Market uncertainty and the prospect for modest gains in 2020 could have investors looking for more value propositions that strike the perfect balance between performance and cost. Of course, the more performance for lesser cost the better, but one sector that could provide this combination is energy.

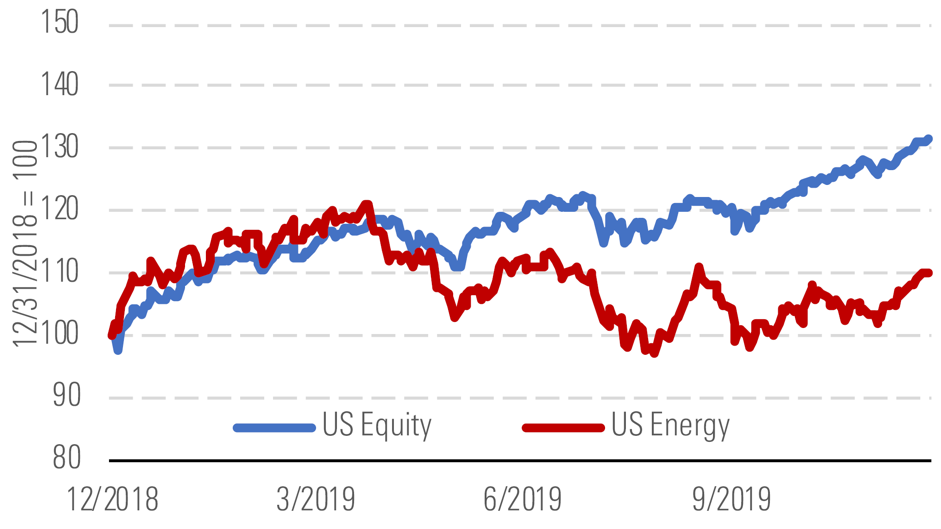

2019 wasn’t a banner year for energy as the sector languished while the rest of its peers in U.S. equities excelled. One only has to look at the Morningstar US Energy Index, which underperformed for much of last year.

“The Morningstar US Energy Index continues to underperform the market, rising just 5.7% versus the overall domestic market’s 9.0% gain in the fourth quarter,” wrote Dave Meats in Morningstar. “Through 2019, the sector displayed more volatility than the market and ended with a 10% gain over the prior year, trailing the market’s 31% return. While investors have remained pessimistic on oil and gas stocks in 2019, the recent (albeit slight) uptick reflects a 13% increase in spot prices for West Texas Intermediate over the quarter.”

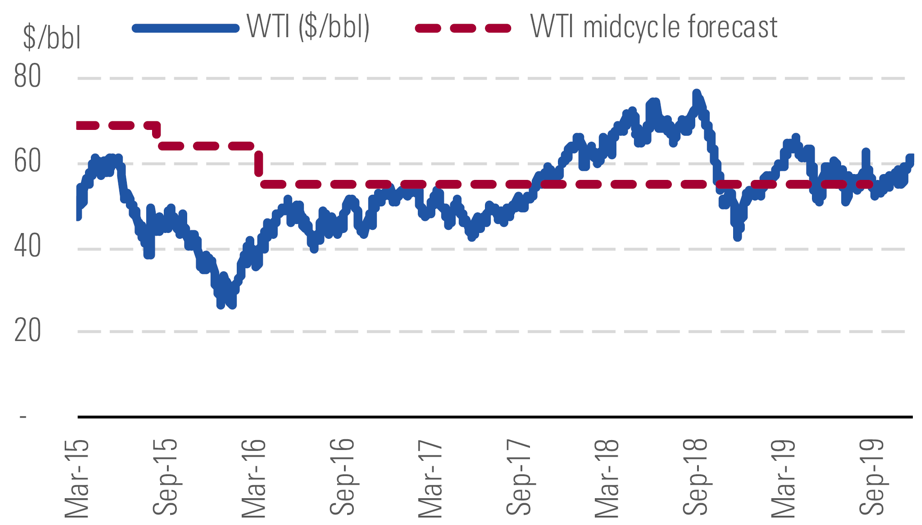

“Even with spot prices 11% above our midcycle price forecast, we continue to see investment opportunities, as energy remains the most undervalued sector, trading at a 10% discount (Exhibit 2),” Meats added. “Oilfield-services stocks in particular trade at a 16% discount, offering a lucrative buying opportunity.”

For broad market exposure to energy via an ETF wrapper, investors can look at the Energy Select Sector SPDR Fund (XLE). XLE seeks to provide investment results that correspond generally to the price and yield performance of publicly traded equity securities of companies in the Energy Select Sector Index, which includes securities of companies from the following industries: oil, gas and consumable fuels; and energy equipment and services.

An Active Energy Option

For an actively managed energy play, investors can look at the First Trust North American Energy Infrastructure Fund (NYSEArca: EMLP). The fund invests the majority of its net assets in equity securities of companies deemed by the sub-advisor to be engaged in the energy infrastructure sector.

These companies selected by the fund include publicly-traded MLPs and limited liability companies taxed as partnerships, MLP affiliates, pipeline companies, utilities, and other companies that derive the majority of their revenues from operating or providing services in support of infrastructure assets such as pipelines, power transmission and petroleum and natural gas storage in the petroleum, natural gas and power generation industries.

For more market trends, visit ETF Trends.