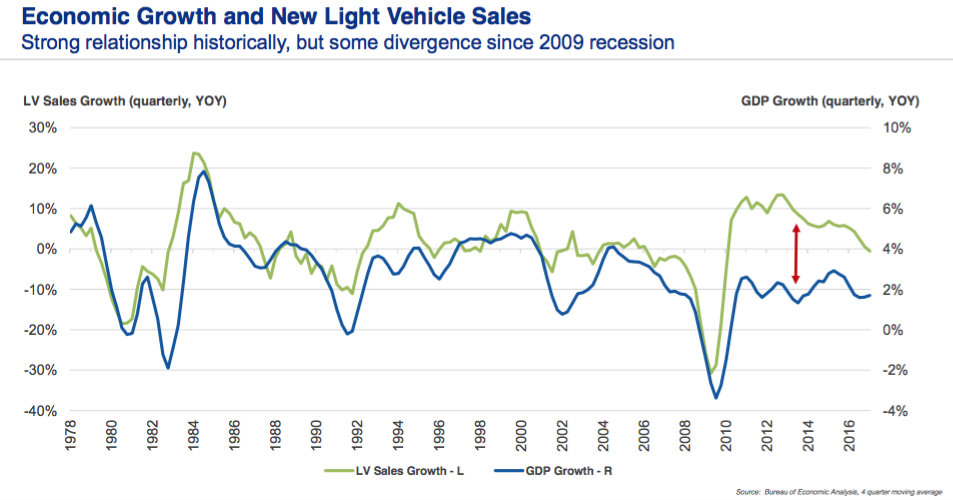

Another cautionary flag that indicates trouble could be brewing is when a given loan sector grows faster than GDP. That situation has surfaced in the auto area and can be seen below.

