Mexico’s president-elect has yet to take office, but Andres Manuel Lopez Obrador already caused a stir with his proposals, igniting a sell-off of the iShares MSCI Mexico Capped ETF (NYSEArca: EWW).

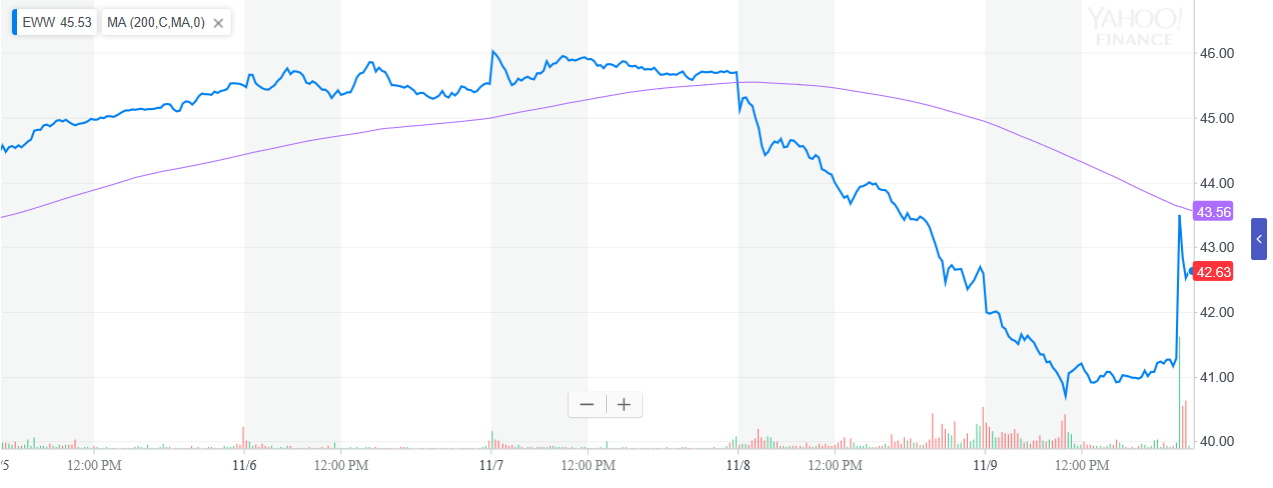

EWW was down as much as 6.8% on Thursday as 13,827,962 shares exchanged hands, which is over 200% higher than its average trading volume. EWW ticked lower again on Friday before recouping its losses an hour before the close of the session to settle for a slight 0.23% loss.

Obrador sparked controversy when his latest plans for his forthcoming presidency were deemed as damaging to Mexico’s economy, causing Thursday’s volatility in EWW. The exodus caused EWW to track below its 200-day moving average.

Obrador’s proposed moves include a push to limit the fees banks can charge customers as well as a decision to end a $13 billion airport project in Mexico City that already raised funds via overseas bonds. Investors were always suspect of Obrador’s penchant for effecting business-friendly policies, but the most recent moves sent investors on an EWW selling frenzy.

“It’s a shock to the system,” said Andy Wester, a senior investment analyst at Proficio Capital Partners.

EWW seeks to track the investment results of the MSCI Mexico IMI 25/50 Index, which is a free float-adjusted market capitalization-weighted index with a capping methodology applied to issuer weights so that no single issuer of a component exceeds 25% of the underlying index weight, and all issuers with a weight above 5% do not cumulatively exceed 50% of the underlying index weight.