![]()

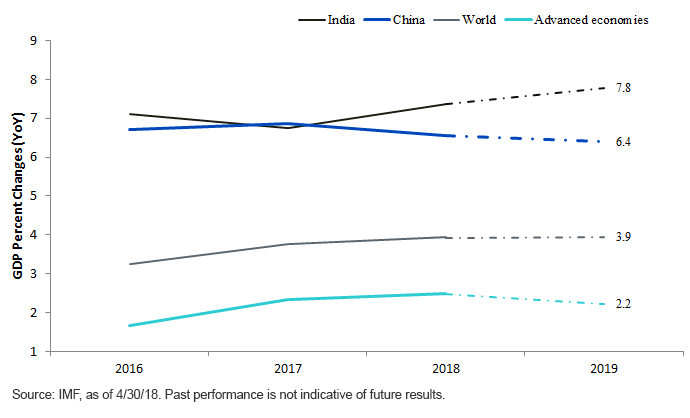

Gross Domestic Product (GDP) Growth Rates (Past and Projected)

When I juxtapose this chart with corporate growth above, there are two primary takeaways:

Countries like India and China, whose growth was nearly twice as fast as global growth, provided massive support for their large-cap companies to piggyback on and grow alongside. As their economies picked up, rewards percolated to all segments of society, and small-cap companies, which are typically tied more strongly to local consumption, benefitted and made more profits.

Related: Investors Retreat from Emerging Markets ETF

For advanced economies, 2016 and 2017 were years when growth picked up pace, and this helped companies in countries running fiscal surpluses as they exported more goods to satisfy global demand. This led Japanese and German firms to grow and make profits as well.

Conclusion and Key Risks

There are a few conclusions here:

Strategic investors should consider over-weighting countries that are growing fast (i.e., India and China). As fast economic growth is a strong tailwind to large-cap companies and as benefits of economic expansion percolate downward, small caps get a boost as well.

Over-weighting export-oriented countries, especially Japan and Germany, could be a great way to play on global growth. Continued growth in global demand is likely going to be favorable to corporate earnings in these countries.

This is not to say there are no risks. The top risks I see:

As institutions in EM are fragile, any change in sentiments can temporarily send EM equities on a downward trend. In my opinion, investors can mitigate such a risk by staying focused on fundamentally attractive and profitable companies. For instance, the WisdomTree India Earnings Fund (EPI), by ONLY selecting profitable companies and then weighting them by trailing 12-month profits, is, in our view, a smart way to invest in profitable companies with less expensive valuations. Similarly, the WisdomTree China ex-State-Owned Enterprises Fund (CXSE) is a strategy to invest with non-state-owned companies, thus gravitating to more companies in China that have more robust growth profiles.

A rising dollar or rotation to safe-haven assets due to escalation in geopolitics can also put downward pressure on currencies, dragging equities down too. One way to partially hedge this risk is by removing currency exposure that comes with investing internationally. Because of the cheaper cost to hedge, hedging currency risk can be easier for developed countries and makes even more sense for export-oriented countries with trade surpluses, such as Japan and Germany. Investors should consider currency-hedged strategies from WisdomTree, which provide a great way to invest internationally while mitigating currency risk.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Funds focus their investments in China and India thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. The Fund’s exposure to certain sectors may increases its vulnerability to any single economic or regulatory development related to such sector. As the Funds can have a high concentration in some issuers and can be adversely impacted by changes affecting those issuers. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Hedging can help returns when a foreign currency depreciates against the U.S. dollar, but it can hurt when the foreign currency appreciates against the U.S. dollar.

For more investment solutions, visit the Advisor Solutions Channel.