The VanEck Vectors Rare Earth/Strategic Metals ETF (NYSEArca: REMX) could be getting some help from the Trump Administration.

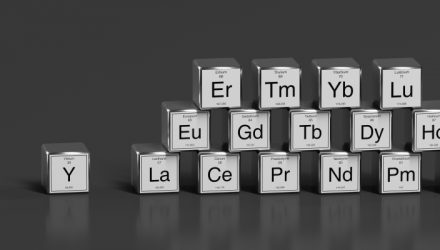

REMX seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS Global Rare Earth/Strategic Metals Index (MVREMXTR), which is intended to track the overall performance of companies involved in producing, refining, and recycling of rare earth and strategic metals and minerals. REMX offers investors the opportunity to participate in the rare earth metals arena, without as much of the risk presented when investing in an individual rare earth stock.

In a move aimed at shoring domestic supplies of rare earths minerals, President Trump recently signed an executive order declaring national emergency in the mining industry.

“The directive, issued late Wednesday night, asks the Interior Department to explore using the 70-year-old Defense Production Act to speed up mine development,” reports Cecilia Jamasmie for Mining.com.

Rare Earths Move Could Pay Dividends for REMX

For years, the global rare earths industry has been dominated by Chinese exports while U.S. production slumped due to stringent regulations.

Rare earth metals are crucial factors in the 21st century, as they are a part of industries as disparate as electronics, mobility, and sustainable energy. Strategic Metals include rare earth elements as well as specialty metals used in nuclear reactors, LEDs, magnets, electric motors, sensors, and many other components used in smartphones, flatscreens, hybrid vehicles, and our homes. Now they are becoming available for physical investment, including secure storage in bonded warehouses.

“Critical minerals have been a focus of the Trump administration. The White House has signed agreements with Canada and Australia, among other nations, to secure supply of minerals needed for a range of modern life’s aspects, including electric vehicles (EVs), green technologies and military applications,” according to Mining.com.

Increased production in the U.S. is important because the Defense Department is trying to stockpile reserves of these minerals in an effort to reduce dependence on Chinese imports.

“Last year, the White House ordered the Defense Department to boost production of rare-earth magnets used in consumer electronics, military hardware and medical research, amid concerns China would restrict exports of the products as trade tensions between the countries grew,” reports Mining.com.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.