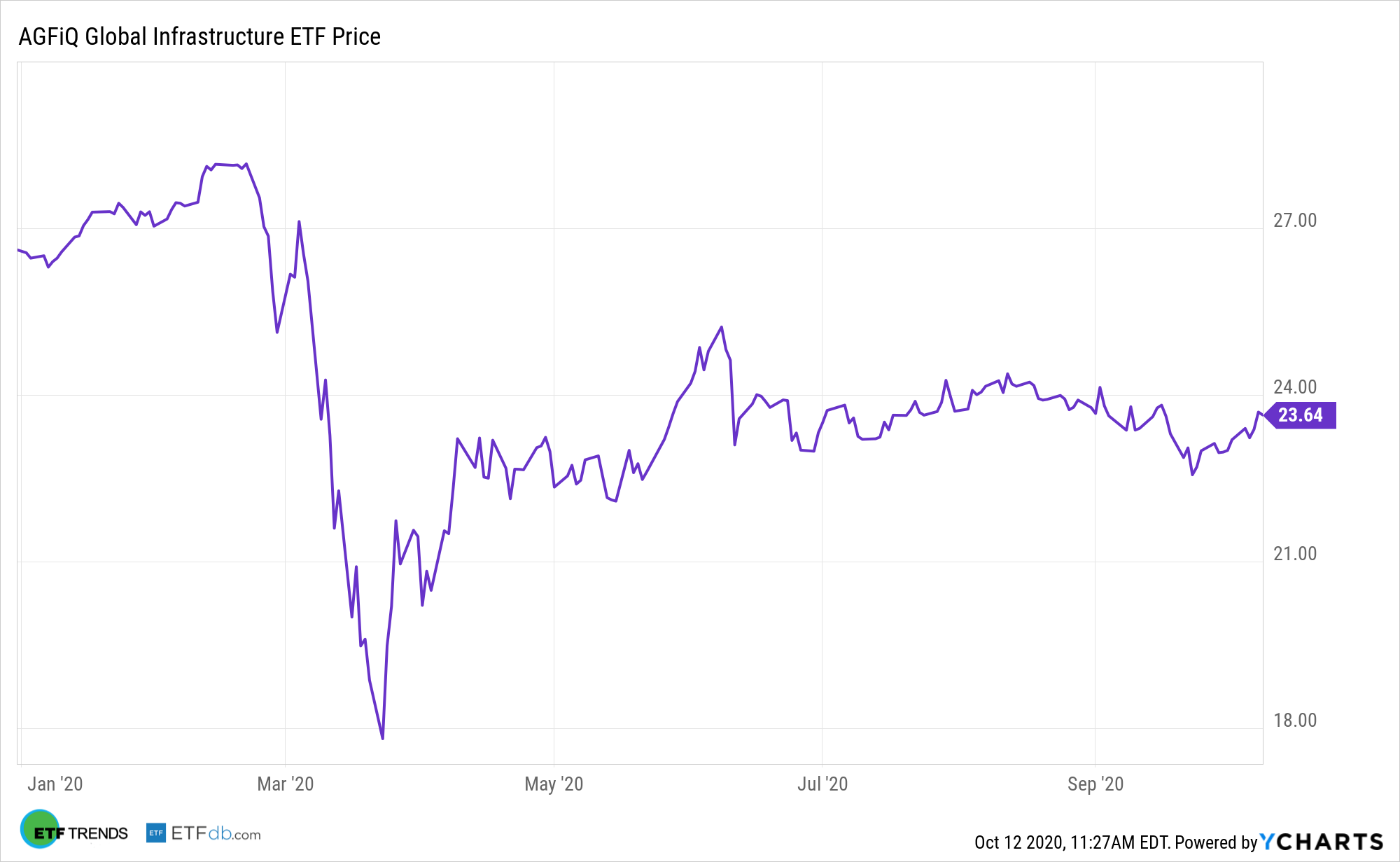

The AGFiQ Global Infrastructure ETF (GLIF) and other infrastructure assets are coming into focus as Election Day draws closer and that could be to the benefit of investors.

A victory by former Vice President Joe Biden “would put a big infrastructure package in play for early next year, possibly a plus for the economy but negative for bonds since it would bring more debt issuance,” reports Patti Domm for CNBC.

The AGFiQ Global Infrastructure ETF uses a multi-factor investment process to seek long-term capital appreciation by investing primarily in global equity securities in the infrastructure industry. President Trump is pitching a 10-year, $1 trillion infrastructure plan, which is scaled back from his 2016 campaign trail plan. Indeed, costs play a role in determining the fate of domestic infrastructure efforts.

Candidate and former vice president Joe Biden proposed spending $2 trillion within the next four years for clean energy development, as well as rebuilding the nation’s infrastructure.

Get With GLIF

Some of the largest airports and seaports throughout the world are all public securities, which makes them something that investors could consider for portfolio diversification, which provides a lower correlation to equity and fixed income markets.

How infrastructure dollars are spent is equally as important as knowing those dollars are earmarked for infrastructure in the first place. During the 2016 presidential campaign, Trump promised to spend $1 trillion to shore up America’s sagging infrastructure, but politicians have clearly agreed to exceed that number. That promise is likely to be reiterated on the campaign trail this year.

One issue to consider is that President Obama’s infrastructure effort, one unveiled while Biden was vice president, largely fell flat.

The infrastructure category has also historically offered higher dividend yields than global fixed-income and global equities, along with greater predictability of long-term cash flows. GLIF may be able to capture the growing demands of economic development that are driving more funding into transport, power, and other systems.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.