![]()

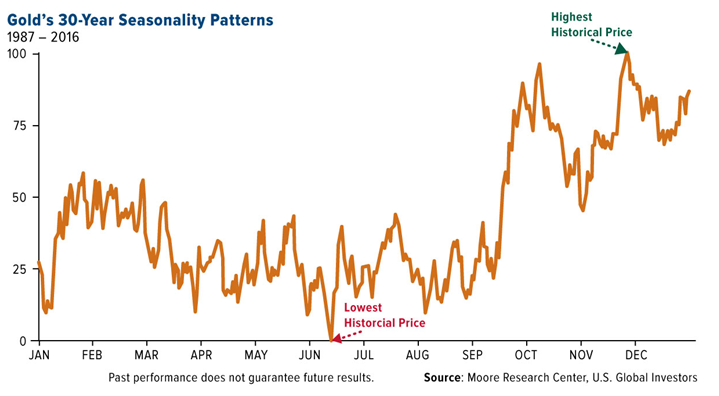

Furthermore, demand is on the rise. While gold is seen as a safe haven asset, the precious metal also enjoys support from consumer discretionary spending. For example, gold has found support from cultural celebrations like Ramadan, the Indian wedding season, Diwali, Christmas and the Chinese New Year. Demand is especially strong in India, where Indian households now account for the world’s largest private gold holdings at 24,000 metric tons.

Investors interested in capitalizing on the gold outlook may consider an alternative play like a smart beta gold miner ETFs such as the

For example, the U.S. Global GO GOLD and Precious Metal Miners ETF (NYSEArca: GOAU). GOAU is a smart beta offering that tracks a specialized or rules-based index to help hone in on quality players in the gold mining space. The underlying U.S. Global GO GOLD and Precious Metal Miners Index uses quantitative analysis to pick stocks, with a particular focus on royalty companies.

“Royalty companies serve as specialized financiers that provide upfront capital to help fund producers’ exploration and production projects. They receive royalties on what is produced or rights to a ‘stream,’ an agreed-upon amount of gold, silver or other precious metal at a fixed, lower-than-market price,” Holmes explained.

U.S. Global believes royalty companies are a superior way to target the gold mining segment because they offer more stable revenue and cash flow, show rising book value per share, have high revenue per employee and have low SG&A to revenue, which have contributed to the outperformance to gold bullion and the broader gold producer segment.

Financial advisors who are interested in learning more about the gold miners space can watch the webcast here on demand.