Source: Bureau of Economic Analysis

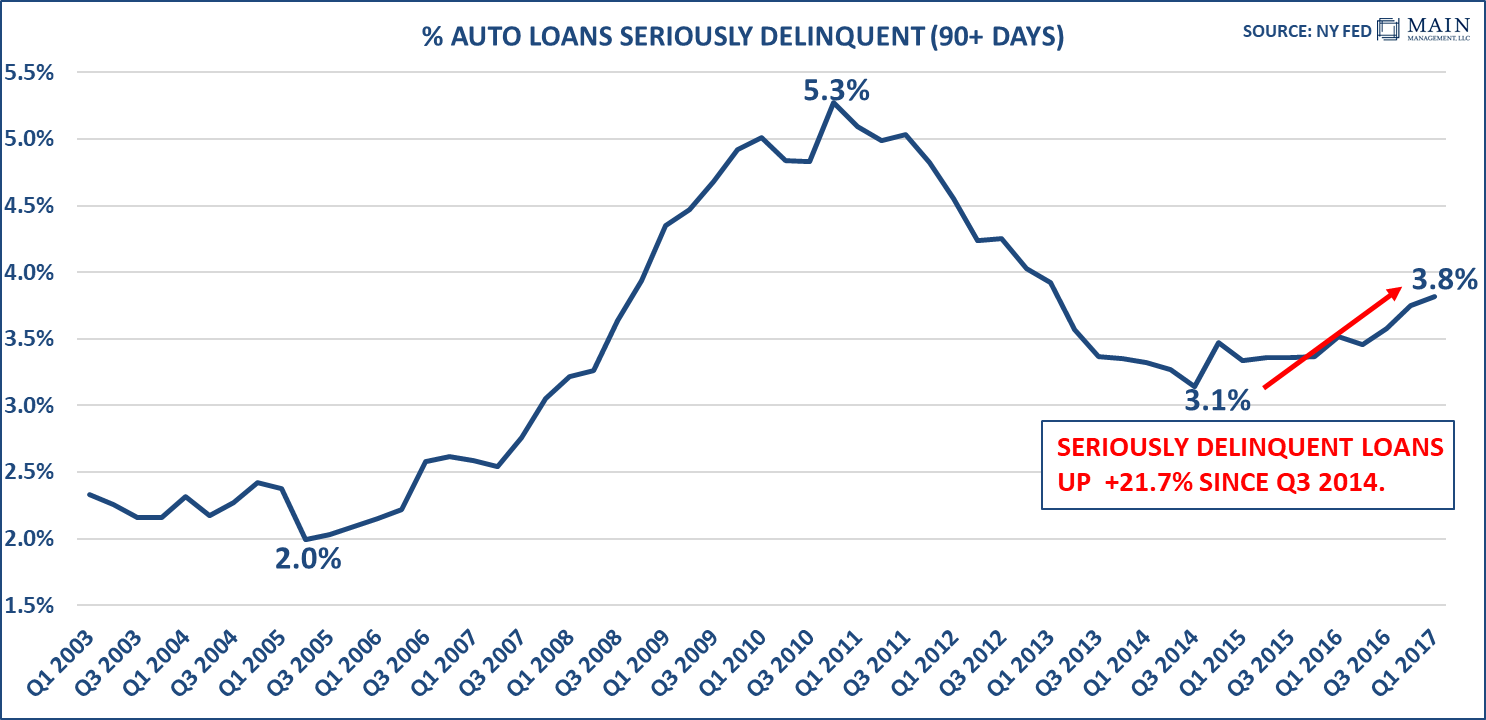

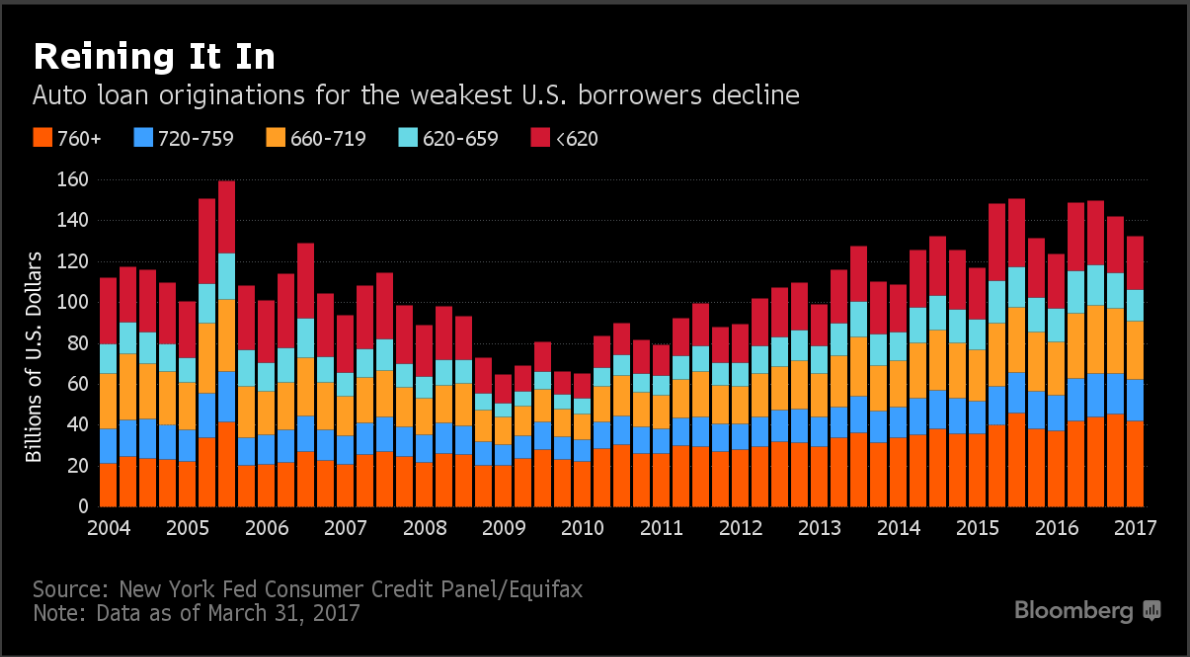

As sales slow and production is cut back, the worry becomes loan quality. As always, the worst credits fail first. Today, 6 million Americans are more than 90 days past due on their auto financing. Many of these would fall into the subprime auto lending category, which are loans made to borrowers with spotty lending records. Nearly 25% of auto loans are deemed subprime. To protect themselves, lenders have tightened their terms lately and shifted away from subprime borrowers toward higher quality borrowers (see second panel below) but the overall trends are worsening nonetheless.

