For instance, many are currently questioning dividend yields of 3% in exchange-traded funds like SPDR Select Sector Consumer Staples (XLP) and/or 3.5% in exchange-traded funds like SPDR Select Sector Utilities (XLU). After all, safer cash equivalents yield as much as 2% in exchange-traded funds like Pimco Enhanced Short Maturity Active (MINT).

![]()

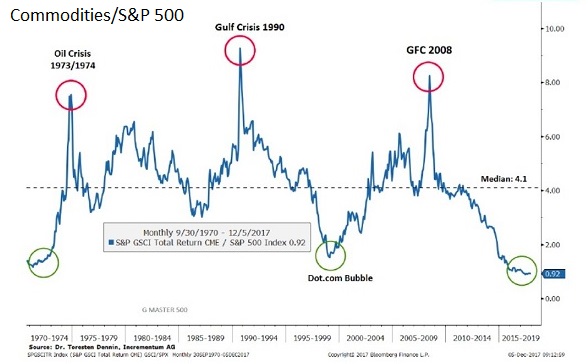

Similarly, risk assets that had previously been out of favor may become more desirable. The iPath Bloomberg Commodity Index Total Return ETN (DJP) just notched a fresh 52-week high, even as the dollar continues to strengthen.

And why not? The relative attractiveness of commodities over the S&P 500 is difficult to refute.

“Wait just one minute there,” you protest. “Aren’t forward earnings-per-share estimates in the area of 20%?” Why yes, they are. Yet the S&P 500 failed to make meaningful progress in the tax-cut-inspired earnings season.

So stocks barely benefited from one of the strongest showings for earnings in this century. Heck, it was one of the best performances on first quarter results and on forward guidance ever. Yet the best the stock market could do was hold its ground?

There is a primary reason for underwhelming price movement in equities today. Consider the reality that when traditional easing and QE force borrowing costs into the basement, every aspect of society (e.g., households, corporations, governments, etc.) borrows a whole lot of “dough.” On the flip side, when traditional tightening and QT push borrowing costs higher, some borrow less and others borrow at higher interest rates. Either way, the massive debt that helped to lever up asset prices begins to leave asset prices susceptible.

It’s not that one should abandon all exposure to risk assets or to stocks. Nevertheless, the notion that there is no alternative (T.I.N.A.) to equities can be tossed out of a single casement window. Cash equivalents provide value for the near term. Commodities may provide value over the next 10-year period. Even investment-grade convertible bonds with 6% yield-to-maturities are likely to outperform equities with less risk.

Related: Demystifying Liquid Alternatives

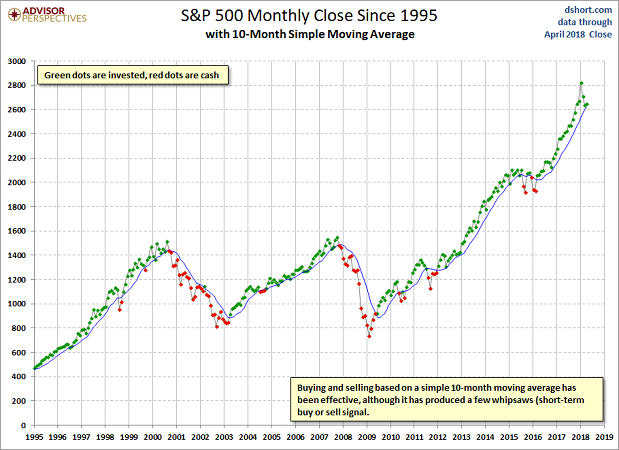

In spite of mounting evidence that stocks will have a rough go of it over the next three years, we still maintain a healthy allocation for our near-retiree and retiree client base. The reason? We have a time-tested exit strategy. When the MONTHLY close of the 10-month moving average falls below its trendline, we significantly reduce our stock market footprint.

Disclosure Statement: ETF Expert is a web log (“blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert website. ETF Expert content is created independently of any advertising relationship.