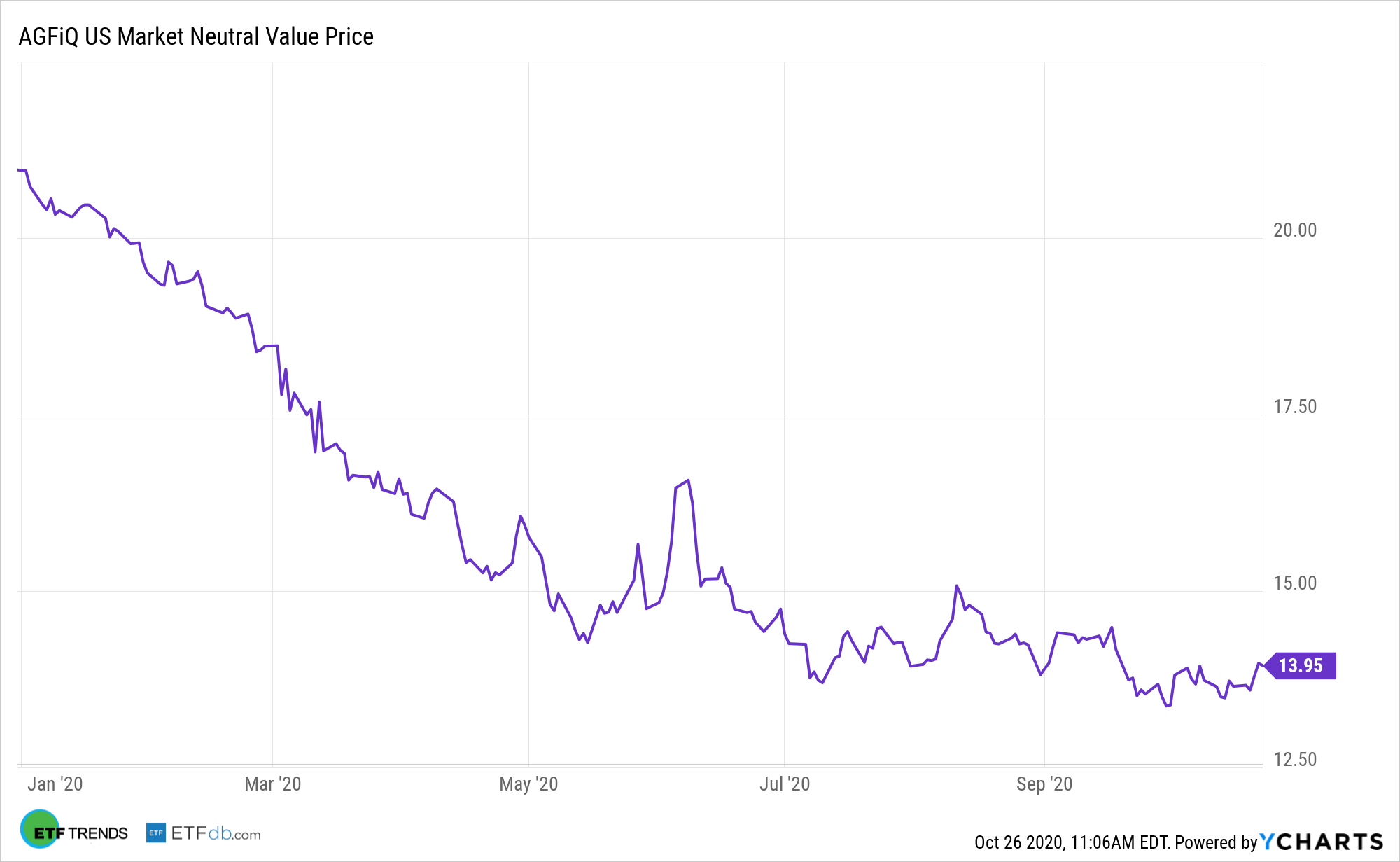

There’s considerable talk that value stocks could be back in style following Election Day, a scenario that could shine a light on the AGFiQ U.S. Market Neutral Value Fund (NYSEArca: CHEP).

AGFiQ’s market neutral ETFs don’t focus on going long stock components that have historically exhibited minimal swings in volatility. Instead, the market-neutral ETFs hold an equal dollar amount long and short within the various segments of the U.S. market, based on quantitative factors like momentum, size, and quality.

Value stocks usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets. On the other hand, growth-oriented stocks tend to run at higher valuations since investors expect the rapid growth in those company measures, but more are growing wary of high valuations.

CHEP’s Time to Shine?

Some asset allocators argue that investors may be overlooking valuation as a key factor for long-term excess return. Regardless of valuation metrics, cheap stocks typically outperform the market. Looking at data back from 1956, cheap stocks outperformed 80% of the time, with a median excess return of 2.99%.

CHEP “provides consistent exposure to the value factor by investing in the underlying index which reconstitutes and rebalances monthly in equal dollar amounts in equally weighted long high value (cheap) positions and equally weighted short low value (expensive) positions within each sector,” according to the issuer.

A lot of data points indicate that it could be CHEP’s time to shine.

Growth valuations becoming further disconnected from value. Forward price-to-earnings ratios over the next 12 months in the Russell 1000 Growth Index was at 30x, compared to 17x for the Russell 1000 Value Index.

“CHEP’s objective is to seek performance results that correspond to the price and yield performance, before fees and expenses, of the Dow Jones U.S. Thematic Market Neutral Value Index,” according to the issuer. “In striving to achieve this objective, CHEP provides exposure to the ‘value’ factor by investing in U.S. equities that have below average valuations and shorting those securities that have above-average valuations.”

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.