![]()

Again we see good performance from Algo X, but not quite as good as in the previous analysis. Certainly lower cost of SMAs could account for some of the discrepancy.

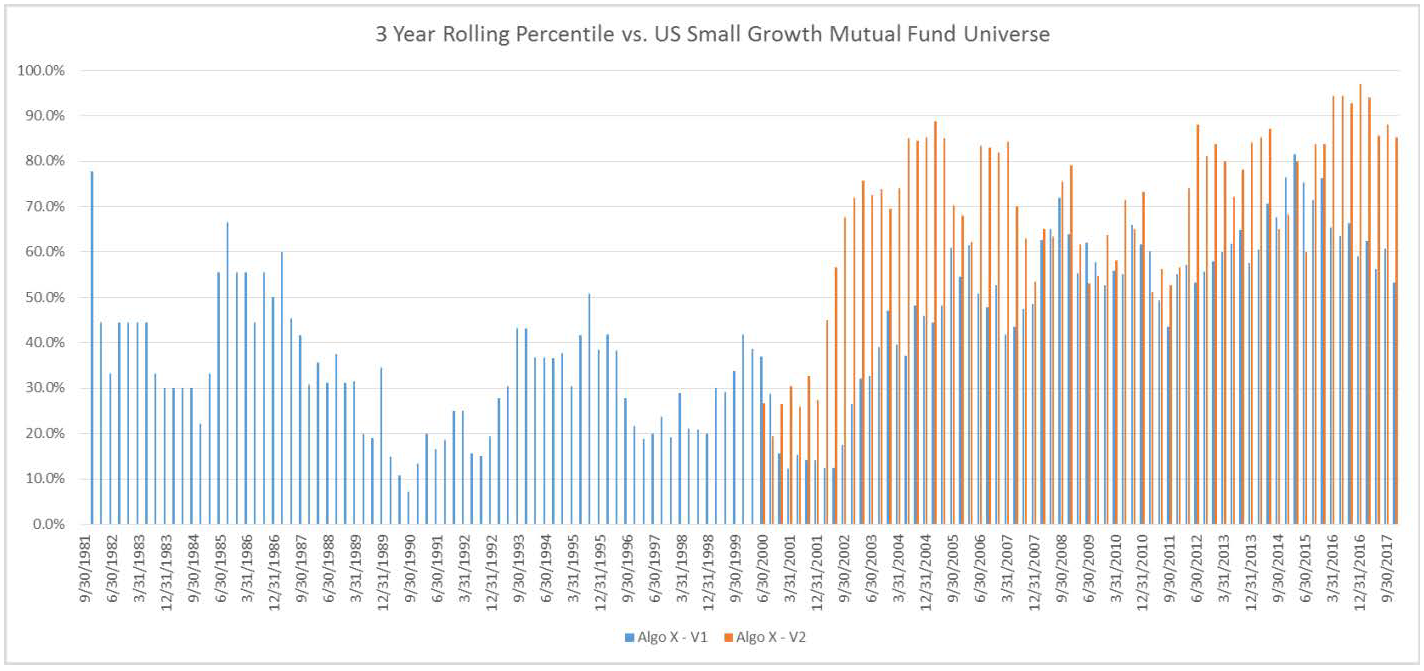

In Exhibit 3, we changed the investment universe to US Small Growth stocks. Why small growth? The SPIVA study shows an incredible 98% of funds have underperformed the S&P 600 index over the last 10 years. Again, we evaluate 3 year trailing performance of Algo X to a universe of US Small Growth funds.

Going back to the 80s, Algo X really didn’t look great. It started to hit its stride in 2006, and has outperformed consistently ever since. We made one last tweak to the Algo (Verson 2 – V2) going back to 2000, and our results really improved.

Algo X Revealed

So what is Algo X? You are probably way ahead of me here. Each of the Algos is the investable version of the respective passive index within the asset grouping we are evaluating. US Large Blend = S&P 500. Small Growth V1 = Russell 2000 Growth. Small Growth V2 = S&P 600 Growth.

Implications For Investing

Although this is a basic analysis of one passive benchmark vs. its peer group, there are several important implications that come from our work:

1) For passive investors, the Index you choose really can make a difference. The difference in performance between the Russell 2000 Growth and the S&P 600 Growth, for example, was enough to materially improve the performance of Algo X in the Small Growth space.

2) Technology has changed the game. Whether it is the use of the ETF wrapper, or model delivery of managers’ intellectual property for a lower cost, investors are getting access to more for less. For example, if there were an investment strategy that was previously delivered in a mutual fund with a 1% expense ratio, and suddenly that were available for 30bps – how much of a difference would that make in its odds of being successful relative to other investment options?

3) Cycles have not disappeared from the investment landscape. How many investors would shy away from a strategy like Algo X with a great short-term track record, because they have seen the data on mean reversion (and lack of consistency) in active managers? Yet passive strategies, which have had a great run over the past decade (and even better over the last 3 years), are excluded from the very same analysis. In essence, they get a free pass.

Final Thoughts

History tells us that much of investing is cyclical. Styles will come in and out of favor. Passive strategies have enjoyed immense success and $ inflows. That said, we believe that non-capitalization weighted investments will outperform traditional passive going forward. Why? For two main reasons: First, the cost for investors to access traditional active (or strategic beta) strategies is coming down materially. This creates a lower success hurdle for non-passive options. Second, passive strategies have been red-hot. Buying the strategy that has the best 3 year trailing performance has typically ended poorly for most investors that have shorter time horizons.

This article was written by David Garff, President & Chief Investment Officer at Accuvest, a participant in the ETF Strategist Channel.