Furthermore, as we discussed last May, foreign small cap stocks have the advantage of being far more diversified across sectors and industries than their large cap counterparts, so, in aggregate, they offer investors more balanced exposure to the parent economies.

Another key advantage to broader sector and industry exposure is that the relative cheapness of foreign small caps relative to U.S. small caps is less a product of aggregation bias, and therefore more likely indicative of real, versus merely apparent, value.

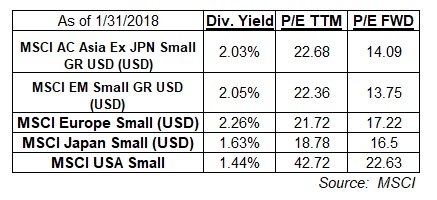

It is important to note that despite 2017’s surge in global small cap stocks, all major regions still boast higher dividend yields and lower earnings multiples than U.S. small caps:

![]()

Finally, foreign small cap stocks have offered investors better diversification benefits than foreign large caps, which is critical in a time of somewhat elevated correlations across the globe.

Finally, foreign small cap stocks have offered investors better diversification benefits than foreign large caps, which is critical in a time of somewhat elevated correlations across the globe.

As the global economy continues to improve, a combination of an improved earnings outlook and favorable valuations should continue to boost the case for exposure to foreign small caps.

This article was republished with permission from Fortune Financial.