Momentum investing can target those companies that are exhibiting high levels of growth. The momentum factor selects company stocks that have recently outperformed based on the idea that “the trend is your friend” and that stock market leaders typically continue to outperform. This type of strategy can be an effective way of targeting growth-oriented companies since stocks with positive momentum often continue to generate strong earnings.

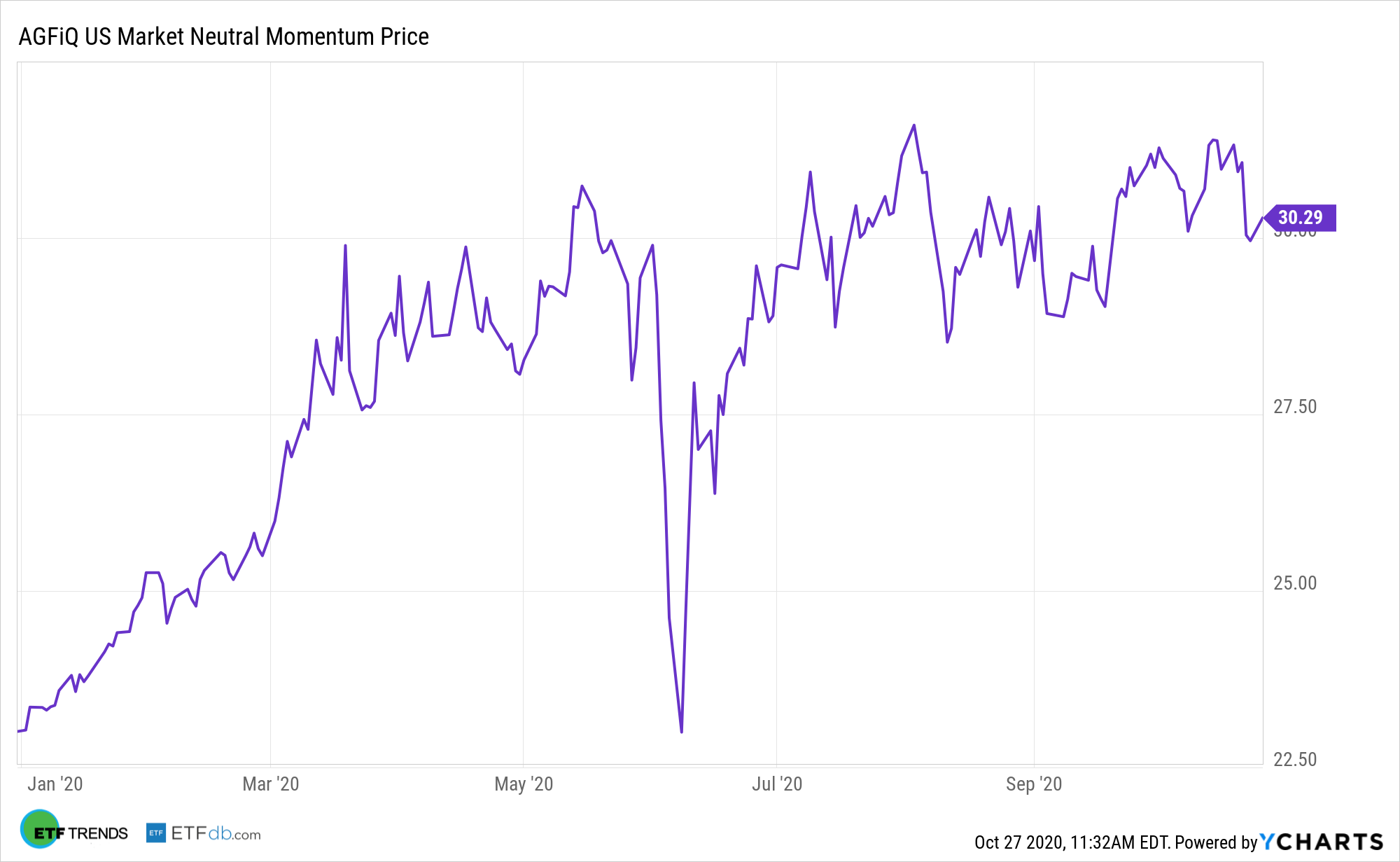

There are risks with this style of investing, but they can be mitigated with the AGFiQ U.S. Market Neutral Momentum Fund (MOM).

MOM seeks results that are in tune with Dow Jones U.S. Thematic Market Neutral Momentum Index. In order for the fund to accomplish its goal, “MOM provides exposure to the ‘momentum’ factor by investing long in U.S. equities that have had above-average total returns and shorting those securities that have had below-average total returns,” according to the fund’s fact sheet.

MOM Could be Ideal Near-Term Play

Momentum investing is rooted in the notion that securities that are on torrid paces will continue acting that way over the near-term while laggards will continue slumping. Long-term data for the momentum factor are compelling, but the factor can be volatile

Momentum—once it picks up, it can be difficult to stop and while the debate in the capital markets is whether value can sustain its lead overgrowth, investors can’t forget about the momentum factor, especially if events like a coronavirus easing or cure stir a rally for riskier assets.

The momentum strategy is based on a simple idea, the theory about momentum states that stocks which have performed well in the past, should continue to perform well, while on the other hand, stocks which have performed poorly in the past, should continue to perform poorly.

High momentum stocks are those that are capable of rising very fast in a short period of time, which makes them very attractive to potential buyers. However, in many cases, these stocks can also crash unexpectedly and carry significant risks as a result. When handled properly, however, momentum trading can be a rewarding method of profiting from the stock market.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.