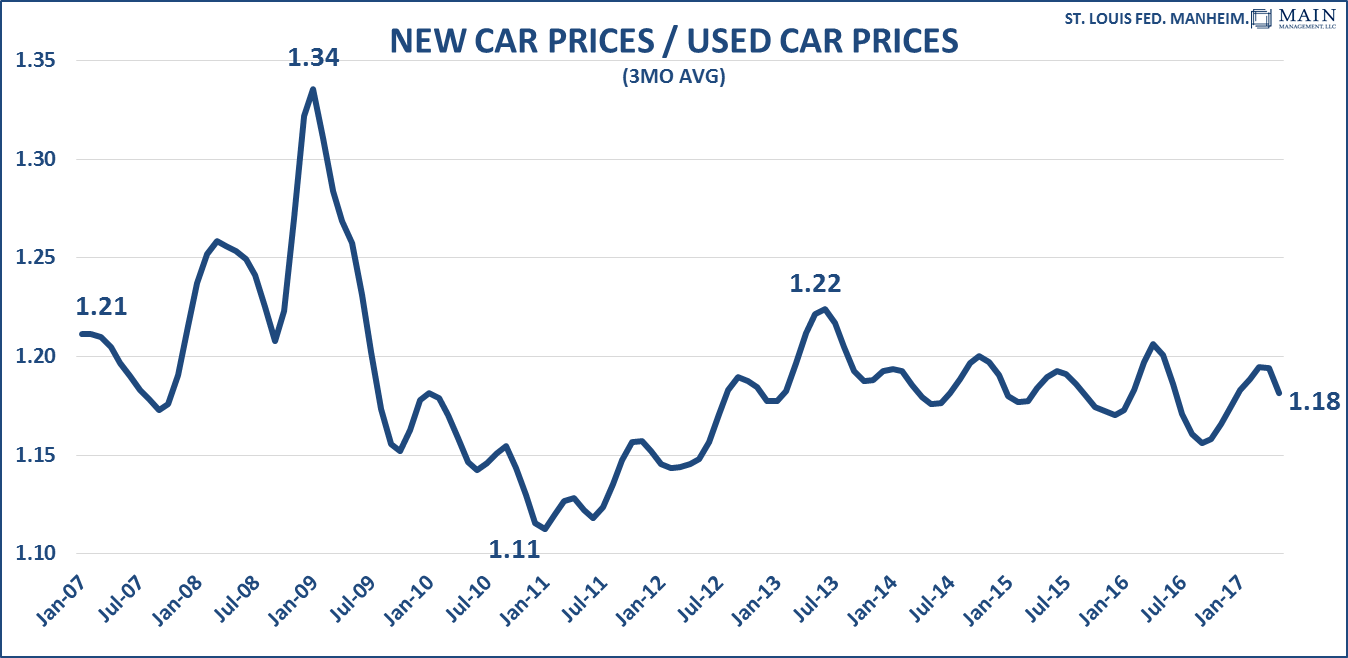

Another “tell” to monitor the ongoing risk in the auto lending arena can be found in the trends with used cars. One measure would be the growth of used car sales compared to the rate of change of new vehicles. The same is true for price trends of used cars versus new cars. Looking at the prices on a ratio basis, as the ratio of new cars relative to used car prices rises, the consumer will more closely consider a used car purchase. The ratio has been slowly increasing since 2011, which is a factor in the slowdown of new vehicle sales. That fact, combined with the higher total of borrowed money to support a purchase also has an impact. CNBC has noted recently that the “typical” loan on a new car is $30,621. By contrast, the average loan on a used car is $19,329, or $11,292 lower, which makes the possibility of a used car more attractive.

DOES THIS CREATE THE POSSIBILITY OF SYSTEMIC RISK?

We do not believe it does! While this area of lending is strained, it is not large enough to cause systemic problems. People might harken back to the problems that surfaced in the mortgage meltdown, but there is no comparison. The total market for auto credits is $1.2 trillion, which amounts to only 9.4% of total aggregate household debt at the end of the first quarter. The mortgage market is $8.63 trillion, or 7 times the size of the auto financing market so there is no comparison to the risk levels that mortgages represented in the last recession. The one area of concern with autos would be in the subprime area, which is only around $300 billion. The securitized portion of the subprime market would be the most vulnerable piece of the subprime market yet it is “only” $97 billion. We don’t see the possibility of a systemic problem, but we do see the potential of some modest pain.

J. Richard Fredericks is founding partner at Main Management, a participant in the ETF Strategist Channel.

Disclosure Information

A pioneer in managing all-ETF portfolios, Main Management LLC is committed to delivering liquid, transparent and cost-effective investment solutions. By combining asset allocation insights with smart implementation vehicles, Main Management offers a unique approach that translates into distinct advantages for our clients, including diversification, cost efficiency, tax awareness and transparency. http://www.mainmgt.com