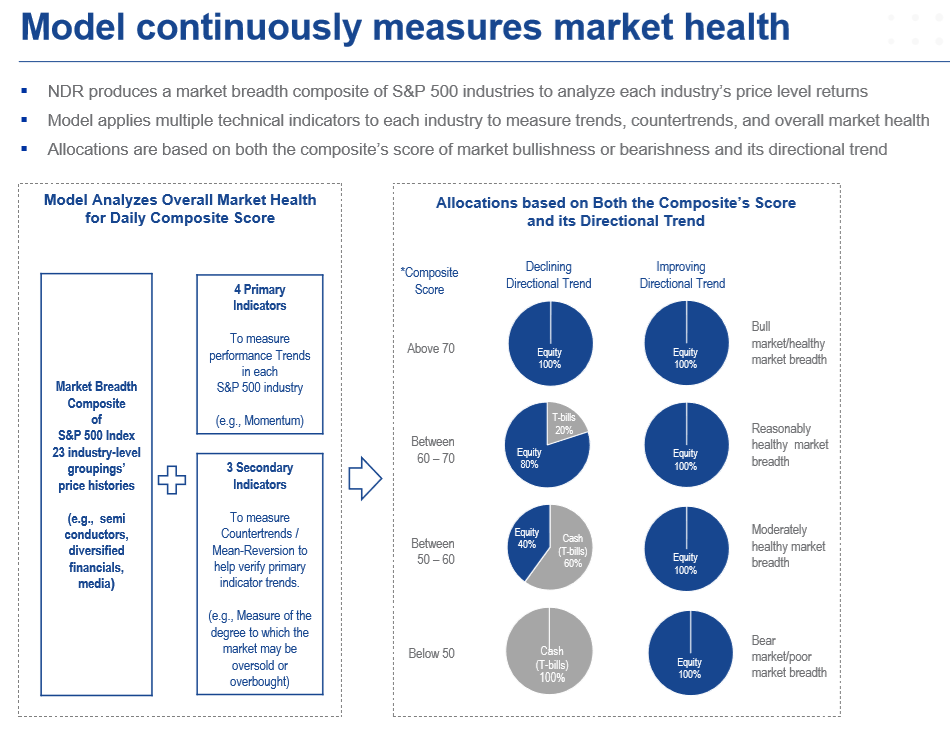

The index’s model follows a two-step process–the first step measures trend following and mean reversion within the S&P 500 industry groupings to determine a bullish or bearish market environment. Additionally, the model applies a risk filter process to ensure that all of the price-based industry level indicators are effective over time.

The second step calculates the scores taken from the first phase to produce the equity allocations of the index. When the index is not completely long or flat, either 80% or 40% of the portfolio will be allocated to the S&P 500, with the remainder allocated to the Solactive 13-week U.S. T-bill Index.

“It (LFEQ) tries to avoid those major market downturns, but give you the ability to participate in a meaningful way on any equity upside,” said Lopez.

“It (LFEQ) tries to avoid those major market downturns, but give you the ability to participate in a meaningful way on any equity upside,” said Lopez.

To obtain more information on how the LFEQ market breadth model works, click here or click here to read the white paper.

Related: ETF of the Week: VanEck Vectors Morningstar Wide Moat ETF (MOAT)

For more market trends, visit ETF Trends.